Market Overview

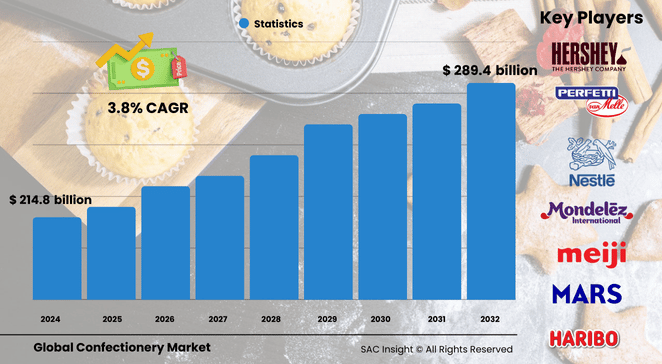

The global confectionery market size is currently valued at US$ 214.85 billion in 2024 and is on track to reach roughly US$ 289.43 billion by 2032, expanding at a steady 3.83% CAGR. This market growth is underpinned by first-hand industry insights showing a living-standards tailwind in emerging economies, a resilient gifting culture, and a sharp pivot toward premium and functional treats.

SAC Insight's deep market evaluation also points to a full post-pandemic rebound in impulse purchasing; brick-and-mortar traffic has normalized, while e-commerce sales are climbing off a much smaller base. The U.S. confectionery market alone is projected to top about US$ 36.09 billion by 2032, supported by consumer willingness to trade up for artisanal and sugar-reduced options.

Summary of Market Trends & Drivers

• Growing appetite for premium chocolates, organic candies, and inclusive dietary lines (sugar-free, vegan, plant-based) is reshaping product pipelines and pushing average selling prices upward.

• Rapid urbanization and busy lifestyles are lifting demand for on-the-go formats and smaller pack sizes, especially in Asia-Pacific, where single-serve chocolate bars and resealable pouches are booming.

Key Market Players

Global confectionery market share is concentrated among a handful of household names renowned for vast portfolios and marketing muscle. Multinationals known for iconic chocolate and sugar brands leverage scale to launch limited edition flavors, run omnichannel campaigns, and defend shelf space in mass merchandising. A second tier of regional specialists focuses on premium couvertures, novelty candies, and seasonal assortments, using craftsmanship stories to command higher margins. Competition increasingly hinges on speed to market with healthier lines: players that combine reformulated recipes (stevia, monk fruit, fiber enrichment) with playful branding are carving out new segments while safeguarding traditional favorites.

Key Takeaways

• Market value (2024): USD$ 214.85 billion

• Projected value (2032): USD$ 289.43 billion at a 3.83 % CAGR

• Europe leads with roughly 36.89 % market share, while Asia-Pacific delivers the quickest volume gains.

• Chocolate dominates product mix (45 % share) thanks to high per-capita consumption and premiumization.

• Offline retail still commands more than 75 % of global revenue, but online channels post the fastest growth at about 5 % CAGR.

• Sugar-free and reduced-calorie innovations form the fastest-expanding niche within both chocolate and sugar confectionery.

Market Dynamics

Drivers

• Rising disposable income and an entrenched gifting tradition boost all-season demand, particularly around festive calendars.

• Health-oriented reformulations (organic cocoa, clean-label gummies) widen the addressable customer base without sacrificing indulgence.

Restraints

• Volatile cocoa and sugar prices squeeze manufacturer margins and challenge strategic planning.

• Heightened regulatory scrutiny on sugar content and marketing to children raises compliance costs.

Opportunities

• Digital storefronts enable direct-to-consumer storytelling, allowing niche brands to build loyal communities at low distribution cost.

• Emerging-market cold-chain upgrades open entirely new territories for premium chocolates previously limited by temperature sensitivity.

Challenges

• Balancing indulgence with wellness: products must satisfy taste expectations while meeting stricter nutrient profiles.

• Supply-chain resilience: extreme weather in key cocoa-growing regions threatens long-term raw-material security.

Regional Analysis

Europe retains the largest share of global confectionery sales thanks to a deeply rooted chocolate culture, strong purchasing power, and early adoption of organic and fair-trade badges. Asia-Pacific is the pacesetter in absolute growth, propelled by urban middle-class expansion and a flourishing convenience-store network.

• Europe – Premium chocolate focus, strong sustainability positioning, sophisticated retail execution.

• North America – High brand loyalty, rapid uptake of plant-based and sugar-reduced lines, robust omnichannel presence.

• Asia-Pacific – Fastest volume growth, young demographics, rising disposable income, thriving online grocery.

• Latin America – Chocolate perceived as premium indulgence; manufacturers test affordable formats to widen reach.

• Middle East & Africa – Gradual growth driven by tourism, duty-free sales, and expanding modern trade.

Segmentation Analysis

By Product

• Chocolate – Flagship revenue driver

Chocolate continues to set the pace, buoyed by premium single-origin bars, filled tablets, and gifting assortments. Growing consumer interest in high-cacao and bean-to-bar stories supports margin expansion.

• Sugar Confectionery – Fastest-growing at 4.9 % CAGR

Novel textures, natural colors, and functional additions (vitamin-infused gummies) keep sugar candies relevant as quick energy boosters and kid-friendly treats.

• Gums & Mints – Impulse staples

Functional positioning around oral health and digestion helps gums defend share despite declining traditional chewing habits.

• Cookies & Ice Cream – Seasonal and co-branded momentum

Confectionery-inspired cookie inclusions and ice-cream mix-ins create cross-category buzz and incremental shelf space.

By Distribution Channel

• Offline (Supermarkets/Hypermarkets, Convenience, Department Stores) – More than 75 % share

Physical stores dominate because shoppers like to inspect freshness, compare flavors on the spot, and capitalize on promotions. Branded boutiques in malls amplify experiential engagement.

• Online Retail – Highest growth, 5 % CAGR

E-commerce lets consumers discover limited edition flavors, subscribe to curated boxes, and access personalization tools—all while brands gather real-time purchase data for agile product development.

Industry Developments & Instances

• May 2023 – A leading global chocolatier unveiled a five-SKU premium chocolate range in North America, backed by immersive pop-up experiences.

• March 2023 – A major U.S. confectioner launched plant-based peanut-butter cups, marking its first mainstream vegan line.

• November 2022 – One of the world’s largest cocoa processors opened its biggest Asia-Pacific factory to meet surging regional demand.

• January 2021 – A multinational rolled out a mousse-filled bar under its flagship Silk platform in India, targeting the upscale youth segment.

• January 2020 – A U.S. chocolate group introduced its heritage bar format in India to expand distribution in a high-growth market.

Facts & Figures

• Europe accounts for nearly 37 % of global market share, translating to around USD$ 78 billion in 2024 sales.

• Chocolate’s 45 % slice equates to roughly USD$ 96 billion this year.

• Offline channels represent more than USD$ 160 billion in annual sales.

• The U.S. segment is projected to hit about USD$ 36 billion by 2032, a rise of USD$ 7 billion from current levels.

• Sugar-free and reduced-calorie SKUs already command close to 10 % of new product launches globally.

Analyst Review & Recommendations

The confectionery market analysis underscores a clear playbook: keep indulgence front-and-center while trimming sugar, highlighting origin stories, and expanding omnichannel reach. Brands that pair faster innovation cycles with transparent sourcing and data-driven personalization will outpace slower rivals. To mitigate margin pressure from raw-material swings, forward contracts and sustainable-crop programs are prudent. Overall, market trends signal reliable mid-single-digit growth, rewarding companies that master both premium experiences and responsible nutrition.