Market Overview

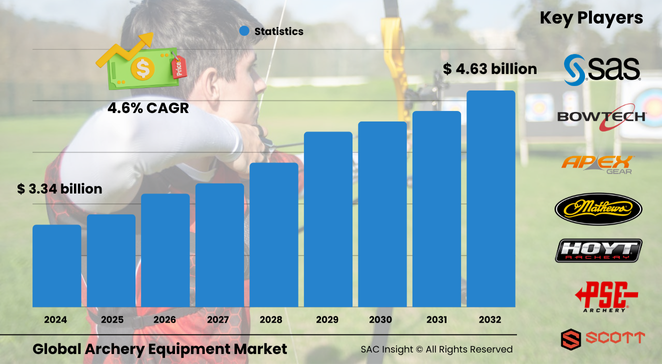

The global archery equipment market size is valued at about US$ 3.34 billion in 2024 and is projected to approach roughly US$ 4.63 billion by 2032, advancing at an average 4.6% CAGR. SAC Insight's first-hand industry insights indicate three clear drivers: steady recreational uptake, growing visibility of competitive tournaments, and rapid product innovation that lowers entry barriers.

SAC Insight's deep market evaluation shows the U.S. archery equipment market alone could rise from close to US$ 1.1 billion in 2024 to about US$ 1.6 billion by 2032 as school programs, bow-hunting seasons, and e-commerce channels widen access for beginners and seasoned archers alike.

Summary of Market Trends & Drivers

• Consumer demand is shifting toward lighter composite bows, smart sights, and carbon arrows that boost accuracy without steep learning curves.

• Wellness-focused buyers see archery as a low-impact workout that blends focus and fitness, supporting continuous market growth across all age groups.

• Online tutorials, influencer content, and video game tie-ins are expanding the funnel of new participants, especially in Asia-Pacific and Europe.

Key Market Players

Leading manufacturers—Easton, Hoyt, Mathews, Bear, PSE, Bowtech, SAS, Black Gold, Apex Gear, and Scott—collectively hold the largest market share. They compete on precision engineering, modular add-ons, and brand-backed shooting schools that nurture loyalty. Competitive dynamics now revolve around mergers and U.S.-based sourcing commitments that shorten lead times while preserving “made-in-the-USA” cachet.

Key Takeaways

• Current global market size (2024): roughly USD$ 3.34 billion

• Projected global market size (2032): about USD$ 4.63 billion at a 4.6 % CAGR

• North America commands near-38 % market share, aided by deep hunting traditions and strong retail infrastructure

• Bows account for nearly half of revenue, yet arrows show the fastest clip at 4.5 % CAGR on rising target-shoot and bow-hunting demand

• Online outlets are the quickest-growing distribution channel, expanding almost 4.7 % annually

• Product launches tout lighter carbon risers, adjustable cams, and integrated dampening systems that refine user experience

Market Dynamics

Drivers

• Rising recreational participation backed by school curriculums, camps, and Olympic exposure

• Continuous equipment upgrades—compound cams, laser-etched sights, and 3D-printed grips—that improve accuracy and cut setup time

• Wellness and mindfulness trends positioning archery as a stress-relieving outdoor pursuit

Restraints

• High upfront costs for premium rigs may deter casual users

• Stringent safety regulations and licensing complexity in some regions slow onboarding of new shooters

Opportunities

• Smart-sensor add-ons that track shot metrics create upsell space for tech-savvy consumers

• Female and youth segments remain under-penetrated; tailored bow sizes and marketing can unlock fresh revenue streams

Challenges

• Supply-chain tightness for specialty carbon shafts and precision aluminum raises input costs

• Urbanization limits range availability, pushing the need for compact indoor facilities

Regional Analysis

North America maintains the revenue lead thanks to entrenched hunting culture, a robust coaching network, and abundant retail points. Asia-Pacific is pacing the fastest CAGR—about 4.6 %—as South Korea, India, and China pump funding into Olympic pipelines and commercial ranges.

