Market Overview

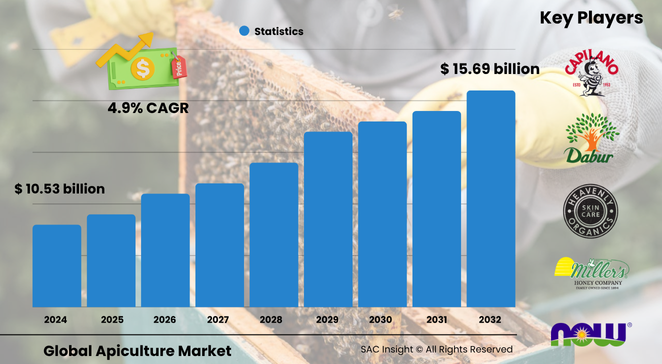

The global apiculture market size is currently valued near US$ 10.53 billion in 2024 and is set to advance to roughly US$ 15.69 billion by 2032, expanding at an average 4.97 % CAGR. SAC Insight's first-hand industry insights point to three core growth engines: consumers swapping refined sugar for natural honey, governments backing pollinator protection, and steady demand for bee-derived functional ingredients across food, health, and beauty.

SAC Insight's deep market evaluation indicates the United States apiculture market alone could climb from today’s sub-billion level to around US$ 2.24 billion by 2032 as dietary-supplement makers and craft food brands scale up bee-product use. Asia Pacific already accounts for about 35 % market share and keeps its lead thanks to large-scale beekeeping operations in China and India.

Summary of Market Trends & Drivers

• Natural-ingredient push in cosmetics is lifting beeswax and royal-jelly demand alongside clean-label skincare launches.

• Direct-to-consumer e-commerce is giving small apiaries global reach, accelerating market growth far beyond traditional retail.

• Internet-enabled hive monitoring and smart extraction equipment are trimming colony-loss rates and raising yields, signalling a tech-savvy shift in market dynamics.

Key Market Players

Leading names include Capilano Honey, Dabur, Koster Keunen, NOW Foods, Barkman Honey, Organic Bee Farms, Heavenly Organics, Strahl & Pitsch, Miller’s Honey, and Durham’s Bee Farm. These firms anchor the market through integrated supply chains, large export footprints, and brand credibility built on product purity claims. Mid-tier companies focus on niche segments such as monofloral honey, medicinal-grade propolis, or organic private-label contracts, relying on agile marketing and regional partnerships to differentiate.

Key Takeaways

• Current global market size (2024): about USD$ 10.53 billion

• Projected global market size (2032): roughly USD$ 15.69 billion at a 4.97 % CAGR

• Honey dominates type revenue; food & beverage applications capture more than 40 % market share

• Asia Pacific remains the largest regional cluster, while North America shows the fastest value-added product adoption

• U.S. apiculture market expected to reach roughly USD$ 2.24 billion by 2032

• Smart-hive technology and organic certification drive competitive advantage

Market Dynamics

Drivers

• Rising health awareness positions honey and propolis as preferred natural sweeteners and immunity boosters.

• Government programs such as pollinator-friendly farming grants and World Bee Day campaigns widen beekeeper participation.

• Expansion of organic personal-care brands increases procurement of beeswax and royal jelly.

Restraints

• Adulteration scandals involving sugar syrups erode consumer trust and trigger stricter testing costs.

• Declining bee populations from pesticide exposure and habitat loss threaten raw-material availability.

• Price sensitivity in emerging markets limits premium-product uptake.

Opportunities

• Value-added SKUs—infused honey, propolis gummies, beeswax wraps—offer margin upside for processors.

• Precision apiculture (IoT hive sensors, AI-driven disease alerts) can cut colony mortality and lift yields.

• Carbon-neutral or “elephant-friendly” honey certifications appeal to eco-conscious shoppers.

Challenges

• Fragmented quality standards complicate cross-border trade and slow market harmonisation.

• Climate volatility alters flowering cycles, forcing migratory beekeeping and higher logistics costs.

• Competition from alternative sweeteners such as agave or stevia challenges honey’s share in beverage formulations.

