Market Overview

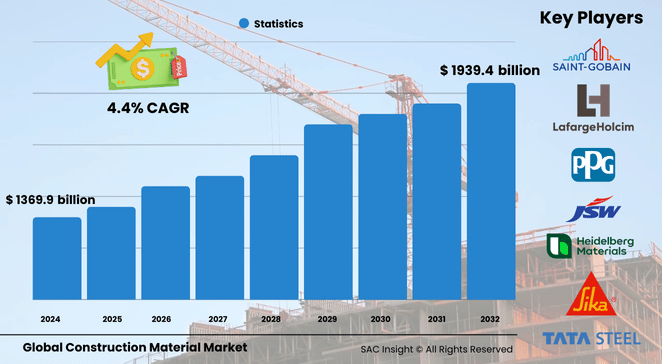

The global construction material market size was valued at US$ 1,369.9 billion in 2024 and is on track to reach roughly US$ 1,939.42 billion by 2032, expanding at an average 4.4% CAGR over the 2025-2032 forecast period. First-hand industry insights point to three reliable growth engines: sustained urban migration in Asia, a worldwide push for climate-resilient infrastructure, and rapid uptake of smart, low-carbon materials that cut job-site waste.

SAC Insight's deep market evaluation shows the U.S. construction material market alone could surpass US$ 211 billion by 2032, fueled by federal infrastructure spending and a swing back to domestic manufacturing.

Summary of Market Trends & Drivers

• Rising adoption of 3D-printed concrete, smart glass, and composite shingles is reshaping specifications and shortening build cycles.

• Government-backed smart-city programs and housing schemes in India, China, and the U.S. are lifting demand for aggregates, cement, and rebar.

• Developers are prioritizing low-carbon cement blends and recycled steel to meet tougher emissions targets, creating new premium niches.

Key Market Players

Global construction material market leadership is shared by diversified groups with broad material portfolios. Firms such as China National Building Material, CRH, LafargeHolcim, HeidelbergCement, and CEMEX command sizeable market share through vertical integration and regional breadth, supplying everything from cement and aggregates to ready-mix solutions.

Regional specialists like BBMG, Anhui Conch, Knauf, Lixil, and Boral complement the majors with localized product mixes, agile logistics, and innovations in lightweight drywall, insulation, and modular blocks. Their combined strategies set the competitive tempo—heavy capex in greener kilns, targeted M&A, and digital supply-chain platforms that guarantee on-time delivery.

Key Takeaways

• Global market value (2024): USD$ 1,369.9 billion

• Forecast value (2032): USD$ 1,939.42 billion at a 4.4% CAGR

• Asia Pacific holds about 48% market share; North America 28%, Europe 25%

• Aggregates remain the dominant product with roughly 40% revenue share

• Smart materials and 3D printing lead market trends as builders seek waste cuts and faster project turnover

• The U.S. market growth outlook is tied to highways, bridges, and energy-transition projects under recent infrastructure bills

Market Dynamics

Drivers

• Accelerating urbanization and middle-class housing demand in Asia-Pacific and Africa

• Government incentives for smart-city infrastructure and net-zero building codes

• Advanced manufacturing (e.g., additive construction) lowering material waste and labor costs

Restraints

• Supply-chain congestion and high logistics expenses lengthening lead times

• Environmental regulations limiting natural resource extraction and quarry expansions

• Volatile raw-material pricing squeezing contractor margins

Opportunities

• Commercialization of low-carbon cement, geopolymer concrete, and recycled steel

• Digital twins and BIM integration enabling precise material take-offs and lifecycle tracking

• Growing refurbishment market in Europe and Japan driving demand for insulation and lightweight panels

Challenges

• Labor shortages slowing job-site productivity and increasing project risk

• Capital intensity of retrofitting aging kilns and foundries with carbon-capture technology

• Fragmented regulatory landscape complicating compliance for multinational suppliers

Regional Analysis

Asia Pacific dominates thanks to relentless urban expansion, large public-works pipelines, and a vast residential base. China and India together consume more cement than the rest of the world combined, while Southeast Asia is a hotspot for megaprojects and industrial parks.

• Asia Pacific – Largest consumption hub; government housing targets and industrial corridors underpin double-digit volume gains in aggregates and cement.

