Market Overview

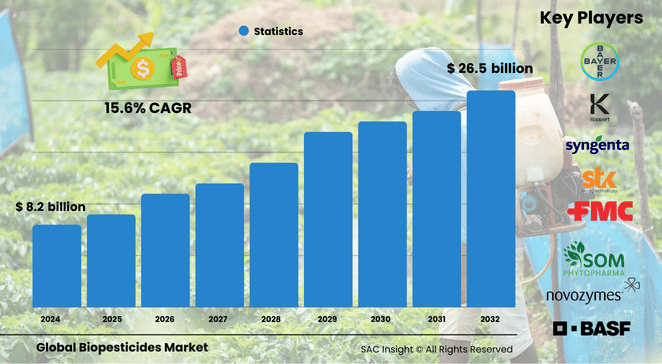

The biopesticides market size was valued at approximately US$ 8.225 billion in 2024 and is projected to reach about US$ 26.52 billion by 2032, advancing at a brisk 15.6% CAGR over 2025-2032. This market growth is fueled by surging demand for residue-free food, tighter pesticide regulations, and steady advances in microbial fermentation, formulation science, and precision-application technologies. First-hand industry insights indicate North America held roughly 36.8% of global market share in 2024, while the U.S. biopesticides market alone is on track to cross US$ 7.34 billion by 2032. This market analysis draws on SAC Insight's deep market evaluation of purchasing patterns, policy shifts, and R&D pipelines that signal a structural move away from synthetic chemistries toward biological solutions.

Summary of Market Trends & Drivers

• Farmers worldwide are integrating biopesticides into integrated pest management programs as governments restrict chemical actives and consumers demand organic labels.

• Rapid product launches based on next-generation bacteria, fungi, and plant-derived actives are shortening development cycles and broadening the pest spectrum addressed.

• Digital farming tools—drones, sensor networks, and AI-guided sprayers—are improving the precision and cost-effectiveness of biopesticide applications, accelerating adoption.

Key Market Players

Global competition is led by diversified agrochemical majors and specialized biologicals firms. Multinationals with strong R&D funding are scaling fermentation capacity, while mid-sized innovators focus on niche crops and local registration expertise. Established names such as BASF SE, Bayer AG, Syngenta Group, UPL, Corteva, and FMC Corporation continue to expand biological portfolios through in-house research and selective acquisitions. At the same time, companies like Koppert, Nufarm, Sumitomo Chemical, Gowan, Bioceres Crop Solutions, and Certis USA leverage technical support networks to deepen grower trust and accelerate field-level adoption.

Key Takeaways

• Current global market value (2024): USD$ 8.225 billion

• Projected value (2032): USD$ 26.52 billion at a 15.6% CAGR

• North America leads, holding roughly 36.8% market share; the U.S. alone could top USD$ 7.34 billion by 2032

• Biofungicides command the largest revenue share today; bioinsecticides are the fastest-growing sub-segment thanks to rapid label expansion

• Liquid formulations account for the majority of new registrations due to ease of mixing, uniform coverage, and extended shelf life

• Fruits & vegetables remain the core application segment, driven by raw-consumption safety concerns and organic-premium pricing

Market Dynamics

Drivers

• Accelerating consumer shift toward organic and sustainably produced food

• Stricter global and regional limits on synthetic pesticide residues

• Continuous innovation in microbial strains, RNA-based actives, and carrier technologies

Restraints

• Performance variability tied to temperature, humidity, and other environmental factors

• Shorter shelf life versus conventional chemicals, raising distribution and storage challenges

Opportunities

• Precision-agriculture platforms enabling targeted, data-driven biopesticide delivery

• Government subsidies and fast-track registrations that lower barriers for biological products

• Expansion into seed-treatment coatings and post-harvest disease management niches

Challenges

• Low awareness and limited training among smallholder farmers in emerging markets

• Need for harmonized global regulations and clear efficacy standards to speed market access

Regional Analysis

North America dominates primarily on the back of well-defined organic standards, funding for biological R&D, and an advanced retail distribution network. Europe follows closely, propelled by a formal 50% chemical-pesticide reduction target by 2030, while Asia-Pacific is the fastest-growing region as China and India scale organic acreage and invest in local biological manufacturing.

