Market Overview

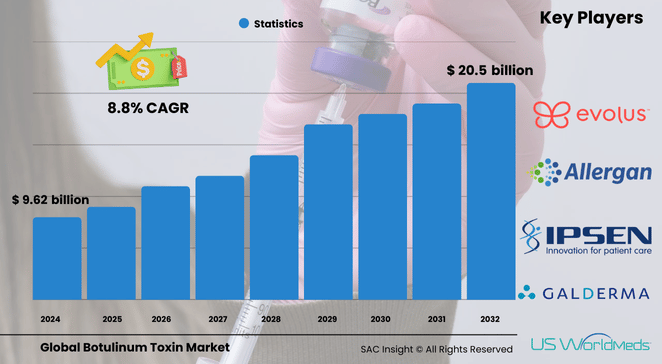

The global botulinum toxin market size was valued at roughly US$ 9.62 billion in 2024 and is set to reach about US$ 20.54 billion by 2032, expanding at an 8.85% CAGR over the 2025-2032 forecast window. SAC Insight's deep market evaluation shows momentum on two fronts: sustained demand for minimally invasive aesthetic procedures and a broadening therapeutic playbook that now spans chronic migraine, spasticity, and overactive bladder.

SAC Insight research insights underscore an especially strong U.S. botulinum toxin market, projected to reach nearly US$ 11.53 billion by 2032 as consumers with higher disposable income lean into quick, clinic-based treatments that promise short recovery times.

Summary of Market Trends & Drivers

• Non-invasive aesthetic procedures are rising faster than surgical alternatives, with botulinum toxin injections remaining the go-to choice for smoothing dynamic facial lines.

• Major manufacturers are pouring R&D dollars into new indications, formulation tweaks, and extended-duration toxins, widening the addressable patient pool and supporting steady market growth.

• Heightened social media visibility is normalising “lunchtime” cosmetic touch-ups, nudging younger demographics toward preventive treatments earlier in life.

Key Market Players

Industry leadership rests with a handful of global firms that pair deep clinical data with powerful brand recognition. AbbVie dominates through its flagship franchise, backed by a loyalty program that pulls repeat aesthetic users into therapeutic pathways. Ipsen, Merz, and Galderma leverage regional strengths and targeted R&D alliances to fortify their portfolios, while South Korea’s Medytox and HUGEL drive competitive pricing and innovate around unit potency. Emerging challengers such as Evolus and Revance are carving niches with boutique positioning or extended-release profiles, adding fresh competitive pressure.

Key Takeaways

• Current global market value (2024): USD$ 9.62 billion

• Forecast value (2032): USD$ 20.54 billion at an 8.85% CAGR

• North America commands roughly 56.6% market share, fuelled by high procedure volumes and favourable reimbursement trends.

• Botulinum toxin-type A accounts for about 98.8% of 2024 revenue and remains the default clinical choice.

• Cosmetic centres and medspas captured close to 44.5% of global revenue in 2024, reflecting consumer preference for specialised aesthetic settings.

• Continuous product launches aimed at extended duration and new therapeutic uses are key market trends shaping the competitive landscape.

Market Dynamics

Drivers

• Rising preference for minimally invasive aesthetics and “preventive Botox” among adults aged 25-45.

• Expanding therapeutic indications, notably in neurology and urology, supported by robust clinical pipelines.

• Growing middle-class spending power in Asia Pacific bolsters elective procedure volumes.

Restraints

• Proliferation of counterfeit or unapproved products that erode consumer trust and can undermine legitimate market analysis.

• High treatment costs in developing regions limit access for some patient segments.

• Supply tightness for purified neurotoxin sources creates occasional pricing pressure.

Opportunities

• Longer-lasting formulations could extend retreatment intervals and attract cost-sensitive users.

• Combination therapies (toxin plus dermal filler) open revenue streams for multi-product portfolios.

• Untapped therapeutic niches—such as essential tremor or refractory depression—offer white-space growth.

Challenges

• Stringent regulatory scrutiny demands rigorous post-market surveillance and can slow approvals.

