Market Overview

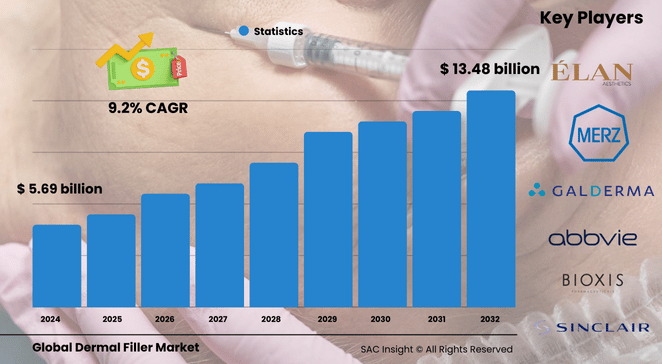

The global dermal fillers market size was valued at approximately US$ 5.69 billion in 2024 and is projected to reach about US$ 13.48 billion by 2032, expanding at a healthy 9.2% CAGR over the 2025-2032 forecast window. First-hand industry insights reveal three clear growth engines: rising demand for minimally invasive anti-aging procedures, broader social acceptance of aesthetic treatments, and continuous product innovation that delivers longer-lasting, natural-looking results.

SAC Insight's deep market analysis also points to a swift rebound from pandemic-era clinic closures, with procedure volumes now comfortably ahead of 2019 benchmarks. Within North America, the U.S. dermal fillers market alone generated roughly US$ 2.53 billion in 2024 and is on track to surpass US$ 5 billion by 2032, underscoring strong consumer appetite for premium injectable solutions.

Summary of Market Trends & Drivers

• Growing preference for hyaluronic acid fillers that offer reversible, biocompatible results with minimal downtime.

• Expanding male patient segment and younger demographics seeking preventive treatments are widening the addressable base.

• Continuous R&D—and swift regulatory clearances—are shortening product refresh cycles, stimulating steady market growth across established and emerging economies.

Key Market Players

Global leadership rests with a handful of diversified aesthetics specialists. AbbVie’s portfolio anchors the market with its versatile filler collection, while Galderma, Merz Pharma, and Revance continue to broaden indications through targeted R&D. Up-and-coming innovators such as Sinclair Pharma, Prollenium, and BIOPLUS are carving out niche positions through differentiated cross-linked technologies and region-specific launches, collectively shaping competitive intensity and keeping pricing rational yet dynamic.

Key Takeaways

• Current global market value (2024): US$ 5.69 billion

• Projected value (2032): US$ 13.48 billion at a 9.2% CAGR

• North America commands roughly 38% market share, driven by high-income patient segments and strong clinic networks.

• Hyaluronic acid remains the dominant material thanks to safety, reversibility, and broad aesthetic indications.

• Wrinkle correction and lip enhancement together account for more than half of total procedure volume.

• Biodegradable fillers vastly outperform non-biodegradable types, reflecting patient preference for safer, transient options.

Market Dynamics

Drivers

• Steady rise in minimally invasive cosmetic procedures as patients favor quick treatments with limited recovery.

• Product innovation—longer-lasting gels, lidocaine combinations, and cannula delivery—improves outcomes and boosts demand.

• Growing R&D investment and frequent launches across key regions accelerate market expansion.

Restraints

• High procedural costs and the need for repeat injections can deter price-sensitive consumers.

• Occasional adverse events such as bruising or vascular complications require skilled injectors, limiting adoption in underserved areas.

Opportunities

• Untapped demand in Asia-Pacific and Latin America where rising disposable incomes and social media influence are driving aesthetic awareness.

• Development of next-generation, regenerative fillers that stimulate collagen can open premium pricing tiers.

Challenges

• Stringent regulatory pathways and post-market surveillance heighten time-to-market for novel formulations.

• Intense competition among clinics exerts downward margin pressure, demanding continuous differentiation.

Regional Analysis

North America leads the global landscape on the back of high awareness, established reimbursement for reconstructive use, and a dense network of board-certified dermatologists and plastic surgeons. Europe follows closely, buoyed by strong R&D activity and growing acceptance of male aesthetics. Asia-Pacific is the fastest-growing region thanks to rapid urbanization, medical tourism, and a maturing middle class.

• North America – Largest revenue pool; steady flow of new product approvals and clinician training programs.

• Europe – Robust regulatory framework and high procedure volumes in Germany, France, and the U.K.

• Asia-Pacific – Double-digit market growth, driven by rising aesthetic consciousness and aggressive regional product rollouts.

