Market Overview

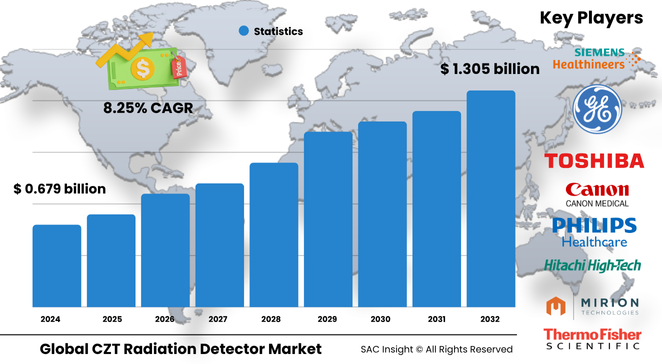

The global CZT radiation detector market size is valued at roughly US$ 0.679 billion in 2024 and is projected to reach about US$ 1.305 billion by 2032, expanding at an average 8.25 % CAGR. First-hand industry insights reveal that sharper room-temperature spectroscopy, expanding nuclear-medicine workloads, and stepped-up homeland-security funding are the core engines behind current market growth. SAC Insight's deep market evaluation indicates the United States CZT radiation detector market alone could move from nearly US$ 0.24 billion in 2024 to around US$ 0.46 billion by 2032 as hospitals adopt solid-state SPECT/CT systems and ports modernize radiation gates.

Summary of Market Trends & Drivers

• Falling crystal costs and higher wafer yields are pushing CZT detectors past legacy scintillators in energy resolution, fuelling rapid replacement cycles in medical imaging and laboratory analysis.

• Security agencies are shifting budget toward handheld, networked spectrometers that locate illicit sources in real time, a change that widens addressable demand for portable devices.

• Industrial quality-control regimes—especially in aerospace and semiconductor fabrication—are tightening, driving interest in fixed CZT arrays that run continuous, high-precision inspections.

Key Market Players

Specialist manufacturers such as Redlen Technologies, Kromek, and Baltic Scientific Instruments dominate high-purity crystal growth and ASIC integration, giving them an edge in premium medical and research niches. Multiproduct suppliers including Mirion Technologies, AMETEK, and Hitachi High-Tech leverage broad distribution and service networks to win large security and industrial contracts, often bundling software analytics with detectors. Competitive dynamics centre on detector yield, electronic noise suppression, and vertically integrated module design; recent alliances between crystal growers and OEM medical-imaging firms illustrate the push to lock in next-generation supply.

Key Takeaways

• Global market share leadership rests with North America, driven by early clinical adoption and strong federal security budgets.

• Portable detectors are the fastest-expanding product slice, growing near 10 % annually as field users prioritise size and connectivity.

• Medical imaging already accounts for more than 45 % of revenue and could top USD$ 0.6 billion by 2032 as CZT SPECT systems migrate from cardiology into neurology and oncology.

• Homeland security demand is buoyed by national infrastructure upgrades and stricter cargo-screening mandates.

• Average detector pixel size has shrunk below 200 µm, improving spatial resolution without raising operating voltage.

• Ongoing R&D into thicker crystals promises to extend effective energy ranges beyond 3 MeV, opening heavy-industry and research opportunities.

Market Dynamics

Drivers

• Superior energy resolution at room temperature delivers clearer images and faster isotope identification.

• Rising cancer incidence boosts nuclear-medicine procedures, spurring hospitals to replace NaI(Tl) systems with solid-state CZT cameras.

• Global trade-volume growth and nuclear-smuggling concerns elevate spending on advanced portal monitors.

Restraints

• High material and fabrication costs keep entry-level prices above competing silicon or scintillator options.

• Supply-chain tightness for high-purity cadmium and tellurium occasionally lengthens lead times.

• Limited awareness in emerging economies slows large-scale procurement outside premium segments.

Opportunities

• Integration of artificial-intelligence algorithms for spectral deconvolution can turn detectors into smart sensors, adding recurring software revenue.

• Electric-battery recycling plants and small-modular-reactor projects require compact, high-resolution monitors, widening industrial use cases.

• Government incentives for domestic semiconductor supply chains open grants for local CZT wafer production.

Challenges

• Managing thermal gradients in thicker crystals without degrading charge collection remains a design hurdle.

• Regulatory approval cycles for new medical devices can stretch beyond three years, delaying revenue realisation.

• Competing technologies such as silicon photomultipliers continue to improve, forcing vendors to maintain performance headroom.

