Market Overview

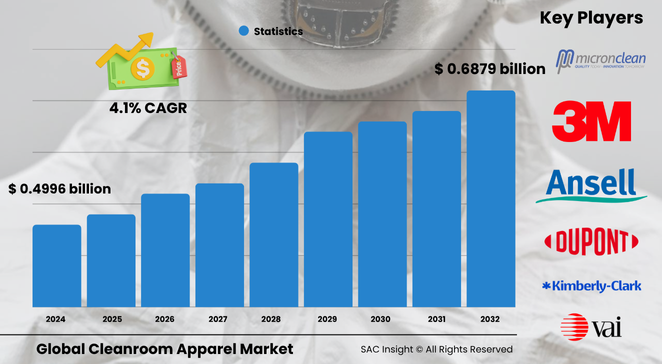

The global cleanroom apparel market size is valued at roughly US$ 0.4996 billion in 2024 and is projected to reach about US$ 0.6879 billion by 2032, reflecting a steady 4.1% CAGR over the 2025-2032 forecast window. First-hand industry insights indicate that tighter contamination-control standards in advanced manufacturing, a post-pandemic focus on infection prevention, and ongoing investments in next-generation semiconductor fabs are the primary engines behind this market growth. SAC Insight's deep market evaluation suggests that the United States cleanroom apparel market alone could move from approximately US$ 0.15 billion in 2024 to nearly US$ 0.21 billion by 2032 as pharmaceutical and chip-fabrication capacity expands.

Summary of Market Trends & Drivers

• End-use consolidation around high-purity production environments—particularly mRNA drug lines and 3-nanometer wafer plants—fuels demand for disposable, low-lint garments.

• Continuous fabric innovations, such as electrostatic-dissipative micro-filament weaves, are raising protection levels without compromising wearer comfort, supporting wider adoption.

Key Market Players

Industry leadership rests with a mix of global safety-equipment suppliers and cleanroom specialists. Firms such as Ansell, DuPont, 3M, and Kimberly-Clark leverage broad distribution networks and advanced material science to serve multinational fabs and contract drug manufacturers. Alongside them, niche players like KM Corporation, Micronclean, and Valutek focus on custom garment systems and sterile-laundry services, giving end users flexible sourcing options.

Competitive dynamics increasingly revolve around partnership models. Apparel producers are collaborating with filtration-system providers to offer bundled contamination-control packages, while several North American vendors have set up regional laundering hubs to shorten turnaround times for reusable coveralls.

Key Takeaways

• Current global market size (2024): about USD$ 0.4996 billion

• Projected global market size (2032): about USD$ 0.6879 billion at a 4.1 % CAGR

• Coveralls represent the largest product segment, driven by one-piece designs that minimize shedding at critical joints

• Pharma laboratories account for the highest market share in applications, yet semiconductor cleanrooms show the fastest incremental revenue gains

• North America leads in revenue, while Asia-Pacific posts the quickest percentage market growth thanks to new fab build-outs in China, South Korea, and Taiwan

• Fabric enhancements—anti-fog visors, breathable laminates, and ESD-safe threads—rank among key market trends shaping product differentiation

Market Dynamics

Drivers

• Expansion of high-grade biologics and vaccine facilities heightens demand for sterile, single-use garments

• Surge in semiconductor capital expenditure to sub-5 nm nodes requires stricter airborne-particulate thresholds, driving apparel upgrades

• Rising awareness of hospital-acquired infections accelerates adoption of disposable hoods and sleeves in clinical settings

Restraints

• High unit costs for premium ESD-safe fabrics can limit uptake among price-sensitive biotech start-ups

• Limited garment-laundering infrastructure in developing regions increases lifecycle costs for reusable systems

Opportunities

• Recyclable non-woven materials offer a path to greener procurement policies and potential cost savings

• Growth of modular cleanrooms in contract research organizations opens fresh channels for mid-tier suppliers

Challenges

• Ensuring global supply stability for micro-denier yarns and PTFE membranes amid raw-material shortages

• Harmonizing divergent regional standards—ISO 14644, EU-GMP, and USP —to simplify cross-site qualification

Regional Analysis

North America currently commands the largest revenue base thanks to mature pharmaceutical clusters and intensive electronics manufacturing. Europe follows, driven by vaccine fill-finish expansions, while Asia-Pacific shows the fastest CAGR as governments subsidize domestic chip production.

