Market Overview

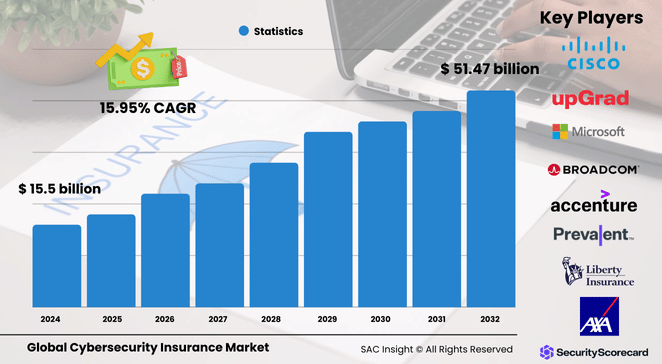

The global cybersecurity insurance market size was valued at roughly US$ 15.5 billion in 2024 and is on course to reach about US$ 51.47 billion by 2032, registering a brisk 15.95% CAGR across the 2025-2032 forecast window. First-hand industry insights show three structural tailwinds driving this market growth: a sharp escalation in attack frequency and ransom demands, tightening data protection regulations in every major economy, and board-level recognition that traditional cyber defenses cannot fully absorb financial fallout.

SAC Insight's deep market evaluation indicates the U.S. cybersecurity insurance market alone could command nearly US$ 16.48 billion by 2032 as enterprises accelerate policy uptake to protect cash flow and brand equity.

Summary of Market Trends & Drivers

• Stand-alone cyber liability policies are replacing silent cyber riders as insurers seek clearer underwriting language and faster claims handling.

• Large enterprises are bundling analytics platforms with coverage to benchmark risk, making actuarial pricing more data-driven.

• BFSI and healthcare clients are prioritizing higher limits and ransomware endorsements after multi-million-dollar settlements became commonplace.

Key Market Players

Global capacity is dominated by multiline giants that use deep balance sheets to absorb large claims while partnering with specialist analytics vendors for smarter risk selection. Names profiled in the report include Allianz, AIG, Zurich, Chubb, AXA XL, Munich Re, Liberty Mutual, and Beazley—firms noted for broad market share and active product innovation.

Complementing these carriers is a cohort of cyber-focused enablers such as BitSight, SecurityScorecard, CyberCube, and RedSeal. Their scoring engines, threat-intel feeds, and scenario tools underpin most modern underwriting models and give insurers greater confidence to expand limit offerings.

Key Takeaways

• Market value (2024): USD$ 15.5 billion

• Projected value (2032): USD$ 51.47 billion at a 15.95% CAGR

• North America leads with roughly 32% market share; the U.S. is forecast at USD$ 16.48 billion by 2032.

• Cyber liability coverage accounts for the largest premium pool, outpacing basic data-breach riders.

• Large enterprises command about 61% of premiums, yet SME appetite is rising as parametric products simplify claims.

• BFSI remains the top end-use vertical with 26% share, followed closely by IT services and healthcare providers.

Market Dynamics

Drivers

• Rising attack frequency and sophistication, with ransomware payouts surpassing USD$ 1 billion annually.

• Stricter global frameworks such as GDPR, CCPA, and proposed SEC incident-disclosure rules.

• Board-level pressure for enterprise-wide risk transfer following high-profile supply-chain breaches.

Restraints

• Limited awareness among mid-market firms that still equate cyber cover with traditional errors-and-omissions insurance.

• Inconsistent policy wording and exclusions that make comparison shopping difficult.

• Premium inflation as underwriters re-rate portfolios after large multi-vector events.

Opportunities

• Growth of data-driven underwriting platforms that lower loss ratios by flagging weak security controls.

• Expansion into emerging economies where regulatory mandates for breach notification are taking hold.

• Development of parametric and micro-policy formats that enable quick payouts for SMEs and gig-economy operators.

Challenges

• Scarcity of long-term actuarial data complicates pricing for catastrophic, systemic cyber events.

• Escalating privacy concerns can limit insureds’ willingness to share incident data with carriers.

