Key Market Insights

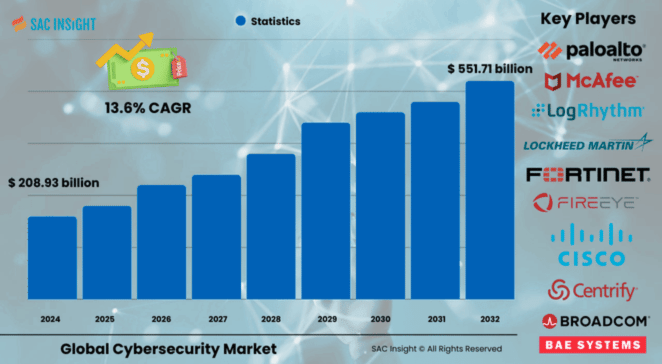

The cybersecurity market size was valued at US$ 208.93 billion in 2024 and is set to accelerate roughly US$ 551.71 billion by 2032, reflecting a healthy 13.6% CAGR. SAC Insight evaluation shows three structural drivers: relentless growth in connected devices, a sharp rise in sophisticated ransomware and phishing campaigns, and board-level focus on regulatory compliance. First-hand industry insights also point to a lasting shift toward cloud-delivered protection as hybrid workforces become the norm. The U.S. cybersecurity market alone is projected to top US$ 166.73 billion by 2032 on the back of high e-commerce penetration and stringent federal mandates. North America is expected to command roughly 39% market share by the end of the period, underscoring the region’s continued technology leadership.

Market Trends & Drivers

• Hardware refresh cycles, zero-trust frameworks, and AI-powered threat hunting are redefining market trends as enterprises demand faster, more autonomous defenses.

• Rapid cloud migration and the Bring-Your-Own-Device culture are expanding attack surfaces, fueling market growth for advanced identity, endpoint, and network security stacks.

• Heightened scrutiny from data-privacy regulations worldwide is pushing even cash-constrained SMEs to invest in managed security and cyber insurance.

Key Market Players

Major participants shaping the cybersecurity market competitive landscape include IBM, Microsoft, Fortinet, Cisco, Palo Alto Networks, Broadcom, Check Point, Zscaler, Proofpoint, Sophos, and BAE Systems. These vendors differentiate through integrated platforms, proprietary threat-intelligence networks, and strategic acquisitions that broaden cloud and zero-trust capabilities. While global giants dominate large-enterprise accounts, a vibrant layer of specialized firms targets niche areas such as industrial control systems, OT security, and compliance automation—raising the competitive bar on innovation and service quality.

Key Takeaways

• Current global market size (2024): USD$ 208.93 billion

• Projected value (2032): USD$ 551.71 billion at a 13.6% CAGR

• North America leads with an estimated 39% market share by 2032, Asia Pacific is the fastest-growing region.

• Hardware still captures about 55% of revenue, but solutions and managed services are closing the gap.

• Network security remains the highest-revenue security type, while cloud security posts the quickest gains.

• SMEs show the fastest adoption curve, driven by affordable SaaS models and rising cyber-insurance uptake, with a potential CAGR above 15%.

Market Dynamics

Drivers

• Escalating frequency and sophistication of cyberattacks across critical infrastructure and consumer applications.

• Proliferation of IoT, 5G, and edge devices creating new security gaps.

• Regulatory momentum (GDPR, CCPA, CMMC, etc.) compelling companies to prioritize data protection.

Restraints

• Shortage of skilled cybersecurity professionals leading to implementation delays and higher costs.

• Budget constraints among small enterprises limiting adoption of comprehensive in-house solutions.

• Fragmented vendor landscape causing integration complexity across legacy and next-gen tools.

Opportunities

• Surge in demand for AI-driven detection, response, and automation platforms.

• Growing appetite for security-as-a-service and managed detection & response in mid-market segments.

• Expansion of zero-trust and Secure Access Service Edge (SASE) architectures to secure hybrid and remote work.

Challenges

• Rapid evolution of adversarial tactics outpacing legacy defense mechanisms.

• Data-sovereignty requirements complicating cross-border cloud deployments.

• Balancing user experience with stringent authentication and access controls.

Regional Analysis

North America will remain the epicenter of cybersecurity spending through 2032, buoyed by strict regulatory frameworks, high digital adoption, and deep vendor ecosystems. Europe follows closely as the Digital Markets Act and GDPR enforcement tighten, while Asia Pacific shows double-digit gains thanks to cloud-first initiatives and the explosive expansion of data centers and fintech services.

• North America – Largest share; heavy investment in zero-trust, cloud, and critical-infrastructure protection.

• Europe – Strong growth driven by data-privacy laws and rising smart-manufacturing projects.

