Market Overview

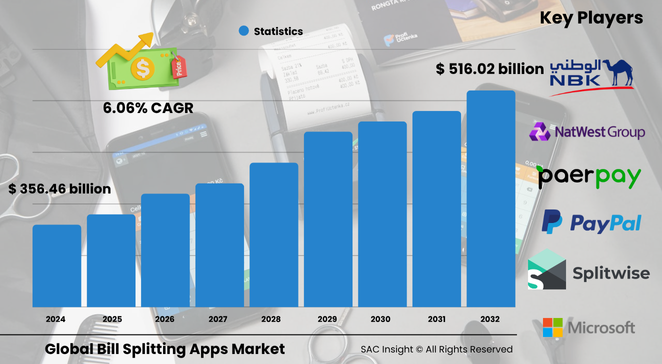

The global bill splitting apps market size stands at roughly US$ 356.46 billion in 2024 and is projected to approach about US$ 516.02 billion by 2032, expanding at an average 6.06% CAGR. First-hand industry insights indicate three clear growth drivers: widespread smartphone adoption, friction-free digital payments, and a steady rise in social, shared-expense occasions such as group travel and co-living. Deep market analysis shows the United States bill splitting apps market alone could move from just under US$ 110 billion in 2024 to around US$ 155 billion by 2032 as consumers gravitate toward instant, contact-free bill settlement.

Summary of Market Trends & Drivers

• AI-supported receipt scanning, voice input, and real-time currency conversion are turning basic split tools into full personal-finance hubs.

• Partnerships with banks and payment gateways are shortening settlement cycles to seconds, sharpening the value proposition for users and merchants.

• Travel and hospitality platforms are embedding bill splitting features to retain customers and capture transaction fees, accelerating overall market growth.

Key Market Players

The competitive field combines pure-play specialists and universal payment brands. Splitwise, Tricount, Divvy, Billr.me, and Bring10 focus on intuitive expense tracking, while PayPal, Venmo, Alipay, Google Pay, and WeChat Pay leverage existing wallet user bases to capture larger market share. Agile newcomers are closing capability gaps with chat-bot helpers, group budgeting modules, and smartwatch extensions, forcing incumbents to refresh their roadmaps and pursue co-marketing alliances.

Key Takeaways

• Current global market size (2024): USD$ 356.46 billion

• Projected global market size (2032): USD$ 516.02 billion at a 6.06 % CAGR

• Android phones account for the highest install base, yet iOS users generate larger average revenue per user

• Cloud-based deployments dominate as developers seek frictionless updates and elastic scaling

• Integration with banking applications and payment gateways is now a minimum entry ticket for credible market players

• Asia Pacific leads in user numbers, while North America maintains the highest revenue per download

Market Dynamics

Drivers

• Rising digital wallet penetration lowers consumer resistance to app-based payments.

• Social dining, shared rentals, and coworking spur frequent micro-transactions needing accurate splits.

• Continuous feature drops—voice commands, AI suggestions, NFC tap-to-split—keep engagement high.

Restraints

• High development and compliance costs, especially for cross-border KYC and AML requirements.

• User churn spikes if fee structures are unclear or settlement times lag.

Opportunities

• Embedded finance: white-label APIs let non-financial platforms offer seamless splitting.

• Blockchain-secure ledgers could unlock enterprise-grade transparency for business expense reconciliation.

Challenges

• Intensifying privacy regulations raise the bar for data handling, particularly in Europe and parts of Asia.

• Fragmented regional payment rails can slow real-time settlement in emerging markets.

Regional Analysis

Asia Pacific currently commands the largest user base thanks to affordable smartphones and a cultural tilt toward group dining and super-app ecosystems. North America generates the bulk of revenue per user, driven by high disposable income and entrenched digital payment habits. Europe follows with rapid fintech adoption and strong open-banking mandates that favor app interoperability.

• North America – Revenue leader; strong digital wallet saturation and tipping culture.

• Europe – Fast adopters of open-banking APIs, fueling feature-rich app launches.

• Asia Pacific – Largest install base; super-apps integrate splitting as a default function.

• South America – Growing smartphone uptake and social spending habits boost demand.

• Middle East & Africa – Still nascent; cross-border worker remittances present a compelling niche.

