Market Overview

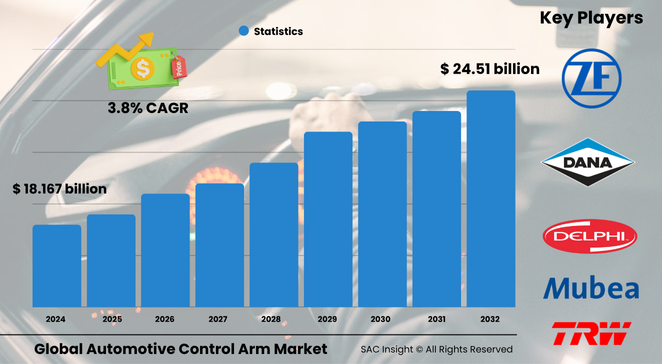

The global automotive control arms market size is valued at roughly US$ 18.167 billion in 2024 and is projected to advance to about US$ 24.51 billion by 2032, reflecting a steady 3.8% CAGR over 2025-2032. SAC Insight's first-hand industry insights point to three growth levers: rising global vehicle output, accelerating electrification that demands lighter suspension links, and aftermarket replacement driven by longer vehicle life cycles. SAC Insight's deep market evaluation shows the United States automotive control arms market alone could edge past US$ 7 billion by 2032 as OEMs and repair shops prioritise ride comfort and safety.

Summary of Market Trends & Drivers

• Lightweight aluminium and composite arms are moving from premium models into high-volume platforms, trimming curb weight and boosting fuel economy.

• Electrified and autonomous vehicles require stiffer, high-precision suspension geometries, spurring demand for multi-link and trailing-arm designs.

• Digital supply-chain tools are shortening design-to-launch timelines, supporting flexible production and faster aftermarket fulfilment.

Key Market Players

Leading control-arm suppliers combine metallurgy know-how with automated forging and casting lines. Groups such as Dana, Aisin Seiki, Magna International, Hyundai Mobis, and ZF leverage global footprints to serve both OEM and aftermarket channels, while regional specialists like Bharat Forge and Saint Jean Industries focus on high-strength steel and aluminium knuckles for performance and electric cars. Competitive strategies centre on lightweight alloys, robot-welded assemblies, and multi-year supply agreements with top automakers.

At the same time, aftermarket champions including TRW Automotive and ACDelco maintain broad catalogues and rapid-ship logistics, capturing market share as ageing fleets boost replacement volumes. Partnerships with e-commerce distributors and 3D-scanning fitment tools sharpen their customer reach.

Key Takeaways

• Current global automotive control arms market size (2024): USD$ 18.167 billion

• Projected global market size (2032): USD$ 24.51 billion at a 3.8 % CAGR

• Steel remains the volume leader, but aluminium posts the fastest material-level market growth above 4 % annually.

• Multi-link configuration demand rises sharply in electric vehicles thanks to battery-pack packaging constraints.

• OEM sales channel holds the largest market share, yet the aftermarket expands faster as vehicles stay on the road longer.

• Asia Pacific accounts for over 45 % of 2024 revenue, driven by China’s high vehicle output and cost-efficient manufacturing clusters.

Market Dynamics

Drivers

• Expanding global vehicle production, especially crossovers and EVs, lifts baseline demand.

• Regulatory pressure for lighter, greener cars accelerates the shift to aluminium and composite arms.

Restraints

• High raw-material costs—particularly for aluminium and advanced composites—squeeze supplier margins.

• Stringent quality audits raise entry barriers for new manufacturers.

Opportunities

• Smart control arms with embedded load sensors enable predictive maintenance and could unlock premium pricing.

• Emerging markets in Southeast Asia and Africa present untapped aftermarket potential.

Challenges

• Supply-chain disruptions and energy-price volatility complicate forging and casting schedules.

• Counterfeit aftermarket parts threaten brand reputation and vehicle safety.

Regional Analysis

Asia Pacific dominates market share thanks to concentrated vehicle assembly hubs, local alloy supply, and cost-competitive labour. Europe posts strong value growth on the back of premium EV production, while North America benefits from resilient pickup and SUV demand and a large service-parts ecosystem.