• Asia Pacific – Fastest CAGR; massive cloud and 5G roll-outs plus government-backed cyber-resilience programs.

• Latin America – Expanding fintech sector and ransomware activity spurring adoption of managed security.

• Middle East & Africa – Uptake supported by national cybersecurity strategies and rapid digital-banking expansion.

Segmentation Analysis

By Offering

• Hardware – Roughly 55% revenue share.

Hardware such as next-generation firewalls, encrypted drives, and purpose-built intrusion-prevention appliances remains indispensable for protecting critical on-premises assets.

• Software – Rapid shift to cloud-native suites.

Subscription-based platforms combine endpoint protection, SIEM, and identity management, giving enterprises unified visibility and faster patch cycles.

• Services – Fastest growth in managed detection & response.

Outsourced SOCs and consulting packages help organizations lacking in-house expertise close skills gaps, and control operational costs.

By Security Type

• Network Security – Highest revenue contributor.

Core controls such as next-gen firewalls and secure web gateways defend high-value data flows.

• Cloud Security – Fastest-growing segment.

Tools like CASB, workload protection, and Zero-Trust Network Access secure multi-cloud and hybrid deployments as enterprises modernize infrastructure.

• Endpoint Security – Critical as remote devices proliferate.

Machine-learning-based EDR solutions hunt and contain advanced persistent threats across multiple devices connected from any location.

By Deployment

• Cloud – Dominant and expanding.

Elastic, AI-enabled cloud security stacks align with DevOps cycles and offer instant scalability to handle surges in remote-access traffic.

• On-Premises – Steady demand among regulated sectors.

Banks, governments, and healthcare providers with stringent data-sovereignty rules prefer on-site control and custom configurations for mission-critical systems.

By Organization Size

• Large Enterprises – Biggest spenders.

With vast data footprints and compliance exposure, large enterprises invest heavily in layered defenses, threat intelligence, and 24 × 7 incident response.

• Small & Medium Enterprises – Fastest CAGR.

Cost-effective SaaS, automated configuration, and bundled cyber-insurance drive rising adoption, turning SMEs into a powerful growth engine with a CAGR forecasted above 15%.

By Solution

• Identity & Access Management – Market leader.

IAM curbs credential theft, enforces least-privilege policies, and underpins zero-trust strategies across workforce and customer identities.

• Risk & Compliance Management – Growing urgency.

Real-time dashboards and automated audits help firms track evolving regulations and mitigate fines or reputational damage.

By End Use

• IT & Telecommunications – Largest vertical.

Always-on services demand bullet-proof uptime and data integrity, driving continuous upgrades of network defenses.

• Healthcare – Fastest-growing vertical.

Sensitive patient records and rising ransomware incidents push hospitals toward AI-enhanced monitoring, data encryption, and staff training programs.

Industry Developments & Instances

• September 2023 – Cisco agreed to acquire Splunk for US$ 28 billion, expanding its security-analytics footprint.

• December 2023 – IBM signed deals with NATO and partnered with Palo Alto Networks to bolster hybrid-cloud and enterprise defenses.

• March 2024 – Check Point unveiled Harmony SaaS to shield organizations from software-as-a-service threats.

• March 2024 – Liquid C2 allied with Google Cloud and Anthropic to deliver advanced security and generative-AI features across Africa.

• October 2024 – ComplyScore launched to help mid-to-large firms, starting with healthcare, automate risk mitigation.

• December 2024 – Wipro rolled out an optimization service with Netskope to consolidate and tame sprawling security spend.

• January 2025 – U.S. Cyber Trust Mark introduced to label consumer connected devices that meet stringent security criteria.

• March 2024 – Darktrace partnered with Xage Security to couple AI threat detection with zero-trust OT protection.

Facts & Figures

• Hardware commands 55% of global revenue, underscoring ongoing need for physical defenses.

• Roughly 8 in 10 enterprises adopted at least one cloud security tool by 2023.

• Network security contributes the highest segment revenue at an estimated 28% share.

• North America is projected to capture about 39% market share by 2032.

• SMEs are forecast to post a CAGR above 15% thanks to managed and subscription-based offerings.

• Average breach cost surpassed US$ 4.6 million in 2024, rising 14% in three years.

• Over 60% of organizations plan to implement zero-trust strategies by 2026, up from 24% in 2022.

Analyst Review & Recommendations

Our latest market analysis indicates that cybersecurity procurement is moving from point products to integrated, AI-assisted platforms that deliver faster detection and automated response. Vendors combining robust hardware, cloud-native software, and managed services will capture outsized share. To stay ahead, enterprises should embed zero-trust principles, prioritize identity and cloud workload protection, and invest in continuous staff training. Solution providers, meanwhile, must simplify deployment, address skills shortages with automation, and offer clear ROI metrics to win budget approval in a crowded, fast-moving market.