Market Overview

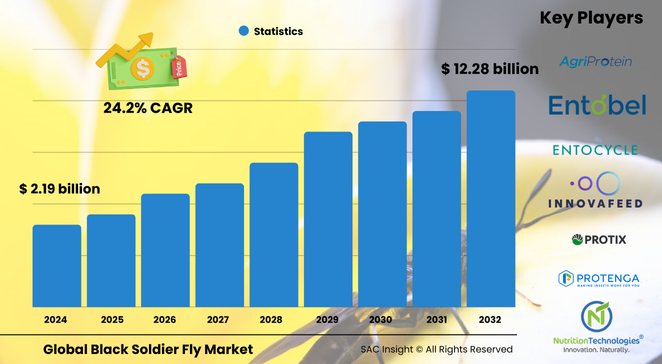

The global black soldier fly market size is valued near US$ 2.19 billion in 2024 and is on track to reach roughly US$ 12.28 billion by 2032, advancing at an average 24.25 % CAGR. First-hand industry insights point to three structural growth engines: the hunt for sustainable protein, tightening waste-management rules that reward circular bio-conversion, and rapid scale-up of automated insect farms. SAC Insight's deep market evaluation indicates the U.S. black soldier fly market alone could climb from about US$ 0.48 billion in 2024 to close to US$ 2.60 billion by 2032 as feed makers swap soy and fish meal for insect protein. The combination of robust demand and supportive regulations underpins strong market growth through the forecast window.

Summary of Market Trends & Drivers

• Continuous improvements in vertical-stack farming and climate-smart rearing systems are boosting yields while cutting land and water use.

• Brand-owners in aquafeed, pet nutrition, and specialty fertilizers are embracing insect-based inputs to hit emissions targets and satisfy consumer sustainability concerns.

• Government incentives—ranging from landfill levies to feed-ingredient approvals—are accelerating commercialization across North America, Europe, and fast-growing Asia-Pacific.

Key Market Players

Industry leadership rests with a mix of technology pioneers and integrated feed suppliers. Firms such as Protix, InnovaFeed, EnviroFlight, Nutrition Technologies, and Entobel command meaningful market share through proprietary breeding lines, large-scale vertical farms, and close ties with aquaculture majors. Their strategies center on widening product portfolios—protein meal, defatted larvae oil, and high-potassium frass—while locking in long-term supply contracts with feed, pet-food, and agriculture customers. Competitive intensity is rising as newcomers launch modular container farms and as established renderers explore insect protein as an add-on to existing waste streams.

Key Takeaways

• Current global black soldier fly market market size (2024): about USD$ 2.19 billion

• Projected global market size (2032): USD$ 12.28 billion at a 24.25 % CAGR

• Protein meal secures the largest product market share and will likely top US$ 7 billion by 2032

• Aquafeed dominates application revenue, yet animal feed shows the fastest uptick as livestock integrators trial insect blends

• Industrial-scale automated farms already exceed 10 000 t annual capacity and are expanding in Europe, Vietnam, and the U.S.

• Waste valorization partnerships with food processors and municipalities are reshaping supply chains and trimming input costs

Market Dynamics

Drivers

• Rising fish- and soy-meal prices push feed formulators toward alternative proteins with lower land-use footprints.

• Circular-economy policies reward bioconversion of food and ag waste, reducing disposal fees and methane emissions.

• Advances in genetics, sensory controls, and AI-based farm management lift survival rates and throughput.

Restraints

• Non-standard feed regulations across regions slow cross-border shipments and product approvals.

• High upfront capex for automated rearing and processing lines can deter small producers.

• Limited consumer awareness of insect-derived ingredients in human food segments tempers near-term uptake.

Opportunities

• Co-locating insect farms next to breweries, produce distributors, or livestock operations unlocks steady organic-waste feedstock.

• Larvae oil shows promise in pet food, cosmetics, and biodiesel, creating new revenue streams beyond meal.

• Carbon-credit schemes for waste diversion and emission avoidance could boost project economics.

Challenges

• Disease-management protocols and biosecurity standards are still evolving, posing operational risk.

• Scaling vertical farms in hot, humid climates requires robust cooling and energy management.

• Talent shortages in entomology and insect-process engineering may slow facility ramp-ups.

Regional Analysis

The Europe black soldier fly market currently holds the largest market share thanks to early regulatory greenlights, abundant venture funding, and a mature aquaculture sector hungry for certified sustainable feed. North America follows, propelled by landfill diversion mandates and strong venture capital, while Asia-Pacific is the fastest-growing territory on the back of surging aquafeed demand and supportive government programs in China, Vietnam, and Malaysia. Latin America and the Middle East & Africa contribute smaller but steadily rising volumes as protein-deficit economies explore localized insect farming.

