Market Overview

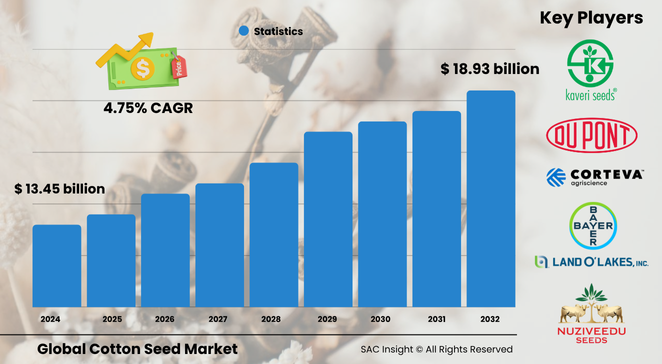

The global cotton seed market size is valued near US$ 13.45 billion in 2024 and is set to climb to roughly US$ 18.93 billion by 2032, reflecting a steady 4.75 % CAGR. First-hand industry insights point to three clear growth engines: rising global fibre demand, ongoing seed-genetics upgrades that push yields, and supportive government programs encouraging high-quality inputs. SAC Insight's deep market evaluation shows the United States cotton seed market alone could top US$ 6.08 billion by 2032 as growers adopt stacked-trait varieties for pest and drought resilience.

Summary of Market Trends & Drivers

• Mass adoption of genetically enhanced seed is lifting farm productivity while trimming pesticide use.

• Consumers and retailers are calling for sustainably grown, traceable cotton, nudging breeders toward organic and low-input traits.

• Strong export demand for cottonseed oil and meal is broadening the revenue mix for processors, underpinning market growth.

Key Market Players

Global leadership rests with a mix of life-science majors and region-focused specialists. Multinationals renowned for broad trait portfolios dominate premium segments, while home-grown companies tailor hybrids to local soils and pest pressures. Competitive dynamics now pivot on rapid field-testing, digital agronomy support, and partnerships that bring next-generation traits—such as heat-tolerance—into mainstream breeding pipelines. Consolidation, evident in landmark acquisitions during 2023-24, is sharpening R&D scale and shortening product-development cycles.

Key Takeaways

• Current global cotton seed market size (2024): about USD$ 13.45 billion

• Projected global market size (2032): roughly USD$ 18.93 billion at 4.75 % CAGR

• Asia-Pacific holds the largest market share, driven by India and China’s combined production strength

• Upland Cotton supplies close to 90 % of global seed volume

• Textile applications account for the biggest revenue slice, yet food and feed uses are expanding fastest

• Sustainable and organic seed lines represent the most dynamic niche for new entrants

Market Dynamics

Drivers

• Escalating textile demand in emerging economies pushes acreage and hybrid adoption

• Government input-subsidy schemes and credit lines lower barriers for quality seed purchase

• Breakthrough biotech traits boost yield, fibre length, and pest resistance, fuelling repeat seed sales

Restraints

• Regulatory scrutiny of GM traits delays approvals and raises compliance costs

• Cotton price volatility squeezes farmer margins, discouraging investment in premium seed

• Rising pest resistance to first-generation Bt traits threatens performance gains

Opportunities

• Organic and non-GMO cotton seed opens a premium channel with double-digit growth potential

• Drought-tolerant and salt-tolerant varieties can unlock acreage in arid zones

• Digital seed-placement tools and traceability platforms create new service revenue streams

Challenges

• Climate-driven shifts in planting windows complicate seed production planning

• Competition from synthetic fibres caps long-term fibre-demand growth

• High upfront R&D spend strains smaller breeders and encourages further consolidation

Regional Analysis

Asia-Pacific cotton seed indsutry dominates thanks to vast cultivation areas, rising middle-class consumption, and proactive biotech adoption. North America ranks second on the back of precision-farming uptake and robust export logistics, while Africa shows the fastest percentage gains as governments target cotton for rural income diversification.

• North America – High mechanisation, strong biotech penetration

• Europe – Niche acreage, premium organic focus

• Asia-Pacific – Largest producer and consumer; rapid hybrid roll-out

• Latin America – Expanding irrigated acreage in Brazil and Argentina

• Middle East & Africa – Emerging market share, buoyed by strategic investment programs

Segmentation Analysis

By Type

• Upland Cotton – Core volume driver.

Upland’s adaptable genetics, medium-staple fibre, and well-established supply chains keep it the workhorse across five continents.

• Tree Cotton – Pest-resilient legacy crop.

Although lower in commercial yield, its natural resistance positions it for low-input and organic niches in South Asia and Africa.

• Extra-long Staple Cotton – Premium fibre segment.

Favoured by luxury apparel brands, it fetches price premiums that justify intensive agronomy and specialty seed lines.

• Levant Cotton – Regional heritage variety.

Limited global share but vital to traditional textiles in parts of the Middle East, sustaining smallholder demand for locally adapted seed.

By Application

• Textile – Largest revenue contributor.

Spinning mills’ preference for consistent staple length sustains demand for certified, high-germination seed lots.

• Agriculture – On-farm feed and soil-conditioning uses.

Crushed seed cake enriches livestock rations and fields, expanding domestic seed utilisation.

• Food – Rising edible-oil extraction.

Interest in cholesterol-neutral cottonseed oil is opening new refinery capacity across Asia.

• Pharmaceutical – Minor but strategic.

Derivatives such as gossypol find use in antifertility research and veterinary formulations.

• Cosmetic – Niche yet growing.

Cold-pressed oil’s emollient profile appeals to natural skincare brands focusing on traceable plant oils.

Industry Developments & Instances

• December 2021 – A crop-protection firm acquired a diversified seed portfolio, strengthening cotton hybrid offerings for South Asia.

• March 2022 – A regional oilseed processor commissioned a new refinery to expand cottonseed-oil output.

• July 2024 – Breeders announced field trials of drought-tolerant extra-long staple lines aimed at premium apparel markets.

• February 2025 – A digital-ag startup partnered with seed distributors to launch a traceability app linking seed lots to bale provenance.

Facts & Figures

• Global cottonseed output surpassed 46 million t in 2021 and is trending upward with 1-2 % annual growth.

• The top three producing nations—United States, India, China—regularly generate more than 70 % of world supply.

• Tree Cotton holds roughly 43.8 % market share within heritage-variety segments.

• Textile applications absorb about 36.7 % of total seed-derived revenue.

• Extra-long staple varieties command price premiums of 25-30 % over Upland equivalents, supporting breeder margins.

Analyst Review & Recommendations

Our market analysis underscores a gradual but decisive tilt toward trait-stacked seeds and transparent supply chains. Breeders who combine high-yield genetics with sustainability credentials will outpace baseline market growth. We recommend prioritising drought-resilient lines for climate-exposed regions, investing in digital grower-support platforms, and forming joint ventures that speed local hybrid adaptation while sharing regulatory costs.