Market Overview

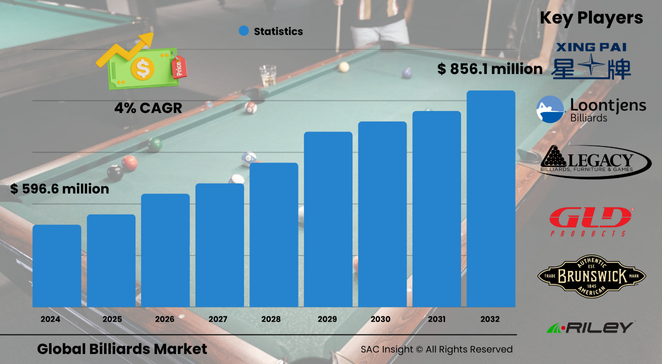

Global market analysis indicates the billiards industry was valued near US$ 596.6 million in 2024 and is set to climb to roughly US$ 856.1 million by 2032, posting average market growth of about 4.0% CAGR. First-hand industry insights highlight three structural drivers: rising disposable income that turns cue sports into a mainstream pastime, organised retail and e-commerce that widen product reach, and steady product innovation—from carbon-fibre cues to compact home tables—that keeps enthusiasts upgrading. SAC Insight's deep market evaluation suggests the United States billiards market alone could advance from just under US$ 200 million in 2024 to around US$ 260 million by 2032 as clubs, bars, and recreation chains refresh their gaming areas.

Summary of Market Trends & Drivers

Wider urban leisure culture makes pool halls and bar-based gaming a preferred social setting, lifting table replacement cycles. Digital marketing and live-streamed tournaments boost visibility among younger demographics. Meanwhile, lighter synthetic slates and flat-pack designs reduce freight costs, encouraging online purchases and global market share expansion.

Key Market Players

Leading billiards manufacturers blend craftsmanship with aggressive omnichannel retailing. Heritage brands known for slate accuracy and premium veneers now package mid-range series for casual players, while specialist cue makers deploy low-deflection shafts that appeal to professionals. On the distribution side, large sporting-goods chains and dedicated web stores compete by bundling accessories and offering financing.

Competitive dynamics centre on product personalisation, strategic sponsorships, and regional assembly hubs that shorten lead times. Recent acquisitions of mid-tier European distributors by multinational cue companies underscore an ongoing push toward vertical integration and direct-to-consumer models that protect margins even as raw-material prices fluctuate.

Key Takeaways

• Current global billiards market size (2024): about USD$ 596.6 million

• Projected global market size (2032): roughly USD$ 856.1 million at a 4.0 % CAGR

• North America leads revenue with more than one-third market share, driven by league play and strong club networks

• Online sales already exceed 40 % of cue and accessory turnover and are still rising

• Synthetic playing surfaces cut table weight by up to 30 %, reducing shipping fees for cross-border e-commerce

• Custom-graphics cues and limited-edition balls are fast-growing niches targeting collectors and gifting segments

Market Dynamics

Drivers

• Higher disposable income in emerging cities fuels demand for aspirational leisure equipment

• Live events and televised championships inspire new players, sustaining long-term market growth

• E-commerce platforms offer wider assortments and easy financing, enlarging the addressable customer base

Restraints

• High slate and hardwood costs push retail prices beyond budget for many households

• Competing digital entertainment options divert attention from physical cue sports

• Space constraints in urban homes restrict household table uptake

Opportunities

• Foldable or multi-game convertible tables appeal to apartment dwellers

• Branded cues endorsed by influencers create fresh revenue channels

• Corporate wellness programs and co-working spaces introduce billiards as a social amenity

Challenges

• Counterfeit cues and low-grade balls undermine brand reputation in price-sensitive markets

• Fluctuating timber supply tightens margins for premium table makers

• Limited grass-roots coaching infrastructure hampers talent development in several regions

Regional Analysis

North America currently tops the leaderboard thanks to established leagues, collegiate circuits, and wide retail coverage. Europe follows, buoyed by club culture and high refurbishment rates, while Asia-Pacific shows the quickest percentage gains as rising middle-class consumers embrace cue sports and local manufacturers scale production.

