Market Overview

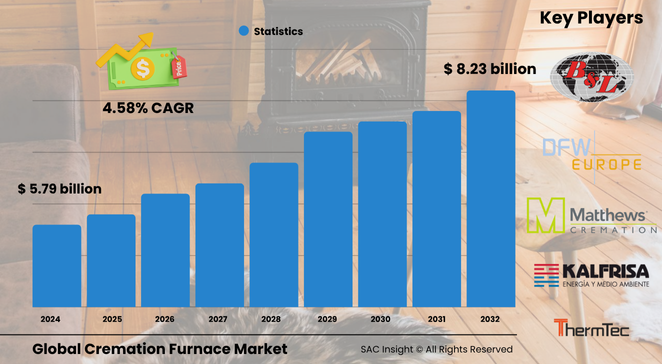

The global cremation furnace market size stands at roughly US$ 5.79 billion in 2024 and is projected to approach US$ 8.23 billion by 2032, reflecting a steady 4.58% CAGR. Deep market analysis attributes this expansion to rising cremation preference, stricter environmental regulations, and accelerating upgrades to low-emission, energy-efficient designs. First-hand industry insights also indicate that the U.S. cremation furnace market could climb from about US$ 1.45 billion in 2024 to nearly US$ 2.05 billion by 2032 as states tighten mercury-control standards and space-constrained metropolitan areas opt for cremation over burial.

Summary of Market Trends & Drivers

Demand is shifting toward electric, propane, and hybrid gas systems with advanced emissions-scrubbing; mobile units and remote diagnostics are gaining traction in emerging regions; and pet cremation services are expanding quickly as companion-animal ownership rises. These market trends, coupled with population ageing and sustainability mandates, underpin resilient market growth through 2032.

Key Market Players

Leading manufacturers include Matthews International, Therm-Tec, Armil CFS, B&L, National Incinerator, CMC, and American Crematory Equipment. They compete on furnace efficiency, emissions control, and tailored service packages. New-technology specialists such as FT and Fuchs are adding electric and plasma models, while regional suppliers in Asia–Pacific focus on compact, cost-optimised lines for high-density urban markets. Strategic moves range from R&D alliances for low-NOx burners to turnkey installation contracts that bundle maintenance and operator training.

Key Takeaways

• Current global market size (2024): about USD$ 5.79 billion

• Forecast global market size (2032): roughly USD$ 8.23 billion, 4.58 % CAGR

• Environmental compliance and space scarcity remain the primary market drivers

• Human furnaces dominate market share, yet pet units post the fastest growth rate

• Asia–Pacific leads regional market growth thanks to urbanisation and supportive subsidies

• Continuous-process, double-chamber designs are gaining share on fuel efficiency gains

Market Dynamics

Drivers

• Heightened environmental awareness motivates adoption of low-emission, energy-efficient furnaces

• Changing cultural attitudes toward personalised, land-saving end-of-life services boost cremation rates

• Technological innovation—remote monitoring, automated loading, and plasma or electric heating—cuts operating costs

Restraints

• Complex zoning and permitting processes can slow new crematorium projects

• High upfront capital requirements challenge small operators in price-sensitive regions

• Public concerns over stack emissions occasionally trigger local opposition

Opportunities

• Mobile and modular units for disaster relief, rural clinics, and military camps

• Service contracts covering lifecycle maintenance, emissions audits, and operator training

• Integration of renewable energy sources and heat-recovery loops for district heating

Challenges

• Harmonising global emission standards adds design complexity and cost

• Volatile energy prices pressure operators to balance fuel mix and capacity utilisation

• Skilled labour shortages hinder rapid adoption of advanced digital control systems

Regional Analysis

Asia–Pacific commands the largest market share and posts the quickest CAGR, driven by dense urban populations, supportive government incentives, and cost-effective electric models. North America follows, propelled by stringent mercury-emission caps and the continued shift toward cremation in the U.S. and Canada. Europe emphasises eco-design directives and heat-recovery integration, while Latin America and the Middle East & Africa represent rising demand pockets where small-footprint, propane-fired units fit local infrastructure.

• North America – Strong replacement demand for mercury-controlled units, rising pet cremation services

• Europe – Focus on ultra-low NOx burners and energy-recovery solutions

• Asia–Pacific – Fastest growth, subsidy programs and land-use constraints fuel adoption

• Latin America – Gradual uptake as funeral homes modernise inefficient furnaces

• Middle East & Africa – Early-stage market with interest in mobile units for remote areas

Segmentation Analysis

By Fuel Type

• Natural Gas – Cost-effective mainstay for large urban crematoria.