• Training gaps among non-specialist injectors raise complication risks, highlighting the need for certified education programs.

• Public perception swings linked to over-done aesthetics may curb uptake without balanced physician guidance.

Regional Analysis

The North America botulinum toxin market remains the epicentre of botulinum toxin demand, buoyed by high consumer awareness, aggressive marketing, and a dense network of trained injectors. Europe follows, where aging demographics and supportive insurance frameworks sustain steady procedure growth. Asia Pacific is the fastest-growing territory, driven by beauty-conscious populations in South Korea, China, and Japan and a surge in medical tourism hubs such as Thailand.

• North America – Largest revenue contributor; strong direct-to-consumer marketing keeps procedure pipelines full.

• Europe – Robust clinical governance, growing older population, and strong spending on elective healthcare.

• Asia Pacific – Double-digit gains; rising disposable incomes and growing medspa chains accelerate uptake.

• Latin America – Competitive pricing and cultural affinity for cosmetic enhancement support healthy volumes.

• Middle East & Africa – Nascent but expanding, aided by premium medical centres in the Gulf states and widening private insurance cover.

Segmentation Analysis

By Application

• Aesthetics – Core volume driver

Botulinum toxin remains the most performed nonsurgical aesthetic procedure worldwide, prized for reliable wrinkle reduction and minimal downtime. As social acceptance grows, preventative treatments in younger cohorts are fuelling incremental market growth.

• Therapeutics – Expanding treatment toolbox

Use cases now span chronic migraine, spasticity, cervical dystonia, hyperhidrosis, and bladder disorders. Continuous label expansions are encouraging payers to finance treatments, broadening adoption beyond aesthetics alone.

By Type

• Botulinum Toxin Type A – Dominant share and trusted clinical track record

Type A commands virtually the entire market thanks to extensive safety data, flexible dosing, and broad indication coverage. Development pipelines are focused on duration extension and recombinant variants.

• Botulinum Toxin Type B – Niche therapeutic option

Type B serves patients showing type-A resistance or needing rapid onset, yet limited product availability and shorter duration cap its commercial footprint.

By End-Use

• Specialty & Dermatology Clinics – Preferred setting

These facilities administer the lion’s share of injections, combining expert technique with a spa-like environment that appeals to time-pressed clients.

• Hospitals & Clinics – Clinical backbone

Hospitals dominate therapeutic procedures such as spasticity management, leveraging multidisciplinary teams and insurance billing frameworks.

• Others – Emerging retail channels

Mobile injectables and pop-up med-spas target on-the-go consumers but face regulatory oversight aimed at preserving treatment quality.

Industry Developments & Instances

• November 2024 – A leading manufacturer launched a nationwide consumer campaign offering bundled loyalty points to spur repeat aesthetic visits.

• October 2024 – Positive phase 3 data released for a novel toxin-E candidate targeting glabellar lines with a potentially faster onset.

• December 2023 – A South Asian pharma group introduced a type A biosimilar, signalling intensifying price competition in emerging markets.

• August 2023 – Collaborative deal signed between a European pharma and an Asian biotech for distribution of a next-generation toxin across EU markets.

Facts & Figures

• An estimated 9.22 million botulinum toxin aesthetic procedures were performed globally in 2023.

• Type A products represented roughly 98.8% of total revenue in 2024.

• Cosmetic centres and medspas accounted for about 44.5% of global spend in 2024.

• North America held nearly 56.6% of 2024 revenue, reflecting a mature injector network and high treatment frequency.

• The typical retreatment interval averages 3-4 months, generating sustained, predictable revenue cycles for providers.

Analyst Review & Recommendations

The botulinum toxin landscape continues to evolve from single-use wrinkle therapy to a multifaceted platform spanning wellness and disease management. Players that optimise formulation longevity, secure diversified therapeutic indications, and invest in injector training will capture outsized market share. Vigilant quality control and anti-counterfeit measures are essential to protect brand equity and maintain the trust underpinning long-term market growth.