Market Overview

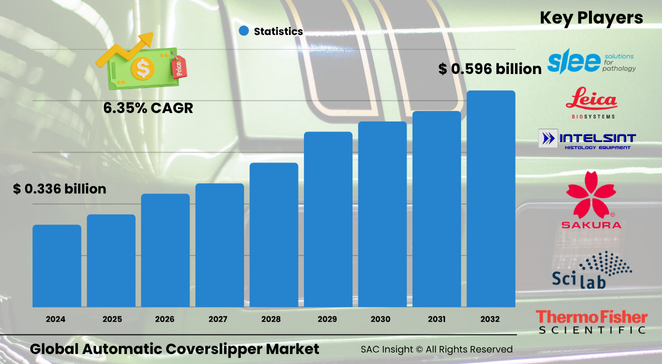

The global automatic coverslipper market size is valued at roughly US$ 0.336 billion in 2024 and is projected to reach about US$ 0.596 billion by 2032, advancing at an average 6.35% CAGR. First-hand industry insights confirm that pathology labs are racing to eliminate manual slide prep, while rising cancer incidence and larger biopsy volumes keep demand steady. SAC Insight's deep market evaluation also indicates the U.S. automatic coverslipper market could approach US$ 0.19 billion by 2032 as integrated hospital networks automate histology workflows to curb turnaround times.

Summary of Market Trends & Drivers

• Laboratories are standardising on fully automated coverslippers that process 400+ slides per hour, reducing error rates by well over 30 % versus manual methods.

• Hybrid AI-enabled units that verify coverslip placement in real time are gaining traction, supporting traceable, high-quality sample archiving.

• Heightened focus on chronic-disease diagnostics and expanding hospital outreach programmes in emerging economies is fuelling market growth across Asia Pacific and Latin America.

Key Market Players

Technology leadership is concentrated among established laboratory-equipment specialists. Leica Biosystems, Sakura Finetek, Thermo Fisher Scientific, Agilent Technologies, and Slee Medical collectively command a significant market share with robust global service networks. Challenger brands such as MEDITE, Bio-Optica Milano, Intelsint, and General Data differentiate through compact footprints, quieter operation, and modular upgrades that fit smaller budgets. Competitive dynamics now revolve around slide-tracking software integration, consumable bundles, and preventative-maintenance contracts that lock in recurring revenue.

Key Takeaways

• Current global automatic coverslipper market size (2024): US$ 0.336 billion

• Projected global market size (2032): US$ 0.596 billion at a 6.35 % CAGR

• Automatic glass coverslippers account for the largest market share thanks to widespread histopathology use.

• Fully automated systems are outselling semi-automated units by more than 3 : 1 as labs seek higher throughput.

• Hospitals represent roughly 60 % of demand, with diagnostic laboratories and research institutes providing the fastest incremental market growth.

• North America leads revenue, but Asia Pacific shows the quickest percentage gains on the back of aggressive healthcare-infrastructure investment.

Market Dynamics

Drivers

• Growing test volumes tied to rising cancer screening and ageing populations.

• Time-saving slide workflows that cut lab turnaround by up to two hours per batch.

• Integration with LIS systems for end-to-end digital pathology, enhancing data integrity.

Restraints

• High upfront capital outlay and service-contract costs deter small labs.

• Occasional mechanical misalignment or air-bubble formation requires skilled intervention, limiting unattended shifts.

Opportunities

• Consumable-agnostic designs open the door for private-label reagents and coverslips.

• AI-powered self-calibration and predictive maintenance can reduce unplanned downtime, attracting value-based purchasing contracts.

Challenges

• Shortage of trained biomedical engineers in developing regions slows installation and maintenance.

• Compliance with varying regional safety standards increases certification timelines for new models.

Regional Analysis

North America maintains the largest revenue pool owing to entrenched reimbursement structures and rapid adoption of digital pathology. Europe follows closely, supported by national cancer-screening initiatives. Asia Pacific is the fastest-growing region, propelled by expanding hospital infrastructure and government funding in China and India.

• North America – High test throughput and early adoption of AI-enabled coverslippers.

• Europe – Strong public-health spending and stringent quality mandates drive replacement demand.

• Asia Pacific – Accelerated lab modernisation, double-digit market growth.

• Latin America – Rising private-hospital investments stimulate equipment imports.

• Middle East & Africa – Gradual uptake, centred on flagship oncology centres.

Segmentation Analysis

By Product Type

• Fully Automated – Dominant share, preferred for high-volume histology labs.

These systems load, mount, and dispense coverslips without human touch, ensuring consistent slide quality and freeing technicians for analytical tasks.

• Semi-Automated – Cost-effective option for moderate workloads.

Operators perform limited manual steps such as rack loading, benefiting small hospitals transitioning from manual methods without major capital spend.

By Slip Material

• Automatic Glass Coverslipper – Gold standard for permanent archives.

Glass coverslips deliver optimal optical clarity and long-term sample stability, making them indispensable for cancer diagnostics and teaching archives.

• Automatic Film Coverslipper – Fast, lightweight alternative.

Film reduces breakage risk and speeds dehydration, suiting high-throughput labs processing large cytology volumes where longevity is less critical.

By Application

• Histopathology – Core demand engine.

Precise tissue-slide preparation is essential for tumour grading, and automated coverslippers underpin reproducible staining results.

• Cytology – Rapid growth segment.

Film-based units shorten Pap smear workflows and support mass cervical-screening programmes.

• Hematology & Others – Niche but expanding.

Specialised blood-film and microbiology protocols are increasingly automated to boost consistency.

By End-User

• Hospitals – Largest user base.

Integrated health systems standardise equipment to streamline multi-site quality control and bulk consumable purchasing.

• Diagnostic Laboratories – Fastest CAGR.

Commercial labs compete on turnaround speed and reliability, investing heavily in high-capacity automated suites.

• Academic & Research Institutes – Innovation hub.

Custom slide protocols for translational research drive demand for flexible programming and low-volume modes.

Industry Developments & Instances

• May 2024 – Leica Biosystems introduced a next-generation coverslipper with machine-vision alignment, cutting misplacements by 40 %.

• February 2024 – Sakura Finetek rolled out a compact film unit designed for satellite oncology clinics with space constraints.

• August 2023 – Thermo Fisher launched remote-diagnostics capability, enabling real-time performance monitoring across multi-site lab networks.

• May 2022 – Bio-Optica released the CVR909, featuring enhanced bubble-prevention algorithms for high-throughput cancer-screening centres.

Facts & Figures

• Fully automated systems can process up to 600 slides per hour, compared with 120 slides for semi-automated units.

• Automated coverslippers reduce manual-handling errors by approximately 35 %, improving diagnostic concordance.

• Glass coverslips still represent nearly 70 % of global consumable volumes despite the rise of film variants.

• Service contracts account for roughly 18 % of total supplier revenue, underscoring the importance of uptime guarantees.

• Labs adopting integrated coverslip-to-scanner workflows report a 25 % reduction in overall slide-processing time.

Analyst Review & Recommendations

Market analysis confirms a decisive shift toward fully automated, digitally connected coverslipping platforms that underpin modern pathology. Vendors that pair robust hardware with AI-based alignment checks, open-standard interfaces, and proactive service analytics will outpace average market growth. Laboratories evaluating capital purchases should factor in whole-workflow efficiency gains, the availability of local technical support, and flexible financing arrangements to maximise return on investment while future-proofing their diagnostic capacity."