• North America – Infrastructure revamp and Build America provisions drive steady market growth, with a tilt toward sustainable asphalt, recycled aggregates, and engineered timber.

• Europe – Strict carbon policies spur demand for clinker substitutes, insulating blocks, and prefabricated components; renovation subsidies support retrofit materials.

• Latin America – Industrialization and mining investments boost requirement for structural steel and ready-mix concrete, though currency volatility tempers imports.

• Middle East & Africa – Energy diversification and tourism projects sustain demand for specialty concrete, glass, and aluminum façades despite water-scarcity constraints.

Segmentation Analysis

By Material

• Aggregates – Core volume driver

Aggregates command about 40% of global revenue as highways, rail corridors, and coastal defenses consume vast quantities of sand, gravel, and crushed stone. Tight quality standards and proximity to urban centers keep local quarries in high demand.

• Cement – Essential binder, pivoting to low-carbon blends

At roughly 25% market share, cement remains indispensable for structural concrete. Producers are scaling supplementary cementitious materials and carbon-capture solutions to meet net-zero targets without sacrificing strength.

• Construction Metals – Backbone of modern structures

Steel and aluminum account for around 20% of sales, buoyed by high-rise construction, data-center expansions, and lightweight curtain wall systems. Decarbonized steel and recycled billets are emerging as premium offerings.

• Bricks, Blocks, and Others – Cost-effective diversification

Traditional clay bricks, AAC blocks, and niche materials such as smart glass make up the remaining 15%. Adoption is accelerating in modular housing and energy-efficient retrofits where speed and insulation matter.

By End-user

• Residential – Strongest rebound segment

Rising disposable income, mortgage subsidies, and pandemic-led home upgrades fuel residential starts, especially in India, China, and the U.S. Lightweight blocks and green cement blends are gaining share as builders chase sustainability ratings.

• Infrastructure – Long-cycle demand engine

Roads, metros, and renewable-energy foundations consume massive volumes of aggregates, rebar, and ready-mix concrete. Governments view infrastructure as a stimulus lever, ensuring a stable pipeline through 2032.

• Commercial – Pivot toward eco-certified materials

Data centers, logistics warehouses, and green office towers are creating pockets of demand for high-strength steel, low-carbon concrete, and glazing systems with superior thermal performance.

• Industrial – Steady growth in warehousing and manufacturing

Factory upgrades and near-shoring trends sustain orders for structural steel and flooring materials, although spending is sensitive to energy prices and global trade dynamics.

Industry Developments & Instances

• January 2023 – Holcim acquired French screed specialist Chrono Chape, integrating fluid self-levelling products into its ready-mix network for improved floor finishing.

• June 2022 – CRH announced a USD$ 1.9 billion deal for Barrette Outdoor Living, expanding its fence and railing portfolio in North America.

• May 2022 – CEMEX launched the Carbon Neutral Alliance, targeting a zero-carbon cement plant in Germany by 2030 via renewable power and green hydrogen.

• March 2022 – HeidelbergCement and Calix secured EU funding for LEILAC-2, aiming to capture 100,000 t of CO2 annually at a Hanover facility.

• May 2019 – CEMEX divested selected German ready-mix and aggregate assets to streamline its European footprint.

Facts & Figures

• Aggregates, cement, and metals collectively represent 85% of global construction material revenue.

• Approximately 82% of new state-funded projects in 2022 specified recycled or eco-labelled materials, up 28% versus 2019.

• Digital supply-chain tracking tools are now in use on 54% of large metro-area projects, cutting material over-ordering by up to 15%.

• Quality-control upgrades boosted material performance scores by 15 points on a 100-point scale across 73% of government contracts.

• Average lead time for imported rebar lengthened by 12 days in 2024, impacting nearly one-third of U.S. projects.

• Energy-efficient insulation materials saw a 37% uptake in public buildings after new mandates, indicating solid secondary demand streams.

Analyst Review & Recommendations

Construction material suppliers face a pivotal decade: policy-driven decarbonization and digitization can either enlarge margins or erode them if companies delay investment. Firms that scale low-carbon cement, recycled aggregates, and traceable steel—while pairing them with BIM-enabled logistics and robust workforce training—stand to capture outsized market growth. Regional agility, balanced raw-material sourcing, and proactive carbon-capture initiatives will distinguish leaders from laggards as clients seek transparent, sustainable solutions through 2032.