Segmentation Analysis

By Operating System

• iOS – Premium spender segment.

High ARPU, early feature adoption, and seamless Apple Pay integration make iOS a magnet for revenue-first strategies.

Developers prioritize timely App Store releases, dark-mode UI, and widget support to capture engaged iPhone users.

• Android – Volume powerhouse.

The broadest device footprint, especially in price-sensitive markets, secures Android the largest market share by downloads.

Optimized APK sizes, offline modes, and diverse payment-rail support are critical to winning retention across mid-range handsets.

• Windows – Niche enterprise foothold.

While consumer traction is modest, Windows remains relevant inside SMEs that prefer desktop dashboards for finance teams.

Cross-platform frameworks and progressive web apps keep maintenance costs manageable.

By Deployment

• Cloud-based – Default choice.

Zero-downtime upgrades and real-time analytics tilt most vendors toward SaaS architectures.

Subscription tiers bundle premium features—exportable reports, multi-currency wallets—boosting recurring revenue.

• On-premise – Compliance-driven.

Selected banks and large corporates demand on-premise control for audit trails and custom integrations.

Longer sales cycles are balanced by multi-year support contracts.

• Hybrid – Bridging model.

Enterprises mix cloud agility with on-site data vaults to satisfy strict regulatory or latency needs.

API gateways route sensitive data locally while keeping UI updates in the cloud.

By Functionality

• Basic – Quick, no-frills split.

Ideal for roommates or casual dinners, core features calculate who owes whom in seconds.

Straightforward UX keeps learning curves flat and virality high.

• Advanced – End-to-end expense management.

Adds group wallets, receipt archiving, spending analytics, and automated reminders.

These features attract digital nomads, frequent travelers, and small teams seeking an all-in-one finance app.

By Target Market

• Personal/Consumer – Core demand engine.

Millions rely on apps to manage shared meals, gifts, and household utilities.

Referral bonuses and gamified debt-clearing nudges sustain user growth and daily engagement.

• Business – Rising secondary stream.

Start-ups and distributed teams embrace automated reconciliation for project expenses and client dinners.

Exportable CSVs and ERP connectors are decisive selling points.

By Integration

• Banking applications – Instant settlement backbone.

Direct links to checking accounts cut transfer times and build trust with users wary of wallet balances.

Fintech-bank collaborations are accelerating in mature markets.

• Social media platforms – Virality accelerant.

One-tap sharing inside chat apps or feeds spreads adoption through friend circles.

Lightweight payment requests inside messages shorten the path from plan to payment.

• Payment gateways – Universal connectivity.

Support for global and local gateways widens merchant acceptance and cross-border capability.

Dynamic routing chooses the cheapest or fastest rail per transaction.

Industry Developments & Instances

• May 2025 – Leading vendor rolled out AI-driven split suggestions that learn individual spending habits.

• March 2025 – Major travel-booking platform embedded a white-label split feature, capturing service fees on shared trip costs.

• January 2025 – Regional bank partnered with a start-up to launch smartwatch bill-splitting for café chains, slashing queue times.

• October 2024 – Blockchain-based expense ledger gained traction among remote-first companies for tamper-proof audits.

• June 2024 – Super-app in Southeast Asia added tap-to-split NFC, spurring six-million new users within a quarter.

Facts & Figures

• More than 70 % of new downloads in 2024 originated from users under 35.

• Apps with built-in payment gateways record 40 % faster debt settlement than peer-to-peer cash methods.

• Average transaction value on business plans is roughly 2.5 times higher than personal accounts.

• Over 55 % of surveyed users rate receipt-scan accuracy as the top feature influencing app loyalty.

• Integration with voice assistants lifts monthly active users by nearly 18 % within six months of launch.

Analyst Review & Recommendations

Bill splitting apps are evolving from handy calculators to sophisticated micro-finance platforms. Vendors that pair intuitive design with deep payment-rail coverage and AI-backed insights will outpace average market growth. To secure long-term loyalty, prioritize transparent fee structures, biometric login, and in-app education on data privacy. For new entrants, focusing on underserved niches—such as shared mortgages or carpool fuel tracking—offers a clear differentiation path without wading into the crowded general-expense arena.