Market Overview

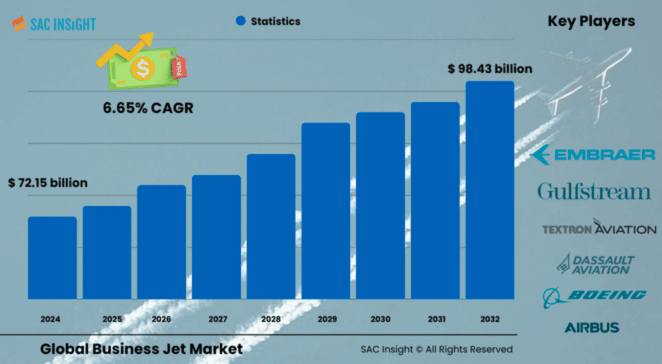

The global business jet market size was valued at US$ 72.15 billion in 2024 (averaging the most recent published estimates) and, according to our market analysis, is on track to reach about US$ 102.82 billion to US$ 98.43 billion by 2032, expanding at a 6.65% CAGR from during the forecast year. First-hand industry insights point to three structural tailwinds: a swelling global population of ultra-high-net-worth individuals, a rebound in cross-border corporate travel, and rapid fleet upgrades that swap older airframes for fuel-efficient, SAF-ready models. SAC Insight evaluation also shows flight activity now exceeding pre-pandemic peaks, especially on trans-Atlantic and intra-Asia routes.

The U.S. business jet market is forecast to approach US$ 35.56 billion by 2032, reflecting robust demand for large-cabin and on-demand charter services.

Summary of Market Trends & Drivers

• Premium mobility as a productivity tool – Executives are using private aircraft to stitch multiple cities into single-day itineraries, sidestepping commercial delays.

• Sustainability push – OEMs and operators are adopting sustainable aviation fuel (SAF) blends and lighter composite structures to curb emissions without sacrificing range.

• Digital marketplaces – App-based charter platforms and jet-card programs are widening access and price transparency, fueling market growth among first-time flyers.

Key Market Players

The business jet market report profiles global and regional leaders such as Gulfstream Aerospace, Bombardier, Textron Aviation, Dassault Aviation, Embraer, Airbus Corporate Jets, Boeing Business Jets, Pilatus, SyberJet, NetJets, Magellan Jets, and Jet Linx. Together, these firms set the competitive tempo through frequent model refreshes—think Gulfstream’s G800, Bombardier’s Global 8000, and Dassault’s Falcon 10X—and strategic alliances with fractional and charter operators.

Key Takeaways

• Market value (2024): ~USD$ 72.15 billion

• Projected value (2032): ~USD$ 102.82 billion to US$ 98.43 billion at a 6.65% CAGR

• North America holds roughly 41.32% market share; Asia-Pacific is the fastest-growing region

• Large-cabin jets command the highest revenue thanks to intercontinental range and cabin comfort

• On-demand services—air taxis, branded charters, jet cards—are the quickest-growing business model

• eVTOL integration and SAF adoption are the two most watched technology trends

Market Dynamics

Drivers

• Rising net-worth population and corporate profitability boost discretionary aircraft spending.

• Time-savings and schedule control versus commercial travel enhance perceived ROI.

• Advancements in avionics, connectivity, and cabin ergonomics improve passenger experience.

Restraints

• High acquisition and operating costs limit addressable customer base.

• Public scrutiny over carbon emissions increases regulatory and reputational pressure.

Opportunities

• Sustainable aviation fuel and hybrid-electric propulsion open new revenue streams.

• Digital charter platforms lower entry barriers, expanding the pool of occasional users.

• Growing appetite for refurbished pre-owned jets creates a parallel aftermarket.

Challenges

• Infrastructure gaps—especially dedicated FBO capacity—in emerging markets.

• Supply-chain tightness for engines and composite materials can delay deliveries.

• Pilot shortage and training pipeline constraints may cap near-term fleet utilization.

Regional Analysis

• North America: Fleet renewal and fractional ownership keep demand steady.

• Europe: Security-driven preference for private terminals; strong charter market.

• Asia-Pacific: Double-digit CAGR on the back of rising UHNWIs in China and India.

• Middle East & Africa: Large-cabin jets favored for long-haul routes; SAF initiatives gaining traction.

• Latin America: Moderate uptake, buoyed by commodity-driven wealth and growing MRO capability.

Segmentation Analysis

By Type

• Light Jets – agile point-to-point hops, cost-efficient for 4-6 passengers.

Light jets remain popular for short regional missions, offering lower operating costs and the ability to access smaller runways.

• Medium Jets – sweet-spot of range, comfort, and price.

Typically seating eight to ten, this class is gaining share among mid-sized corporates seeking nonstop coast-to-coast capability without the expense of large-cabin models.

• Large Jets – long-range flagships, nearly 50% revenue share.

Demand is anchored by global corporates and celebrities who value 6,000-plus nautical-mile range, full-size bedrooms, and advanced connectivity.

By Business Model

• Ownership – full or fractional control, highest revenue today.

Full owners enjoy unrestricted access, while fractional programs (e.g., NetJets) let clients buy hours instead of whole aircraft, balancing cost and convenience.

• On-Demand Service – fastest-growing segment.

Charter, jet-card, and emerging air-taxi services allow pay-as-you-fly flexibility, powered by smartphone booking apps and transparent pricing.

By System

• Propulsion – engine upgrades focus on fuel burn and SAF compatibility.

• Cabin Interiors – surge in bespoke layouts and wellness features like circadian lighting.

• Avionics – touchscreen cockpits and predictive maintenance analytics reduce pilot workload and downtime.

By Ownership

• Pre-Owned – dominates unit transactions.

Refurbished cabins and avionics retrofits make older airframes attractive to cost-conscious buyers.

• New Deliveries – smaller volume, higher revenue per unit.

OEM backlogs stretch into 2027, reflecting healthy forward demand despite macro uncertainty.

Industry Developments & Instances

• Feb 2025: Embraer inks deal to supply up to 212 Praetor and Phenom jets to Flexjet, bolstering its order book through 2030.

• Oct 2024: Textron unveils Citation M2 Gen3, CJ3 Gen3, and CJ4 Gen3 with Garmin Emergency Autoland.

• Aug 2024: Dassault showcases Falcon 6X in São Paulo and opens a dedicated Latin American service center.

• Dec 2024: Gulfstream completes first fully outfitted G800 test flight to validate cabin systems.

• Jul 2022–Dec 2023: OEM-led SAF test flights and composite wing partnerships accelerate sustainability roadmap.

Facts & Figures

• Private aviation generated ~15.6 million t of CO₂ in 2023, up 46% since 2019.

• Large-cabin jets captured ~48% of 2024 revenue, reflecting premium demand.

• North America is slated to take ~66% of new jet deliveries by 2025.

• eVTOL prototypes logged over 1,000 test flights in 2024, signaling imminent urban-mobility crossover.

• Fractional ownership requires an average net worth of US$ 1.5 billion for full share buyers.

Analyst Review & Recommendations

Our SAC Insight evaluation indicates a decisive shift toward greener, tech-forward fleets and service models that trade ownership for access. Players that integrate SAF-capable engines, cabin wellness features, and app-based charter platforms into a single value proposition will outpace competitors. For new entrants, medium-jet leasing in Asia-Pacific offers the quickest path to scale, while established OEMs should double down on hybrid-electric R&D to stay ahead of tightening emission caps and sustain long-term business jet market growth.