Regional Analysis

Asia Pacific leads the global market owing to abundant forage, established beekeeping know-how, and rising disposable income that supports branded honey lines. Europe follows, benefiting from strong organic regulations and a high concentration of cosmetics players using beeswax. North America is closing the gap through tech adoption and clean-label food trends, while Latin America and the Middle East & Africa register steady but smaller bases that could accelerate with expanded export infrastructure.

• North America – Rapid uptake of raw and unfiltered honey; robust pollinator-protection initiatives.

• Europe – Health-conscious consumers drive demand for premium monofloral honey and beeswax skincare.

• Asia Pacific – Largest production hub; China supplies over half of global honey output.

• Latin America – Strong potential in organic honey exports as deforestation curbs tighten.

• Middle East & Africa – Growing gourmet-honey niche piggybacks on tourism and luxury retail expansion.

Segmentation Analysis

By Type

• Honey – Cornerstone product and main revenue engine.

Honey’s natural sweetness, antioxidant profile, and versatility keep it central to every segment from gourmet foods to wound dressings, ensuring resilient demand even when discretionary spending slips.

• Beeswax – Multitasker in cosmetics and food packaging.

The shift toward plastic-free wrappers and clean-beauty formulations positions beeswax as an eco-friendly emulsifier and barrier material, elevating its market importance.

• Propolis – Fast-growing therapeutic extract.

Propolis earns attention for antimicrobial and anti-inflammatory properties, translating into throat sprays, lozenges, and dermatology creams that command premium pricing.

• Royal Jelly – Niche but high-value functional supplement.

Market analysis shows royal jelly gaining traction in energy tonics and anti-aging products, with demand strongest in East Asia where traditional medicine endorsements carry weight.

By Application

• Food & Beverage – Core consumption channel.

Roughly two-fifths of global volume flows into sweeteners, bakery glazes, and functional drinks as brands market honey’s “better-for-you” image.

• Medical – Rising clinical acceptance.

Hospitals and wound-care suppliers are adopting medical-grade honey dressings and propolis ointments that speed healing and curb antibiotic use.

• Personal Care & Cosmetics – Clean-beauty catalyst.

Beeswax lip balms, honey-infused hair serums, and royal-jelly facial creams satisfy consumer desire for natural products, fuelling this segment’s above-average market growth.

• Others – Agriculture and industrial uses.

Beeswax polishes, propolis wood preservatives, and honey-based fermentables all add incremental volume while showcasing sustainable material cycles.

Industry Developments & Instances

• April 2025 – Koster Keunen expanded oleogel wax tech for pharmaceutical transdermal applications, opening a new revenue lane.

• March 2024 – RAK Honey introduced Samar-varietal raw honey to the UK, highlighting terroir-driven flavour and micronutrient depth.

• August 2023 – Bagrry’s launched certified-organic wild honey across Indian e-commerce channels, meeting rising domestic demand for pesticide-free sweeteners.

• March 2023 – Sanctuaire debuted non-toxic beeswax candle line to tap holistic wellness trends.

• December 2022 – A leading Indian honey brand rolled out a nationwide authenticity campaign using QR-code traceability to rebuild consumer confidence.

Facts & Figures

• Asia Pacific controls roughly 35 % global market share.

• Average hive sensor systems can cut winter colony losses by up to 18 %.

• Around 46 % of honey samples tested in a recent EU investigation showed signs of adulteration, prompting tougher import checks.

• Smart-hive adoption is forecast to surpass 120 thousand units worldwide by 2030.

• Premium raw-and-organic honey SKUs command price premiums of 25 % to 40 % over conventional blends.

Analyst Review & Recommendations

Market analysis indicates a decisive pivot toward traceable, value-added bee products underpinned by technology-enabled hive management. Producers that invest in digital quality tracking, diversify into propolis-based health lines, and secure organic or carbon-neutral seals are best placed to outperform average market growth. Retailers should spotlight terroir and functional claims to justify premiums, while policymakers must align testing standards to curb adulteration and protect legitimate players.