• North America – Largest revenue base; league sponsorships and strong replacement demand

• Europe – Robust club density; premium table upgrades support steady growth

• Asia-Pacific – Fastest CAGR driven by urban recreation centres and government sports promotion

• Latin America – Growing pool-hall scene, especially in Mexico and Brazil

• Middle East & Africa – Niche but expanding markets in high-end hospitality and private villas

Segmentation Analysis

By Product Type

• Carom – Loyal but specialised audience.

Carom remains a steady niche, with dedicated clubs in Europe and Asia keeping demand for larger pocket-less tables alive.

• Pool – Mass-market favourite.

Eight-ball and nine-ball dominate bar and home settings, giving pool tables the lion’s share of market size and upgrade cycles.

• Snooker – Skill-intensive prestige segment.

Professional tournaments and televised coverage in the UK and Asia sustain premium snooker-table sales despite their larger footprint.

By Equipment

• Table Ball – Core consumable.

High-density phenolic-resin sets last longer and command higher margins for suppliers.

• Cue – Personal performance piece.

Low-deflection shafts and weight-adjustable butts drive repeat purchases among serious players.

• Snooker Cue – Precision-focused.

Thinner tips and longer taper profiles cater to finesse play, appealing to devoted snooker fans.

• Nine Ball Cue – Power-optimised.

Shorter tapers and harder tips maximise break force, popular in competitive pool circuits.

• Other Equipment – Chalks, racks, gloves.

Accessory bundles elevate average order value, especially in online channels.

By Application

• Club – Largest institutional buyer.

Frequent felt refits and cue replacements sustain recurring revenue for suppliers.

• Race/Tournament – Event-driven spikes.

Professional circuits create seasonal demand for branded tables and lighting rigs.

• Family – Casual home entertainment.

Compact or foldable models attract households seeking space-efficient leisure options.

• Others – Workplaces, schools, cruise ships.

Non-traditional venues integrate tables to boost engagement and dwell time.

By Distribution Channel

• Online – Rapidly scaling.

Drop-shipping models allow even boutique brands to reach global consumers without extensive inventory.

• Offline – Experience-centric.

Showrooms remain vital for test shots and custom fitting, especially at the high end.

• Specialty Stores – Expertise hub.

In-house repairs and cue maintenance build customer loyalty and repeat traffic.

• Department Stores – Entry-level focus.

Value bundles capture impulse buyers unfamiliar with dedicated sports outlets.

By Material

• Wood – Classic premium.

Maple and oak frames preserve traditional aesthetics and command higher price points.

• Synthetic – Lightweight alternative.

MDF cores and composite rails cut costs and ease shipping, driving e-commerce adoption.

• Other Materials – Metal and glass novelties.

Designer tables for luxury interiors create eye-catching statement pieces, albeit at low volumes.

Industry Developments & Instances

• December 2021 – A leading cue firm acquired a German distributor, creating a direct foothold in Central Europe.

• 2024 – Multiple brands launched carbon-fibre shafts under US$ 300, widening advanced technology access.

• 2025 – Major Asian manufacturer opened a slate-processing plant in Vietnam to secure raw-material supply and lower logistics costs.

Facts & Figures

• Online channels account for more than 45 % of global cue sales in 2024.

• North America held roughly 35 % market share last year.

• Average retail price of a home pool table rose 7 % year-on-year due to lumber inflation.

• Professional tournaments streamed on social media logged over 120 million cumulative views in 2024.

• Custom-engraved cues grew at nearly 12 % annually, outpacing standard models.

Analyst Review & Recommendations

The billiards market benefits from a balanced mix of heritage appeal and modern retail innovation. Suppliers that marry precision engineering with flexible fulfilment—think flat-pack tables, modular slates, and quick-ship personalised cues—are best placed to capture incremental market growth. To mitigate raw-material volatility, brands should diversify slate and hardwood sources while expanding synthetic offerings aimed at e-commerce buyers who prioritise convenience over tradition.