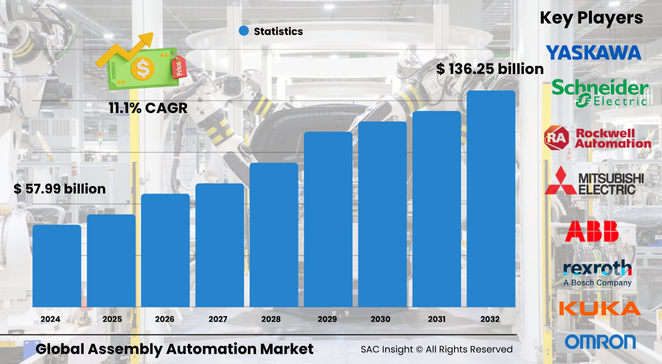

Market Overview

The global assembly automation market size is valued at about US$ 57.99 billion in 2024 and is on track to reach US$ 136.25 billion by 2032, reflecting an average 11.1% CAGR over 2025-2032. SAC Insight industry insights highlight three core growth engines: persistent demand for consistent product quality, rising labour-cost pressure across manufacturing hubs, and rapid adoption of smart robotics that tighten process control. SAC Insight's deep market evaluation confirms that North America commands the largest market share today, while Asia-Pacific delivers the fastest incremental revenue. Within the United States, assembly automation market is expected to post high-single-digit annual gains as automotive re-shoring, electronics final-assembly, and battery gigafactory projects scale.

Summary of Market Trends & Drivers

• Manufacturers are moving from isolated robotic cells to fully networked production lines, unlocking real-time data for predictive maintenance and yield tracking.

• Demand for smaller, lighter consumer devices is fuelling investments in high-precision robot automation equipment capable of micron-level repeatability.

• Sustainability mandates are pushing factories to cut waste and energy use, making flexible, software-defined automation a strategic priority.

Key Market Players

Global leadership is shared by diversified automation majors and specialist robotics firms. Companies such as ABB, FANUC, KUKA, Mitsubishi Electric, Rockwell Automation, Siemens, and Yaskawa anchor the high-end of the market with broad product portfolios and turnkey integration expertise. Mid-tier contenders including ATS Automation Tooling Systems, Universal Robots, and Parker Hannifin focus on modular cells, collaborative robots, and motion-control components that let small and mid-sized manufacturers automate in stages. Competitive momentum centres on AI-enhanced vision, intuitive programming interfaces, and service contracts that guarantee uptime.

Key Takeaways

• Current global market size (2024): about USD$ 57.99 billion

• Projected global market size (2032): roughly USD$ 136.25 billion, 11.1 percent CAGR

• Robot automation equipment is the fastest-growing type as flexible, multi-axis arms replace fixed tooling

• Automotive remains the largest end-use, yet 3C (computers, communications, consumer electronics) exhibits the highest market growth through 2032

• North America leads in market share; Asia-Pacific records the quickest capacity additions driven by electronics and EV supply chains

• First-hand industry insights indicate bifurcated central control systems dominate where legacy machinery must coexist with new robots

Market Dynamics

Drivers

• Continuous quality-improvement targets and tighter tolerance requirements across automotive, medical, and electronics industries

• Rising labour scarcity and cost inflation prompting accelerated payback calculations on automation capital expenditure

• Advances in machine vision and AI that enable rapid changeovers and small-lot production without manual intervention

Restraints

• High upfront investment for end-to-end automated lines, particularly in small and medium enterprises

• Shortage of skilled technicians capable of programming, maintaining, and troubleshooting integrated systems

Opportunities

• Retrofit packages that layer smart sensors and control software onto existing conveyors and fixtures

• Service and maintenance contracts, including remote monitoring and predictive-analytics dashboards, creating recurring revenue streams

Challenges

• Cyber-security risk as production networks connect to enterprise IT and cloud platforms

• Fragmented global standards complicating plug-and-play interoperability among robots, controllers, and legacy PLCs

Regional Analysis

North America retains the revenue crown thanks to a mature automotive base, strong government incentives for on-shoring, and a deep ecosystem of systems integrators. Europe follows on the strength of its premium auto and machinery sectors and strict quality regulations. Asia-Pacific posts the highest CAGR as China, India, and Southeast-Asia expand electronics, battery, and general-industrial capacity.

• North America – Largest market size, strong replacement demand and IIoT retrofits

• Europe – Quality-centric industries and Industry 4.0 subsidies sustain adoption

• Asia-Pacific – Fastest market growth, driven by greenfield plants and consumer-electronics exports

• Rest of World – Emerging uptake in Middle East and Latin America for appliance and packaging lines

Segmentation Analysis

By Type

• Bifurcated Central Control Systems – Versatile backbone.

They allow central supervision while letting individual cells run specialised routines, making them the go-to choice for phased upgrade programmes.

• Robot Automation Equipment – Rapid CAGR leader.

Six- and seven-axis arms with integrated vision perform complex fastening, dispensing, and test operations, supporting mass customisation and shorter product cycles.

• Other Automation Equipment – Niche but necessary.

Indexing tables, feeders, and conveyor modules round out turnkey lines, ensuring smooth part flow and overall takt-time compliance.

By End-Use

• Automotive – Core demand engine.

Electrification, lightweighting, and stricter traceability requirements drive investment in high-precision assembly automation for battery packs, e-axles, and ADAS modules.

• 3C Industry – Fast-rising share.

Smartphones, wearables, and consumer IoT devices need compact, high-speed assembly that robots now deliver at lower cost per unit, pushing aggressive capacity build-outs in Asia.

• Others – Diversifying tail.

Sectors such as medical devices, metal fabrication, and small appliance makers are automating to meet regulatory validation and margin-protection goals.

Industry Developments & Instances

• March 2023 – A leading integrator showcased a live multi-technology demo combining autonomous mobile robots, smart conveyors, and a micro AutoStore for component kitting.

• March 2022 – A USD$ 30 million capacity expansion added 300 000 sq ft of automated line space in a Greenville facility to serve HVAC and electronics customers.

Facts & Figures

• Average robot density in automotive final-assembly lines now exceeds 1 200 units per 10 000 workers in leading plants.

• Predictive-maintenance analytics can cut unplanned downtime by up to 20 percent, boosting line OEE above 85 percent.

• Collaborative robots account for nearly 12 percent of new unit shipments, up from 7 percent three years ago.

• Smart sensors and edge devices can lower energy consumption in automated cells by 10-15 percent through dynamic motor control.

• Service contracts tied to performance metrics already represent about 18 percent of total vendor revenue in mature markets.

Analyst Review & Recommendations

Market analysis confirms a decisive pivot toward orchestrated, data-rich automation that extends beyond discrete robot cells. Vendors that combine intuitive programming, AI-enabled vision, and lifecycle service will outperform average market growth. Manufacturers should pilot modular robotics to validate ROI, then scale with cloud-connected control platforms while prioritising cyber-secure architectures and skills development to sustain long-term competitiveness."