• North America – Largest market, driven by regulatory support and high organic penetration

• Europe – Strong policy push and consumer preference for residue-free produce

• Asia-Pacific – Double-digit expansion as governments back sustainable intensification

• South America – Rising adoption in high-value fruit exports, though regulation is still forming

• Middle East & Africa – Nascent stage, but protected-cultivation growth is boosting demand

Segmentation Analysis

By Type

• Biofungicides – Largest revenue share

Fungal and bacterial antagonists protect high-value fruit and vegetable acreage, offering targeted control without harming beneficial organisms. Growers favor them to meet stricter residue limits and export-market requirements.

• Bioinsecticides – Fastest-growing segment

Novel microbial, botanical, and RNA-based products are replacing broad-spectrum chemicals, delivering quick knock-down and resistance-management benefits. Continued label additions for staple crops are widening the addressable market.

• Bionematicides – Emerging but gaining traction

Soil-applied microbes and plant extracts suppress root-knot nematodes, improving root health and yield in intensive horticulture. Awareness programmes are pushing uptake beyond specialty crops.

• Others – Bioherbicides and viral products

Still niche, but development of weed-specific pathogens and viral controls for insect vectors suggests a pipeline ready for commercialization once efficacy hurdles are cleared.

By Source

• Microbials – Broad-spectrum and strongly researched

Bacteria, fungi, and viruses underpin most new registrations thanks to proven field performance, ability to improve soil health, and compatibility with organic certification.

• Biochemicals – Plant- and mineral-derived actives

These compounds disrupt pest behavior or physiology and often secure faster regulatory approval, making them attractive for rotation programs.

By Mode of Application

• Foliar Application – Widest adoption

Direct contact with pests and pathogens provides rapid action and flexibility across crop stages, cementing foliar sprays as growers’ first choice.

• Seed Treatment – Rising uptake

Early-season protection and compatibility with existing coating lines make seed treatments a cost-effective entry point for biologicals.

• Soil Application – Vital for root-zone pests

Granules and drenches deliver microbes directly to the rhizosphere, enhancing plant vigor and suppressing soil-borne diseases.

• Others – Trunk injection, drip irrigation, and bait stations

Specialty methods target localized infestations while minimizing non-target exposure.

By Crop

• Fruits & Vegetables – Core demand engine

High susceptibility to pests, coupled with zero-tolerance residue standards, drives the bulk of biopesticide usage. Premium pricing of organic produce amplifies return on investment for growers.

• Cereals & Grains – Growing interest

Wider availability of microbial seed treatments and foliar RNA-based products is opening large-acreage opportunities.

• Oilseeds & Pulses – Steady adoption

Disease-resistance management and export-market requirements are encouraging farmers to integrate biologicals alongside reduced-dose chemical programs.

• Others – Turf, ornamentals, and plantation crops

Niche segments benefit from environmental stewardship objectives and regulatory pressures on synthetic actives.

Industry Developments & Instances

• May 2024 – A crop-solutions provider in Brazil secured approval for three new microbial insecticidal and nematicidal products based on inactivated Burkholderia cells.

• May 2024 – A global agrochemical firm partnered with an AI software specialist to accelerate discovery of novel biological crop-protection molecules.

• April 2024 – A leading multinational inked an agreement for a new biological insecticide for arable crops, bolstering its sustainable-protection portfolio.

• March 2024 – Construction began on a large-scale fermentation facility in Europe to manufacture biological fungicides and seed treatments, slated to come online in 2025.

• December 2023 – A bio-innovation company launched a dual-action bionematicide and biofungicide for the sugarcane sector, expanding biological options in cash crops.

Facts & Figures

• Organic food sales in the U.S. exceeded US$ 60 billion in 2023, underpinning sustained demand for residue-free crop inputs.

• Nearly 40% of new crop-protection product registrations in 2024 were biologicals, up from 28% five years prior.

• Liquid formulations accounted for roughly 55% of global biopesticide product launches in 2024 thanks to improved shelf stability.

• North American growers adopting biologicals report up to 25% reduction in chemical-pesticide spend within three seasons.

• Precision-application technologies can cut biopesticide use by 15-20% while maintaining efficacy, according to field-level case studies.

Analyst Review & Recommendations

SAC Insight's deep market evaluation suggests the biopesticides sector is shifting from a compliance-driven niche to a mainstream crop-protection pillar. Companies that combine robust microbial libraries with user-friendly liquid formulations and digital-ag platforms will outpace peers. For new entrants, targeting fruits and vegetables with high-value biofungicides offers the fastest route to revenue, while established players should focus on scaling fermentation capacity and farmer-training programs to overcome performance-perception barriers. Overall, sustained policy momentum, evolving consumer preferences, and continuous innovation set the stage for resilient double-digit expansion through 2032.