• Talent shortage in cyber risk assessment hampers both brokers and insurers in scaling advisory services.

Regional Analysis

The North America cybersecurity insurance market commands the largest slice of premiums, buoyed by relentless attack activity, mature compliance regimes, and high operating margins that justify robust limits. Europe follows closely, driven by GDPR liability exposure and strong reinsurer presence. Asia-Pacific is the fastest-growing region as cloud adoption soars and governments push local data-protection laws.

• North America – Early-mover advantage, high claim severity, largest loss-ratio dataset

• Europe – Strict privacy fines, rapid stand-alone policy growth, active reinsurance market

• Asia-Pacific – Double-digit uptake in Japan, Australia, and India; SMEs fueling demand

• Latin America – Gradual adoption tied to digital banking expansion and fintech regulation

• Middle East & Africa – Nascent market, concentrated in financial hubs seeking ISO 27001 compliance

Segmentation Analysis

By Offering

• Cybersecurity insurance analytics platforms – Fastest-growing sub-segment

Analytics tools provide real-time scoring and scenario modeling, allowing carriers to calibrate premiums and reserve capital more accurately. Adoption is surging as reinsurers demand quantitative risk dashboards.

• Cybersecurity solutions and resilience services – Critical pre-bind requirement

Risk engineering, penetration testing, and incident-response retainers are bundled with policies to cut loss frequency and improve renewals.

By Insurance Coverage

• Cyber liability – Core revenue driver

First-party and third-party protections cover forensics, business interruption, legal fees, and settlement costs, making this segment essential for enterprises handling sensitive data.

• Data breach, ransomware, denial-of-service, and other targeted covers – Niche but expanding

Modular endorsements allow clients to tailor limits for high-probability threats, boosting overall penetration in regulated industries.

By Insurance Type

• Stand-alone – Rapidly eclipsing packaged add-ons

Clear triggers and dedicated limits appeal to buyers seeking certainty in claim settlement, pushing stand-alone adoption across midsize and large enterprises.

• Packaged – Still prevalent among SME bundles

Embedded cyber riders in BOPs or professional-indemnity policies offer entry-level protection where budget is constrained.

By End Use

• BFSI – Largest premium generator

Owing to high-value transactions and strict supervisory oversight, banks and insurers maintain the most comprehensive limits and incident-response playbooks.

• IT & telecom, healthcare, manufacturing, retail, government, and others – Diverse risk profiles

Each vertical tailors coverage to its unique threat surface, with healthcare seeing sharp premium hikes after record ransomware events.

Industry Developments & Instances

• April 2023 – A global carrier broadened cyber policies to include full-limit ransomware coverage, addressing buyer concerns over sub-limits.

• May 2022 – A major software provider launched a built-in endpoint suite for SMEs, reducing underwriting friction by standardizing minimum-control baselines.

• April 2022 – Integration between a breach-simulation vendor and an AI-powered detection platform enabled joint customers to validate defense efficacy pre-renewal.

• November 2021 – A leading analytics firm partnered with a brokerage giant to launch a cyber risk-scoring center, giving underwriters deeper visibility into insured posture.

Facts & Figures

• Average global breach cost stands near USD$ 4.5 million, up 15% in three years.

• Roughly 60% of ransomware victims now carry cyber coverage, versus 30% in 2019.

• More than 2,300 healthcare organizations faced ransomware in 2021, impacting 19.8 million patient records.

• Large enterprises (>1,000 employees) account for 61% of premium volume, yet SMEs drive over 35% of new policy sales.

• Parametric cyber products grew at 25% year-on-year as buyers seek faster claims settlement.

Analyst Review & Recommendations

Cybersecurity insurance has shifted from a discretionary spend to a board-mandated safeguard. Carriers that blend granular analytics with clear policy wording will win share while keeping loss ratios in check. New entrants should target underserved SME segments with simplified parametric covers and bundled risk-engineering support. Meanwhile, mature insurers must keep refining threat-intelligence partnerships to stay ahead of adversaries. The market outlook remains decidedly bullish as digital attack surfaces expand and regulators tighten the screws on breach accountability.