• Latin America – Expanding private-clinic networks and competitive pricing sustain steady uptake.

• Middle East & Africa – Nascent but improving, helped by premium medical tourism hubs and increasing disposable income.

Segmentation Analysis

By Material

• Hyaluronic Acid – Biocompatible champion with reversible results

Hyaluronic acid dominates due to its safety profile and versatility, covering everything from fine lines to deep volumization. Ongoing cross-linking advances now deliver 12-18 months of effect, broadening repeat-visit revenue for clinics.

• Calcium Hydroxylapatite – Durable collagen stimulator

Calcium hydroxylapatite offers immediate lift plus regenerative collagen induction, making it popular for jawline contouring and mid-face volume. Its proven safety record keeps it a reliable alternative where extra longevity is required.

• Poly-L-lactic Acid – Gradual volumizer for pan-facial correction

Poly-L-lactic acid acts as a biostimulatory filler that rebuilds lost volume over months. Recent administration protocol updates and relaunches in key markets are renewing interest among experienced injectors.

• PMMA and Other Fat Fillers – Niche, procedure-specific options

PMMA microspheres remain a permanent solution for selected indications, while autologous fat transfers appeal to patients seeking natural implants. Both stay niche due to specialized skill requirements and patient selection criteria.

By Product

• Biodegradable – Mainstream choice for predictable, safe aesthetics

Biodegradable gels capture the lion’s share because they integrate naturally and dissolve over time, meeting modern safety expectations.

• Non-biodegradable – Limited to specialist indications

Permanent fillers hold a small but stable foothold, typically chosen for reconstructive cases where long-term structural support outweighs removability.

By Application

• Wrinkle Correction Treatment – Core revenue driver

Sustained demand for smoothing nasolabial folds and marionette lines keeps wrinkle correction at the forefront of filler utilization.

• Lip Enhancement – Rising social-media-fueled favorite

Growing consumer focus on balanced, fuller lips has turned this category into the fastest-moving segment across millennials.

• Restoration of Volume/Fullness – Essential for mid-face rejuvenation

Age-related fat loss fuels consistent uptake of cheek and temple volumization procedures, extending market reach among older demographics.

• Scar Treatment and Others – Targeted therapeutic uses

Fillers increasingly support acne scar revision and non-cosmetic medical repairs, adding incremental volumes to the overall market.

By End-User

• Specialty & Dermatology Clinics – High-volume heart of the market

These clinics perform the majority of procedures thanks to specialized expertise and patient trust, often supported by retail partnerships that boost accessibility.

• Hospitals & Clinics – Important for complex cases

Multidisciplinary facilities handle reconstructive indications and high-risk patients, generating steady but smaller volumes.

• Others – Med-spas and physician-offices

Rapid growth in certified medispa chains offers convenient touch-points for entry-level patients, expanding the funnel for future advanced treatments.

Industry Developments & Instances

• March 2025 – A leading player secured FDA clearance for temple augmentation, widening injectable indications to a new anatomical zone.

• October 2024 – A Canadian manufacturer acquired a micro-cannula firm to integrate delivery devices with its filler portfolio.

• February 2024 – Radiesse plus lidocaine launched across key Asian markets, aligning with regional demand for immediate lift and comfort.

• January 2024 – New jawline-specific HA filler hit U.S. shelves, spotlighting consumer appetite for lower-face definition.

• March 2022 – European re-introduction of a biostimulatory filler after protocol optimization signaled renewed clinician confidence.

Facts & Figures

• Approximately 23.7 million minimally invasive cosmetic procedures were performed globally in 2024, with fillers representing a significant share.

• Male patients now account for roughly 11% of global non-surgical procedures, up from single-digits five years ago.

• Hyaluronic acid fillers deliver 12-18 months of aesthetic effect on average, extending retreatment intervals.

• Biodegradable products constitute over 85% of total filler revenue, reflecting patient preference for temporary solutions.

• Dermal filler procedures made up about 14% of total nonsurgical revenue in the U.S. during 2023.

Analyst Review & Recommendations

Demand for minimally invasive facial rejuvenation keeps the dermal fillers market on a stable upward trajectory. Suppliers that combine data-driven product innovation with clinician education and outcome tracking will maintain an edge. For emerging brands, focusing on mid-priced hyaluronic acid lines tailored to Asia-Pacific’s youthful demographics offers rapid scale. Established players should continue investing in collagen-stimulating platforms and anatomy-specific launches to capture premium margins and reinforce long-term market leadership.