• North America – High replacement rate for apparel and strong on-site laundering networks

• Europe – Stringent GMP guidance drives regular garment audits and upgrades

• Asia-Pacific – Rapid fab construction and rising biotech investment underpin double-digit apparel demand

• Latin America – Growing medical-device exports encourage adoption of ISO-class garments

• Middle East & Africa – Early-stage market focused on hospital isolation wards and pilot vaccine lines

Segmentation Analysis

By Type

• Coveralls – Core revenue generator, preferred for head-to-toe sealing.

Coveralls dominate because their seamless design cuts down fiber release and simplifies gowning protocols, especially in ISO Class 4-5 zones where every lint particle counts.

• Boots – Essential footwear barrier, moderate share.

Boots with slip-resistant soles and fully sealed uppers protect critical laminar-flow areas, and demand climbs as users phase out standard overshoes in high-traffic corridors.

• Hoods – High growth in pharma suites.

Integrated hoods with built-in face masks reduce doffing errors and are gaining traction in aseptic fill-finish rooms aiming to cut operator interventions.

• Sleeves – Niche but rising.

Disposable sleeve covers appeal to GMP Class B operators who need quick forearm protection during brief maintenance tasks, keeping gown sets intact.

By Application

• Pharma – Largest consumption bucket.

Stringent sterility rules for injectable drugs and cell-therapy labs ensure consistent ordering cycles for sterile coveralls, hoods, and over-boots.

• Semiconductor – Fastest-growing slice.

Next-gen wafer fabs adopt ultra-low-lint garments with carbon-grid filaments to control electrostatic discharge, supporting multi-year apparel contracts.

• Biotech – Stable but specialized.

Pilot-scale gene-therapy suites require hybrid disposable-reusable systems tailored for sporadic high-risk operations, favouring custom suppliers.

• Others – Hospitals, food processing, and optics.

Rising HAIs and precision food-pack lines extend clean-garment principles beyond traditional micro-contamination sectors.

Industry Developments & Instances

• April 2025 – A leading apparel maker introduced a recyclable polypropylene coverall certified for ISO 5 use, targeting pharma sustainability mandates.

• January 2025 – Major semiconductor consortium signed a multi-year supply agreement with a North American cleanroom-laundry provider to guarantee garment uptime for three new fabs.

• September 2024 – Collaborative R&D project launched to embed RFID tags into garment seams for real-time usage tracking and inventory optimization.

• May 2024 – A European hospital network adopted single-use hood-mask combos across intensive-care units, reducing staff-reported contamination events by 18 %.

Facts & Figures

• Coveralls account for roughly 35 % of total market revenue.

• Single-use garments represent nearly 60 % of unit shipments, up from 52 % in 2020.

• Average gowning-room changeout frequency in ISO Class 5 areas is 4.5 times per shift.

• Incorporating ESD grid fibers can cut electrostatic discharge incidents by up to 70 % in semiconductor lines.

• Reusable garment programs typically reduce waste volume by 65 % over a five-year cycle, despite higher upfront costs.

Analyst Review & Recommendations

Market analysis underscores a decisive shift toward performance-enhanced, sustainability-minded apparel solutions. Suppliers that combine proprietary low-lint fabrics with regional laundering or recycling services stand to outpace overall market growth. Investing in smart-tag tracking will help users streamline inventory and validate cleanroom-protocol compliance. For new entrants, focusing on mid-range disposable hoods and sleeves tailored to fast-growing biologics contractors offers the clearest route to near-term revenue.