Market Overview

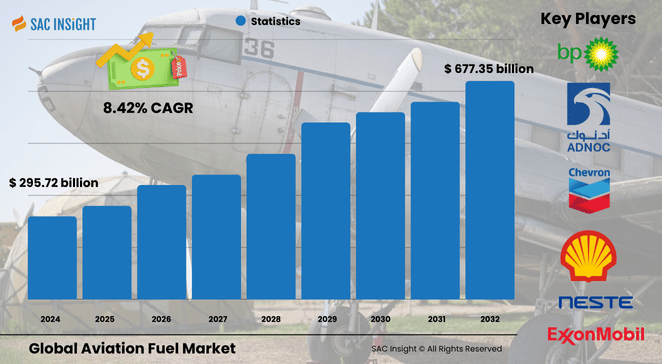

The global aviation fuel market size was currently valued at about US$ 295.72 billion in 2024 and is set to climb to roughly US$ 677.35 billion by 2032, registering a steady 8.425% CAGR over the 2025-2032 forecast window. This market growth is underpinned by resurgent passenger and freight demand, aggressive fleet expansion, and record investment in sustainable aviation fuel (SAF). First-hand industry insights indicate that SAF, although starting from a small base, is the single fastest-scaling fuel type thanks to tightening carbon rules and generous tax incentives.

Within this landscape, the U.S. aviation fuel market is projected to touch around US$ 218.63 billion by 2032, while Asia-Pacific already captured 37.45% market share in 2024, driven by expanding low-cost carrier networks. This market analysis draws on SAC Insight's deep market evaluation and reflects robust supply-chain interviews across refiners, airlines, and technology providers.

Summary of Market Trends & Drivers

Commercial recovery is running ahead of earlier forecasts, with international capacity additions in Asia and North America lifting jet fuel uplift volumes back toward 2019 peaks. Parallel to this rebound, SAF offtake agreements are multiplying, signaling a structural pivot toward low-carbon blends. Advanced analytics and AI are also being deployed to optimize fueling operations, cut turnaround times, and trim operating expenses — key levers in a margin-sensitive sector.

Key Market Players

Integrated oil majors such as Exxon Mobil, Chevron, BP, Shell, and TotalEnergies set the competitive tempo through refinery upgrades, strategic SAF joint ventures, and global supply contracts. Specialist producers including Neste, LanzaJet, and World Energy are scaling dedicated SAF plants, while national champions like Indian Oil Corporation and Bharat Petroleum strengthen regional supply security. Collectively, these firms influence pricing, innovation, and sustainability roadmaps across the aviation fuel ecosystem.

Key Takeaways

• Current global market size: USD$ 295.72 billion (2024)

• Projected value: USD$ 677.35 billion by 2032 at an 8.425% CAGR

• Jet fuel still dominates with around 97% market share but SAF is the fastest-growing segment, posting an 80.6% CAGR through 2030

• U.S. market expected at roughly USD$ 218.63 billion by 2032; Asia-Pacific led with 37.45% share in 2024

• Uptake of AI-enabled fuel management and real-time route optimisation is trimming fuel burn up to 2-3% per flight

• Ongoing capacity build-outs in North American and European biorefineries underpin long-term SAF supply visibility

Market Dynamics

Drivers

• Rising passenger and cargo traffic, especially on trans-Pacific and intra-Asia routes, fuels baseline demand.

• Government incentives, blending mandates, and airline net-zero pledges accelerate SAF deployment.

• Rapid fleet renewal toward more fuel-efficient aircraft cuts per-seat burn yet lifts overall gallons consumed as capacity expands.

Restraints

• Volatility in crude prices complicates budgeting and discourages smaller carriers from long-range route launches.

• High up-front SAF production costs keep average selling prices above conventional jet fuel, limiting short-term adoption.

• Infrastructure bottlenecks — storage, blending, and certification — delay widespread alternative fuel availability at secondary airports.

Opportunities

• Surge in renewable and circular fuel solutions unlocks new revenue pools for refiners, waste-management firms, and tech providers.

• Power-to-Liquid and Hydrogen pathways attract strategic funding, offering longer-term decarbonisation options beyond SAF.

• Multi-year offtake agreements give bio-refineries the volume certainty needed to scale, aligning investor returns with climate targets.

Challenges

• Supply chain disruptions — from geopolitical tensions to refinery outages — impact fuel availability and price stability.

• Regulatory divergence across regions complicates certification and cross-border fuel trading.

• Smaller, low-capital airlines remain vulnerable to fuel-price spikes, risking capacity cuts that could soften demand growth.

