Market Overview

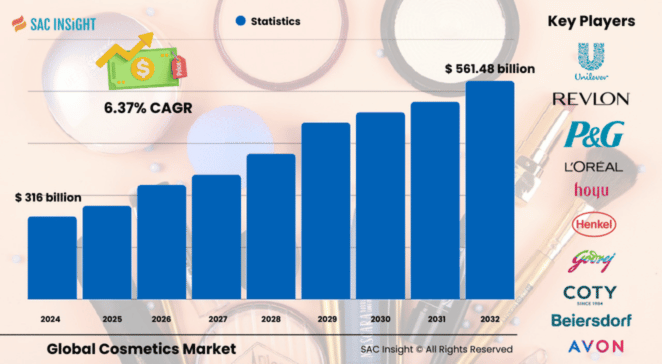

The global cosmetics market size stood at USD$ 316 billion in 2024 and is projected to exceed USD$ 561.48 billion by 2032, advancing at a CAGR of 6.37%. during the forecast period. These figures emerge from SAC Insight analysis that considers evolving consumer behaviors, rising disposable incomes, and intensifying attention to personal health and well‑being. Enhanced product innovation—especially for natural or eco‑friendly formulas—has played a crucial role in boosting consumer engagement. Notably, the U.S. cosmetics market alone is poised to approach US$ 100 billion by 2032, buoyed by robust demand for multi‑functional skincare and hair care lines.

Summary of Market Trends & Drivers

Many brands continue to embrace green formulations and vegan‑friendly lines to align with growing sustainability demands. Skincare remains the leading revenue contributor, owing to the consumer shift toward everyday wellness rituals. Additionally, digitalization, from virtual try‑ons to social media influencer marketing, has redefined how customers discover and purchase cosmetic products.

Key Market Players

Major participants focus on product differentiation, environmentally conscious offerings, and expansion across offline and online channels. Leading global players include well‑established conglomerates known for extensive research and development, as well as emerging innovators focused on niche categories such as luxury organics and specialized men’s grooming solutions. Innovative packaging, influencer partnerships, and timely product launches are especially prevalent among top contenders eager to capture greater market share.

In particular, a handful of industry front‑runners dominate both Western and Asia Pacific markets by leveraging large‑scale manufacturing, advanced formulations, and integrated omnichannel distribution. Meanwhile, agile up‑and‑comers are establishing footholds with specialized lines targeting hair‑strengthening serums, eco‑friendly fragrances, and multifunctional skin treatments.

Key Takeaways

• Market Value (2024): ~US$ 316 billion

• Projected Value of cosmetics industry (2032): ~US$ 561.48 billion at a 6.37% CAGR

• Leading Category: Skincare dominates in terms of both revenue and product launches

• Regional Leader: Asia Pacific holds a commanding portion of overall sales, nearing 42% share

• Offline Versus Online: Offline channels still represent a substantial chunk of global sales, but online growth is accelerating

• U.S. Outlook: Forecast to near US$ 100 billion by 2032, driven by premium and mid‑range product lines

Market Dynamics

Drivers

• Heightened Emphasis on Self‑Care: Consumers worldwide are prioritizing self‑care rituals, generating higher demand for skincare and haircare essentials.

• Rising Eco‑Consciousness: More shoppers are seeking out products with natural ingredients, sustainable packaging, and cruelty‑free certifications.

• Growing Men’s Grooming Segment: Expanding awareness of tailored men’s skincare and color cosmetics is stimulating a broader product portfolio.

Restraints

• Potential Skin Reactions & Side Effects: Synthetic additives can sometimes trigger allergies or irritations, making certain demographics wary of trying new cosmetics.

• Prevalence of Counterfeit Products: In many regions, cheap knockoffs erode consumer trust and chip away at brand sales.

Opportunities

• Technology-Enabled Customization: AI‑driven color matching, personalized skin assessments, and augmented reality tools help brands deliver unique, data-backed offerings.

• Expansion in Emerging Markets: Increasing disposable incomes in areas like Southeast Asia and parts of South America open doors for accessible but high‑quality product lines.

Challenges

• Regulatory Scrutiny: Evolving safety standards can require substantial investment in compliance and testing, creating hurdles for new entrants.

• Saturated Markets in Developed Regions: In highly mature markets, high competition and brand loyalty can restrict breakthrough brand growth.

Regional Analysis

Rising consumer spending, alongside new product innovations, has propelled Asia Pacific to become the largest regional contributor to overall cosmetics market growth. Meanwhile, North America and Europe remain substantial markets, driven by well‑informed buyers and a persistent appetite for luxury, clean‑label, and technology‑integrated cosmetics.