Modern high-efficiency burners cut fuel use and CO2 per cycle, keeping gas the default choice where pipeline supply is reliable.

• Propane – Flexible option for smaller or rural facilities.

Cylinder-based storage allows quick deployment and simplified permitting, particularly in regions lacking gas grids.

• Electricity – Rapidly rising on zero-combustion emissions.

Improved refractory insulation and smart-grid tariffs make electric furnaces competitive while easing permitting in emission-sensitive zones.

By Chamber Type

• Single-Chamber – Simpler, lower-cost configuration.

Favoured by start-ups and clinics for its compact footprint and ease of operation despite modest throughput.

• Double-Chamber – Higher throughput, lower emissions.

Secondary afterburners ensure complete combustion, meeting strict dioxin and particulate limits and appealing to high-volume crematoriums.

By Capacity

• Small (under 100 lbs) – Niche for veterinary and laboratory waste.

Compact models slot into tight spaces and plug into standard electrical service.

• Medium (100–300 lbs) – Workhorse for community crematories.

Versatile loading capacity balances fuel consumption and cycle time, fitting most municipal needs.

• Large (over 300 lbs) – Designed for metropolitan high-volume operations.

Automated charging tables and continuous processes shorten turnaround, supporting 24 / 7 service schedules.

By Cremation Process

• Continuous – Conveyor-based flow maximises throughput.

Operators cut idle time and fuel spikes, achieving lower per-case costs in busy urban centres.

• Batch – Traditional cycle offering flexible scheduling.

Allows customised memorial services and accommodates varied body sizes without process modification.

By Type

• Human Cremation Furnace – Core revenue contributor.

Steady demand supported by demographic ageing and shifting cultural norms toward cremation ceremonies.

• Animal & Pet Cremation Furnace – Fastest-growing niche.

Pet-ownership trends and premium memorial services drive multi-unit installations at veterinary networks.

By Application

• Crematoriums – Largest application segment.

Full-service facilities seek energy-efficient, low-maintenance furnaces to meet rising case volumes.

• Clinics & Hospitals – Safe disposal of medical waste and stillbirth remains.

On-site units reduce biohazard transport costs and comply with infection-control protocols.

• Laboratories – Incineration of hazardous research waste.

Precise temperature control and emissions-scrubbing safeguard personnel and meet regulatory thresholds.

• Others – Industrial and municipal waste streams.

Specialised furnaces handle confidential document destruction, disaster-relief cadaver management, and certain cultural applications.

Industry Developments & Instances

• August 2023 – A leading U.S. manufacturer launched a fully electric furnace featuring integrated mercury scrubbers and 15 % lower energy consumption per cycle

• November 2024 – Major Asia–Pacific distributor signed a multi-year service partnership covering preventive maintenance and remote diagnostics

• February 2025 – European engineering firm introduced a mobile dual-fuel unit for rapid deployment in disaster zones

• April 2025 – Investment in automated loading robotics reduced average charge time by 20 % at several high-volume North American crematoria

• May 2025 – Consortium announced R&D program to capture and reuse waste heat from cremation to supply adjacent greenhouse operations

Facts & Figures

• Electric furnaces can trim CO2 emissions by up to 35 % relative to legacy gas models when powered by renewables

• Average cremation rate in the U.S. reached 60 % in 2024, up from 47 % a decade ago

• Double-chamber designs achieve particulate matter reductions of roughly 90 % versus single-chamber legacy units

• Pet cremations now account for more than 15 % of annual furnace shipments worldwide

• Remote monitoring cuts unplanned downtime by approximately 25 %, boosting annual throughput capacity

Analyst Review & Recommendations

Market momentum is firmly tied to environmental compliance and operational efficiency. Manufacturers that prioritise electric and hybrid fuel flexibility, integrate smart-sensor diagnostics, and bundle lifecycle service contracts are best positioned to outpace average market growth. Operators should evaluate retrofit kits that add secondary combustion and heat recovery, allowing older furnaces to meet tougher standards without full replacement. Long term, coupling cremation heat to local district-energy schemes offers a pragmatic route to emissions reduction and new revenue streams."