Regional Analysis

The North America aviation fuel market retains the leading share in 2024 on the back of high traffic volumes, extensive military operations, and a mature refinery network. Asia-Pacific, however, is the quickest-advancing region, propelled by a swelling middle class and expanding airport infrastructure. Europe’s stringent carbon policies make it the testbed for large-scale SAF blending, while the Middle East leverages its hub-and-spoke model to sustain double-digit fuel uplift growth.

• North America – Large domestic market, early SAF tax credits, advanced pipeline and storage network

• Europe – Strict emissions trading schemes, accelerated SAF mandates, growing hydrogen pilot projects

• Asia-Pacific – Strong passenger growth, new airports, rising low-cost carrier penetration

• Middle East & Africa – Hub airports driving high transit volumes, investments in synthetic fuel R&D

• Latin America – Recovering tourism flows, opportunities in waste-based SAF feedstocks

Segmentation Analysis

By Fuel Type

• Jet Fuel (Aviation Turbine Fuel) – Workhorse of commercial aviation

Jet fuel still accounts for the lion’s share of consumption owing to proven performance, global availability, and entrenched infrastructure.

• Aviation Gasoline – Niche but essential segment

Avgas caters mainly to small piston-engine aircraft and flight training fleets.

• Sustainable Aviation Fuel (SAF) – Rapidly scaling alternative

Backed by airline offtake deals and policy incentives, SAF exhibits the highest CAGR and is central to industry decarbonisation strategies.

• Emerging Alternatives (Hydrogen, Power-to-Liquid, Gas-to-Liquid) – Long-term bets

These nascent pathways promise deeper carbon cuts but require new aircraft designs, supply infrastructure, and supportive regulation before commercial rollout.

By End User

• Commercial Airlines – Core demand engine

Scheduled carriers drive bulk fuel uplift; capacity restoration and new route launches in emerging markets underpin sustained volume gains.

• Government & Military – High-growth niche

Defense aviation, border patrol, and emergency services maintain constant fuel requirements and are beginning to pilot bio-based alternatives for strategic resilience.

• Private and Non-Scheduled Operators – Flexible yet growing

Business jets, charter services, and cargo integrators favour on-demand fueling solutions; rising premium travel and e-commerce accelerate consumption.

By Aircraft Type

• Fixed Wing – Dominant consumer

Commercial narrow- and wide-body fleets continue to account for the majority of gallons burned, with newer models delivering incremental efficiency gains.

• Rotary Wing – Steady niche

Helicopters serving offshore, medical, and urban mobility missions require reliable supply chains, often in remote bases where SAF logistics remain challenging.

• Unmanned Aerial Vehicles (UAV) – Fastest-growing volume percentage

Defense and commercial drone activity is expanding, driving interest in specialized high-density fuels and, eventually, electric or hydrogen solutions.

Industry Developments & Instances

• September 2024 – A European energy major signed a decade-long deal to supply 1.5 million tons of SAF to a flag-carrier group, locking in future demand.

• July 2024 – A leading oil company and a global travel platform extended their blockchain-enabled SAF program, easing corporate emission accounting.

• November 2023 – A fuel supplier debuted SAF at a Middle Eastern private-jet terminal, marking the region’s first commercial alternative-fuel offering.

• September 2023 – A multinational energy group partnered with an FBO network to streamline on-airport SAF delivery logistics at a major European hub.

• August 2023 – Two U.S. energy and engine firms broadened collaboration to include renewable gasoline blends and biodiesel, expanding low-carbon fuel portfolios.

Facts & Figures

• Jet fuel prices represent 30-40% of airline operating costs, making fuel hedging a critical profit lever.

• Global passenger numbers are forecast to add 4 billion annual journeys by 2043 versus 2023 baselines.

• SAF volumes could reach over 6.4 billion gallons by 2030 but still represent less than 5% of total aviation fuel consumption.

• AI-driven route optimisation can save up to 200 kg of fuel on a single long-haul flight.

• Military and government aviation fuel demand is projected to post the highest end-user CAGR through 2032, supported by rising defense budgets.

Analyst Review & Recommendations

SAC Insight's deep market evaluation confirms that the aviation fuel market is pivoting from pure volume growth to a dual mandate of growth and decarbonisation. Investors should prioritise assets linked to SAF feedstock scalability and secure offtake agreements, while established refiners must upgrade infrastructure for flexible blending. Airlines that actively lock in alternative fuel supply and deploy AI-based efficiency tools will be best positioned to protect margins and meet climate targets as market dynamics evolve through 2032.