• North America: Strong demand for premium and multifunctional products, coupled with high brand loyalty.

• Europe: Technological integration, such as virtual makeup try‑ons, underscores growth prospects.

• Asia Pacific: Holds approximately 42% market share, propelled by urban expansion, online retail, and active beauty communities.

• Latin America: Gains momentum through competitive pricing strategies and social media marketing.

• Middle East & Africa: Steady progress as niche brands tap into a growing middle class and younger consumer base.

Segmentation Analysis

By Product

• Skin Care – Largest Revenue Contributor, Daily Use Influence: Skin care continues to capture the highest sales, reflecting consumer emphasis on preventing dryness, fine lines, and UV damage. This wide‑ranging category includes cleansers, moisturizers, serums, and sun protection items, all of which cater to day‑to‑day maintenance and specialized regimens.

• Hair Care – Enhanced Focus on Specialized Solutions: Hair treatments, scalp‑friendly shampoos, and bonding treatments are gaining acceptance among a broader audience. This segment has seen a notable rise in cross‑industry brand expansions, leveraging advanced cosmetic formulations traditionally used for skincare and applying them to hair.

• Makeup – Innovation Through Hybrid Formulations: Color cosmetics remain central to personal expression. BB creams, tinted moisturizers, and nourishing lip products blur the line between makeup and skincare, appealing to on‑the‑go consumers.

• Fragrance – Growing Niche Offerings: Unique fragrance notes, such as botanical and unisex blends, have diversified traditional perfume lines. This niche orientation capitalizes on changing consumer preferences for exclusivity and natural extracts.

• Others – Including Bath & Body and Miscellaneous Personal Care: This broad category covers soaps, bath bombs, and specialized treatments like exfoliating scrubs. Such items deliver daily maintenance and holistic wellness experiences.

By End‑User

• Men – Rapidly Evolving Grooming Culture: Men’s cosmetics show swift growth owing to targeted marketing and a broader acceptance of self‑care routines. Dedicated men’s lines, from beard oils to lightweight moisturizers, are multiplying across physical and online retail.

• Women – Long‑standing Core Demographic: Women’s cosmetics remain central to the industry, bolstered by celebrity brand endorsements and wide-ranging product lines tailored for different skin types, concerns, and budgets.

By Distribution Channel

• Offline – Longstanding Mainstay for Experiential Shopping: Specialty stores, department stores, and hypermarkets/supermarkets remain crucial channels. Many shoppers still prefer hands-on testing before committing to a purchase, especially for makeup and fragrances.

• Online – Rapid Adoption Fueling Convenience: Growing mobile penetration has made e‑commerce a robust platform for cosmetics. Detailed product descriptions, consumer reviews, and influencer collaborations drive strong traffic. Subscription models, auto‑ship services, and exclusive online promotions further boost sales.

Industry Developments & Instances

• January 2024: A major global conglomerate announced an investment in a consumer health startup, aiming to blend advanced anti‑aging technologies into topical skincare formulas.

• September 2023: A well‑known prestige cosmetics group expanded a best‑selling skincare collection, introducing a UV‑protecting hydrator line.

• July 2024: A direct‑to‑consumer haircare specialist introduced its new conditioner and shampoo range in partnership with select drugstore chains across North America.

• February 2024: A leading Asian beauty house released a holistic haircare brand focused on scalp health, underscoring the region’s accelerating innovation.

• October 2024: A premium skincare label opened a flagship store in a major Southeast Asian capital, highlighting the region’s importance for global retail expansions.

Facts & Figures

• Global cosmetics industry valuation in 2024: ~US$ 316 billion

• Approximately 42% of worldwide cosmetics revenue originates from the Asia Pacific region

• Offline channels still represent over 70% of total sales, though online platforms post the fastest growth rates

• Men’s product demand is on the rise, with one recent survey suggesting a double‑digit percentage of men now buy skincare regularly

• Advanced digital tools and AI‑powered skin diagnostics have reduced product trial times by up to 30% in some regions

Analyst Review & Recommendations

Building on first-hand industry insights, the cosmetics sector is primed for balanced growth, propelled by a confluence of health-oriented consumers and continuous product innovation. Brands that invest in online channels, develop transparent ingredient lists, and offer personalized shopping experiences are well positioned to excel. Meanwhile, smaller labels can carve out loyal followings with niche, eco-friendly solutions and influencer campaigns that resonate with younger audiences. Overall, companies that combine compelling brand storytelling with rigorous quality oversight will likely capture sustainable market growth in the decade ahead."