Regional Analysis

North America maintains the largest market share thanks to deep healthcare budgets, active nuclear-safety programmes, and a robust innovation ecosystem. Asia-Pacific records the quickest percentage gains as China, Japan, and India scale diagnostic-imaging fleets and tighten cargo-inspection rules, while Europe follows closely with stringent industrial safety directives and well-funded research institutes.

• North America – Early clinical uptake, vigorous homeland-security spending.

• Europe – Strong industrial radiography standards and collaborative R&D funding.

• Asia-Pacific – Highest CAGR, driven by hospital modernisation and port expansions.

• Latin America – Gradual adoption through cancer-centre upgrades and mining safety.

• Middle East & Africa – Niche demand tied to energy infrastructure and border security.

Segmentation Analysis

By Product Type

• Portable CZT radiation detectors – Field-ready growth leader.

These lightweight handheld spectrometers deliver instant isotope identification for first responders, environmental surveys, and scrap-metal yards, making them the fastest-growing slice of the product mix.

• Fixed CZT radiation detectors – High-duty accuracy backbone.

Installed in medical scanners, conveyor-belt X-ray lines, and research beamlines, fixed arrays offer stable, high-throughput operation that underpins long-term contracts and service revenue.

By Application

• Medical imaging – Core demand engine.

Roughly half of global CZT detectors enter SPECT, PET, and CT systems where sub-millimetre resolution improves lesion detection and reduces scan time, expanding patient throughput.

• Homeland security – Expanding surveillance layer.

Networked portal monitors and backpack units deploy CZT modules to detect shielded sources at airports, ports, and public events, addressing rising security mandates.

• Industrial inspection – Precision quality guardian.

Aerospace, oil-and-gas, and electronics manufacturers use fixed CZT arrays for non-destructive testing, identifying minute voids or inclusions without halting production.

• Research – High-energy exploration.

Accelerator laboratories and astrophysics missions value CZT’s direct-conversion efficiency for gamma-ray spectroscopy and imaging.

• Others – Environmental and emergency response.

CZT detectors aid in contamination surveys and disaster-recovery radiological assessments.

By End-User

• Hospitals – Largest spenders.

Cardiology and oncology departments drive recurring orders for high-resolution SPECT cameras that improve diagnostic confidence and reduce tracer dose.

• Research institutes – Cutting-edge adopters.

Universities and national labs invest in bespoke detector arrays to probe nuclear structure and cosmic phenomena.

• Industrial facilities – Safety-compliance buyers.

High-value production lines deploy fixed CZT monitors to assure material integrity and worker safety under strict regulatory standards.

• Others – Security agencies and environmental bodies.

Border-control units, customs authorities, and environmental regulators rely on rugged portable detectors for rapid field decisions.

Industry Developments & Instances

• March 2025 – Redlen Technologies unveiled a 25 mm thick crystal optimised for photons up to 5 MeV, widening heavy-industry applications.

• January 2025 – Kromek secured a multi-year supply deal to equip European ports with handheld CZT spectrometers linked to cloud analytics.

• September 2024 – Mirion Technologies acquired a US start-up specialising in AI-based isotope identification to enhance its detector software suite.

• July 2024 – A leading PET-CT OEM integrated hemispherical CZT modules, cutting system weight by 30 % and shortening scan cycles.

• December 2023 – Baltic Scientific Instruments began mass production of modular detector kits targeted at university research reactors.

Facts & Figures

• Portable units currently capture about 32 % of global revenue, up from 25 % in 2021.

• Average pixel-pitch has dropped by 18 % over the last five years, lifting intrinsic spatial resolution above 1.5 mm in clinical cameras.

• High-purity CZT wafer yields surpassed 70 % in 2024, trimming cost per square centimetre by nearly 12 % year on year.

• More than 60 % of new SPECT systems ordered in North America during 2024 incorporated CZT detectors.

• Industrial sales grew 9 % in 2024, driven largely by semiconductor X-ray inspection lines in East Asia.

Analyst Review & Recommendations

Current market analysis signals a clear pivot from legacy scintillators to compact, high-resolution CZT platforms across healthcare, security, and industry. Vendors that pair low-noise ASICs with AI-enhanced spectral software will capture outsized market share and defend pricing. To accelerate adoption, manufacturers should pursue cost-sharing alliances with imaging OEMs, invest in supply-chain redundancy for cadmium and tellurium, and streamline regulatory submissions for multi-energy clinical systems. Continuous R&D into thicker, defect-free crystals will remain essential for sustaining performance leadership through the forecast horizon."