• Europe – Early mover advantage, strong policy backing, and large salmon feed market

• North America – Rapid farm construction, sizeable pet-food channel, and landfill fee pressures

• Asia-Pacific – Fastest CAGR, driven by aquaculture expansion and supportive ag-tech funding

• Latin America – Emerging adoption, especially in Brazil and Chile for fish and poultry feed

• Middle East & Africa – Pilot projects link waste-management goals with desert agriculture

Segmentation Analysis

By Product

• Protein Meal – Core revenue generator, commanding over half of 2024 sales.

Protein meal’s balanced amino-acid profile rivals fishmeal, making it the go-to ingredient for aquafeed formulators seeking stable pricing and lower carbon intensity.

• Whole Dried Larvae – Niche but growing for backyard poultry and aquarium enthusiasts.

Direct-to-consumer e-commerce and hobby farming support brisk uptake, though volumes remain modest compared with processed meals.

• Biofertilizers (Frass) – High-volume soil booster with rising organic-farming demand.

Frass delivers slow-release nitrogen and chitin that improves soil microbiota, drawing interest from regenerative-agriculture growers.

• Larvae Oil – Emerging additive for pet food and functional lipids.

Rich in lauric acid, larvae oil offers antimicrobial benefits and is gaining traction as a sustainable substitute for palm or fish oil.

• Other Products – Eggs, pupae, and slurry serve breeding programs and specialty research.

These categories stay small but strategic, supporting genetic improvement and novel ingredient R&D.

By Application

• Aquafeed – Largest slice of market revenue.

Salmonids, shrimp, and tilapia diets integrate insect meal to cut reliance on fishmeal and stabilize fatty-acid profiles.

• Animal Feed – Fastest-growing segment across poultry and swine.

Trials show inclusion rates up to 15 % without performance loss, opening high-volume pathways.

• Agriculture – Fertilizer and soil-amendment uses for frass.

Organic-certified growers value frass for its micronutrient load and pathogen suppression.

• Pet Food – Premium niche targeting hypoallergenic claims.

Grain-free and sustainable-label trends spur dog and cat-food launches featuring insect protein.

• Other Applications – Cosmetics, biodiesel, and pharmaceuticals remain exploratory.

Innovators are testing larvae oil for lauric-based surfactants and chitin derivatives for wound-care materials.

By Production Method

• Industrial-Scale Farming – Dominant model, leveraging robotics and climate-control to hit consistent yields.

High throughput and predictable quality make it the preferred option for major feed contracts.

• Small-Scale Farming – Community-level units valorizing local waste.

Enables rural livelihoods and decentralized protein supply, though scale is limited.

• Vertical Farming – Space-efficient approach ideal for urban or climate-extreme regions.

Stacked racks coupled with IoT sensors deliver steady production close to demand centers.

By End-User

• Feed Manufacturers – Principal buyers locking in multi-year supply deals.

Scale and quality standards drive rigorous supplier audits and co-development projects.

• Pet Food Companies – Early adopters promoting novel-protein diets for sensitive pets.

Marketing emphasises sustainability and hypoallergenic benefits.

• Food & Beverage Industry – Experimental inclusion in protein bars and snacks.

Regulatory approvals and consumer education will dictate pace of adoption.

• Cosmetics Industry – Growing interest in larvae oil and chitin for natural formulations.

Safety studies and clean-beauty trends underpin long-term potential.

Industry Developments & Instances

• February 2024 – A leading Dutch producer broke ground on a second 15 000 t insect-protein plant in the U.S. Midwest.

• October 2023 – A French-Vietnamese JV commissioned Southeast Asia’s largest automated larvae facility, pairing brewery waste with on-site rearing.

• April 2023 – A U.S. insect-protein specialist secured a long-term offtake agreement with a global salmon-feed maker covering 60 000 t over ten years.

• March 2023 – An Irish biotech launched larvae-oil-based emulsifiers aimed at clean-label cosmetics.

• January 2022 – EU feed regulations expanded insect-protein use to pig and poultry diets, unlocking new demand streams.

Facts & Figures

• Industrial-scale farms now achieve feed conversion ratios near 1.6 : 1, ahead of poultry averages.

• Up to 100 kg of food waste can yield roughly 20 kg of fresh larvae and 15 kg of frass.

• Incorporating 5 % insect meal in broiler diets can cut soybean demand by nearly 40 kg per metric ton of feed.

• Larvae oil contains about 40 % lauric acid, rivaling coconut oil’s antimicrobial properties.

• Europe accounts for more than 55 % of current market revenue, yet Asia-Pacific logs the highest year-on-year shipment growth above 30 %.

Analyst Review & Recommendations

SAC Insight's market analysis underscores a decisive pivot from pilot projects to industrial roll-outs. Players that secure reliable waste-stream partnerships, invest in genetics, and integrate downstream applications will outpace average market growth. Priorities include harmonizing feed-safety standards to smooth cross-border trade, diversifying product lines beyond meal, and leveraging carbon-credit schemes to enhance margins. Early adoption in animal feed and pet food suggests a clear pathway, while long-term upside lies in specialty oils, biofertilizers, and advanced biomaterials.