• North America – Robust truck segment and stringent safety standards keep steel and aluminium arm demand high.

• Europe – Premium OEMs adopt multi-link aluminium designs to balance ride quality and battery mass.

• Asia Pacific – Largest production base; local suppliers scale stamped steel and low-pressure cast arms for mass models.

• Latin America – Gradual recovery in light-vehicle builds boosts aftermarket volumes.

• Middle East & Africa – Small but growing replacement market aligned with fleet-ageing trends.

Segmentation Analysis

By Material

• Steel – Cost-effective workhorse.

High tensile grades deliver strength at scale, meeting mass-market price points, particularly in light trucks and commercial vehicles.

• Aluminum – Lightweight growth engine.

Aluminium arms cut unsprung mass by up to 40 %, improving EV range and ride; demand climbs in midsize cars and crossovers.

• Composites – Niche premium option.

Glass- or carbon-fibre layouts slash weight further and damp vibrations, appealing to high-performance and luxury EV badges.

• Plastic/Hybrid – Emerging experiment.

Engineering plastics combined with metal inserts offer corrosion resistance for small-car rear links, though volumes remain limited.

By Configuration

• Upper Control Arm – Crucial for double-wishbone setups.

OEMs specify forged aluminium uppers to reduce camber change and enhance steering feedback.

• Lower Control Arm – Largest aftermarket turnover.

Lower arms take higher loads, making them frequent replacement items, especially in pothole-heavy regions.

• Multi-link Control Arm – Rapidly rising.

Complex rear suspensions for EVs adopt multi-link designs, driving compound annual market growth above the segment average.

• Trailing Control Arm – Durable utility choice.

Preferred in vans and off-roaders, stamped steel trailing arms balance strength and cost for heavy-duty duty cycles.

By Vehicle Type

• Passenger Cars – Core demand centre.

Sedans and compact SUVs account for most unit shipments, bolstered by electrification programmes.

• Light Commercial Vehicles – Stable replacement stream.

Delivery vans and pickups generate steady aftermarket sales due to higher annual mileage.

• Heavy Commercial Vehicles – Smaller, value-intensive niche.

Robust forged arms cater to durability requirements for trucks and buses.

• Electric Vehicles – High-growth pocket.

Battery weight and instant torque necessitate stronger, lightweight arms, spurring material innovation.

By Sales Channel

• OEM – Dominant revenue contributor.

Long-term platform contracts lock in volume and technology road-maps, ensuring consistent market growth.

• Aftermarket – Fastest-growing slice.

Online retail, extended vehicle life, and do-it-yourself culture fuel rising replacement part sales.

Industry Developments & Instances

• March 2025 – A leading supplier launched a cast-aluminium rear multi-link arm 15 % lighter than its predecessor, slated for a global EV platform.

• January 2025 – A joint venture in India commissioned an automated forging line, doubling steel-arm output for both OEM and export aftermarket.

• September 2024 – A European tier-one integrated a continuous fibre-reinforced composite arm into a luxury SUV, reducing NVH levels by 20 %.

• July 2024 – Major aftermarket brand rolled out QR-coded packaging for instant authenticity checks via smartphone app.

Facts & Figures

• Aluminium arms captured nearly 32 % of global material market share in 2024, up from 26 % in 2020.

• Average control-arm replacement interval in developed markets is now 90 000-100 000 km, extending aftermarket demand.

• Multi-link rear suspensions feature in more than 60 % of battery-electric cars launched during 2024.

• Autonomous-ready platforms specify up to 12 individual arms per vehicle, compared with 8 on conventional layouts.

• Automated forging cells can cut cycle time by 25 % and energy use by 15 % versus legacy presses.

Analyst Review & Recommendations

Market analysis signals consistent, moderate market growth underpinned by electrification, lightweighting, and an ageing global fleet. Suppliers that pair advanced alloys with digitally enabled production and robust counterfeit-protection measures will outpace the average CAGR. Investment priority should go to scalable aluminium casting, composite R&D partnerships, and data-rich aftermarket programmes that translate first-hand industry insights into predictive maintenance value propositions for OEMs and end users alike.