Market Overview

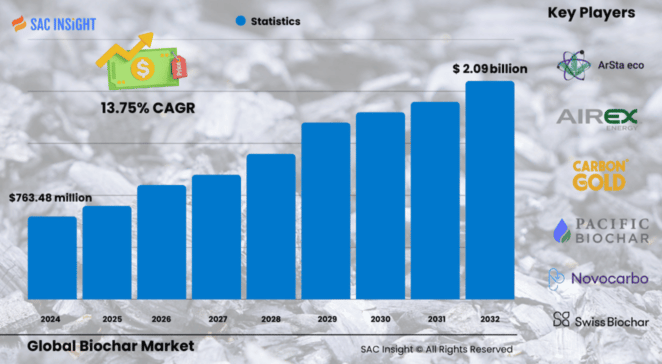

The global biochar market size was valued at US$ ≈ 763.48 million in 2024 and is projected to reach at US$ ≈ 2.09772 billion by 2032, reflecting a robust 13.75% CAGR over 2025‑2032. First‑hand industry insights highlight three structural tailwinds: the pivot toward regenerative agriculture, rising demand for carbon‑credit revenue streams, and government‑backed waste‑to‑energy mandates. SAC Insight evaluation shows that Asia Pacific already commands more than 70.49% of global volume, while the U.S. biochar market is on track to reach at US$ 43.61 million by 2032 as federal incentives for greenhouse‑gas mitigation intensify.

Summary of Market Trends & Drivers

• Accelerating adoption of sustainable farming practices is pushing biochar from a niche soil amendment to a mainstream input across row‑crop, horticulture, and livestock operations.

• Carbon‑credit monetization—particularly long‑duration removal credits—has created a second revenue stream that is shortening payback periods for new production facilities.

• Advances in continuous pyrolysis reactors are lifting throughput and lowering unit costs, improving market share for organized producers.

Key Market Players

The competitive landscape is still fragmented, but scale is building quickly. Established technology specialists such as Airex Energy, Aries Clean Energy, and Carbon Gold lead on automated reactor design, while regional integrators—Oregon Biochar Solutions, Farm2Energy, Safi Organics, and others—anchor local feedstock networks. A growing cohort of start‑ups is pursuing modular systems that bolt onto biomass power plants, aiming to capture both energy and char value.

Key Takeaways

• 2024 biochar industry value: ≈ US$ 763.48 million

• 2032 forecast: ≈ US$ 2.09772 billion at a 13.75% CAGR

• Asia Pacific holds ~70.49% market share; China is the single‑largest producer.

• Pyrolysis accounts for ~65% of output thanks to high carbon yield and reactor stability.

• Agriculture absorbs ~75% of demand, but power‑generation and water‑treatment uses are rising fastest.

• Carbon‑credit sales can add US$ 100‑150 per tonne of additional revenue for premium‑grade biochar.

Market Dynamics

Drivers

• Growing organic‑food demand and soil‑health regulations are accelerating biochar adoption in both developed and emerging markets.

• National and corporate net‑zero commitments are spurring large buyers—particularly in tech and consumer goods—to pre‑purchase biochar‑based carbon offsets.

• Abundant low‑cost biomass residues (crop waste, forestry by‑products, animal manure) support attractive unit economics.

Restraints

• Limited farmer awareness and fragmented distribution in parts of South America, Africa, and Southeast Asia.

• Up‑front capital intensity for high‑temperature, low‑emission reactors can deter small producers.

• Lack of globally harmonized quality standards complicates cross‑border trade.

Opportunities

• Integration of biochar production with biogas or biomass power plants creates dual revenue from electricity and carbon credits.

• Emerging industrial uses—textiles, building materials, and electromagnetic shielding—offer new demand nodes beyond agriculture.

• Blended soil products (biochar plus microbial inoculants or slow‑release fertilizers) can command premium pricing.

Challenges

• Ensuring consistent product specifications to unlock large‑scale offtake agreements.

• Navigating tightening life‑cycle assessment rules that require full traceability from feedstock to end use.