• North America – Largest revenue base, buoyed by bow-hunting seasons and scholastic leagues

• Europe – Steady growth as heritage sports and outdoor tourism packages rekindle interest

• Asia-Pacific – Quickest expansion driven by government-backed training centers and rising disposable income

• Latin America – Emerging, helped by adventure-tourism operators adding archery attractions

• Middle East & Africa – Niche growth where cultural heritage programs spotlight traditional bows

Segmentation Analysis

By Product

• Bows and Accessories – Core revenue anchor.

Refinements such as carbon risers, split limbs, and vibration-control modules keep experienced shooters upgrading every few seasons.

Lightweight builds and adjustable draw ranges make today’s bows friendlier to novices while still satisfying competitive archers.

• Arrows – Fastest-growing slice.

Carbon, micro-diameter shafts, and specialized broadheads boost penetration for hunters and precision for target shooters.

Expanding tournament circuits and the need for multiple practice sets drive recurring sales that outpace bow replacement cycles.

• Others (targets, releases, stabilizers) – Essential support kit.

Foam blocks, bag targets, and quick-disconnect stabilizers round out consumer baskets and raise average transaction values.

As backyard ranges proliferate, demand for durable, weather-resistant targets and easy-tune releases steadily climbs.

By End User

• Individual Consumers – Dominant share.

Hobbyists account for more than three-quarters of equipment demand, spurred by home practice spaces and online coaching.

Flexible financing and entry-level kits under USD$ 300 lower barriers for new entrants without sacrificing brand cachet.

• Clubs and Gaming Zones – Rising niche.

Commercial ranges and adventure parks bulk-buy replaceable limbs, rental bows, and safety gear to serve group events.

Their need for rugged, low-maintenance equipment supports steady repeat orders.

• Sports Organizers – High-spec demand.

Tournament hosts and national teams invest in precision rigs, high-speed cameras, and scoring electronics for elite performance.

Although smaller in volume, this segment sets technology standards that trickle down to mass-market lines.

By Distribution Channel

• Specialty and Sports Shops – Nearly half of sales.

Hands-on fitting, tune-ups, and repair services build loyalty among serious shooters.

Many stores double as clubhouses, running leagues that keep foot traffic high.

• Online Stores – Quickest CAGR.

Broader assortments, comparison tools, and doorstep delivery appeal to digitally native buyers.

Video coaching bundles and try-before-you-buy policies further accelerate e-commerce conversion.

• Department and Discount Stores – Value seeker hub.

Package deals target casual backyard shooters and gift buyers, sustaining baseline volume.

Industry Developments & Instances

• February 2023 – A U.S. precision-shooting brand was acquired by a heritage outdoor group intent on reinforcing “all-American” sourcing for flagship bows.

• January 2024 – Leading OEMs released carbon-frame compound models touting sub-4-pound mass and speed ratings above 340 fps.

• July 2024 – An automotive sponsor opened an AI-enabled interactive range that adapts draw weight and target distance in real time to visitor skill levels.

• May 2025 – A South American rehab program reported improved upper-body strength and reduced lymphedema among breast-cancer survivors using therapeutic archery sessions.

Facts & Figures

• Bows captured about 48 % of 2023 revenue, yet arrows are projected to post roughly 4.5 % CAGR through 2032.

• North America accounted for close to 38 % market share in 2024; the U.S. represented nearly 90 % of that regional total.

• Online channels are expected to top 25 % of global sales by 2032, up from just 17 % in 2024.

• Average ticket size for first-time archers ranges between USD$ 250 and USD$ 400, including safety gear and targets.

• Compound-bow upgrades occur every 4-5 years on average, generating predictable replacement demand.

Analyst Review & Recommendations

Market analysis underscores a pivot from purely performance-driven gear to experience-centric ecosystems that blend smart accessories, coaching apps, and community events. Brands that streamline online fit tools, partner with schools, and offer subscription-based upgrade paths will capture outsized market growth. Investing in sustainable materials and modular components can further differentiate products while easing regulatory pressures tied to environmental impact.