• Scaling supply fast enough to meet multi‑million‑tonne corporate removal pledges without straining feedstock chains.

Regional Analysis

North America leads in organized in the Global biochar market, vertically integrated producers and early carbon‑credit trading, while Asia Pacific dominates on volume thanks to its vast agricultural base and supportive research programs. Europe’s growth hinges on stringent soil‑health and waste‑management directives, and pilot projects in Latin America and Africa are gathering pace as part of climate‑smart agriculture initiatives.

• Asia Pacific: Rapid expansion in China, India, and Australia; strong government R&D funding.

• North America: High organic‑food penetration and carbon‑credit demand drive steady market growth.

• Europe: Policy‑led push for soil restoration and circular economy fuels adoption.

• Latin America: Sugarcane and forestry residues provide abundant feedstock for emerging players.

• Middle East & Africa: Early‑stage market, but desert‑soil remediation and climate‑finance inflows are catalysts.

Segmentation Analysis

By Technology

• Pyrolysis – High carbon yield, dominant share

Pyrolysis remains the workhorse technology because it delivers stable, high‑surface‑area biochar at relatively low operating costs. Continuous kilns are boosting throughput and cutting emissions, keeping pyrolysis in the lead.

• Gasification – Smaller volume, lower emissions

Gasification produces syngas for on‑site power and a co‑product char. While yields are lower, the dual‑energy benefit appeals to facilities that prioritize energy self‑sufficiency.

• Other Processes – Hydrothermal & cook‑stove methods

Niche techniques such as hydrothermal carbonization serve small‑scale rural producers who convert wet biomass into char without extensive drying, opening doors in off‑grid regions.

By Application

• Agriculture – Core demand engine

Roughly three‑quarters of global biochar ends up in farming, where it improves nutrient retention, cuts fertilizer runoff, and boosts crop yields. Awareness campaigns and organic‑certification premiums are widening adoption.

• Livestock – Rising feed and bedding additive

Biochar’s ability to bind toxins and reduce methane in ruminants is creating a fast‑growing secondary market, especially among large dairy and poultry operators.

• Industrial Uses – Emerging high‑value stream

Manufacturers are testing biochar as a lightweight filler in cement, asphalt, and polymer composites, seeking both performance gains and embodied‑carbon reductions.

• Power Generation & Others – Carbon‑negative energy

Co‑firing char with biomass or coal provides dispatchable, low‑carbon power and generates additional removal credits, an attractive proposition for utilities under decarbonization pressure.

Industry Developments & Instances

• March 2024: A global tech firm signed a six‑year offtake agreement for 95 k tonnes of biochar‑based carbon credits from a new Mexican plant.

• July 2023: A Canadian‑French consortium broke ground on North America’s largest facility, a US$ ≈ 60 million investment targeting 100 k tonnes annual output.

• December 2023: A major carbon‑credit marketplace delivered 32 k tonnes of removal credits from a Bolivian biochar project to a Fortune 500 buyer.

• June 2022: A pyrolysis‑reactor supplier joined a bio‑industrial alliance to derisk feedstock sourcing in certified Bio‑Derived Opportunity Zones.

Facts & Figures

• Continuous pyrolysis reactors can convert 1 tonne of biomass into ≈ 300 kg of biochar in under 30 minutes.

• Applying 10 t/ha of biochar can raise maize yields by 8‑15% on degraded soils.

• One tonne of premium biochar can sequester ≈ 2.6 t CO₂‑eq for centuries.

• The average carbon‑credit price for biochar removal projects rose 35% year‑on‑year in 2024.

• Over 70% of surveyed U.S. producers are fully integrated—from feedstock procurement to direct farmer sales.

Analyst Review & Recommendations

SAC Insight analysis indicates that biochar is shifting from experimental to scalable, commercially viable climate tech. Producers that secure reliable feedstock contracts, adopt low‑emission continuous reactors, and bundle char sales with verified carbon‑credit programs will capture outsized market growth. For new entrants, modular pyrolysis units co‑located with agricultural cooperatives offer a fast route to market share, while established players should accelerate R&D into blended soil products and industrial fillers to diversify revenue streams.