Market Overview

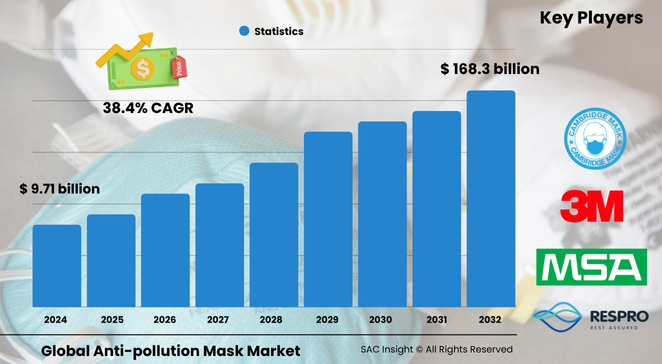

The global anti-pollution mask market size is valued at roughly US$ 9.71 billion in 2024 and is projected to surge to about US$ 168.36 billion by 2032, expanding at an average 38.4% CAGR. SAC Insight's first-hand industry insights highlight three structural growth engines: escalating urban air-quality concerns, sharply rising respiratory-illness prevalence, and a post-pandemic pivot toward everyday personal-protective gear.

SAC Insight’s deep market evaluation shows the United States anti-pollution mask market alone could advance from an estimated US$ 12.49 billion in 2025 to around US$ 85.50 billion by 2032 as commuters, construction workers, and fitness enthusiasts adopt high-filtration masks for routine use.

Summary of Market Trends & Drivers

• Everyday health-and-wellness routines increasingly include filtration masks, turning what was once an episodic purchase into a lifestyle accessory.

• Sustainability and cost pressure are nudging consumers toward washable multi-layer fabrics, propelling reusable models at double-digit volume growth.

Key Market Players

Industry leadership rests with a blend of diversified safety-equipment manufacturers and agile niche specialists. Long-standing incumbents such as Honeywell, 3M, and Kimberly-Clark leverage deep filtration portfolios, automated lines, and wide retail footprints to secure sizeable market share. Alongside them, brands focused on design-led comfort—Cambridge Mask, Vogmask, and Respro—differentiate through fashion collaborations, anti-fog valves, and eco-friendly materials that capture premium price points.

Competitive dynamics increasingly revolve around filter-media innovation and omnichannel reach. Large players integrate nanofiber layers and activated-carbon pellets for PM 2.5 and VOC removal, while smaller firms court online shoppers with limited-edition prints and subscription filter packs.

Key Takeaways

• Current global market size (2024): USD$ 9.71 billion

• Projected global market size (2032): USD$ 168.36 billion at a 38.4 % CAGR

• U.S. market expected to top USD$ 85.50 billion by 2032, outpacing global average growth

• Disposable masks command the largest product market share today; reusable masks post the fastest market growth on sustainability grounds

• Offline pharmacies remain the volume channel, yet online quick-commerce platforms are the highest-growth route to market

• Nanofiber filtration, smart-sensor inserts, and antimicrobial fabrics are reshaping the technology cost curve

Market Dynamics

Drivers

• Rapid urbanization and vehicle density lift particulate and NOx levels, fuelling urgent consumer demand for daily respiratory protection.

• Post-COVID hygiene awareness sustains mask adoption even outside peak flu seasons, expanding addressable user bases.

• E-commerce penetration in emerging Asia accelerates product availability, narrowing the urban–rural adoption gap.

Restraints

• Quality lapses and counterfeit products erode trust and can trigger regulatory crack-downs that slow category momentum.

• Long-term comfort issues—heat build-up, skin irritation—limit all-day wear, curbing repeat purchases in hotter climates.

Opportunities

• Smart masks with replaceable Bluetooth air-quality sensors open premium segments for health-data-driven consumers.

• Corporate wellness schemes and pollution-related employer insurance discounts can institutionalize bulk procurement.

Challenges

• Volatile raw-material costs for melt-blown polypropylene squeeze margins, particularly for low-price disposable lines.

• Recycling logistics for spent filters remain underdeveloped, posing reputational risk for brands championing sustainability.

Regional Analysis

Asia-Pacific dominates today’s market thanks to persistent smog episodes in China and India, rising construction dust, and competitively priced local production. North America follows, buoyed by wildfire smoke and a fitness culture that embraces high-performance gear, while Europe’s growth is tied to stricter PM 2.5 standards and cycling-commuter adoption.

• Asia-Pacific – Largest revenue base, driven by soaring urban pollution and affordable local manufacturing

• North America – Rapid uptake linked to wildfire seasons, fitness trends, and premium reusable launches

• Europe – Growth anchored in air-quality directives and commuter cycling infrastructure

• Middle East & Africa – Dust storms and construction projects spur episodic but rising demand

• Latin America – Industrial expansion and traffic congestion open niche opportunities in major metros

Segmentation Analysis

By Product

• Disposable – Convenience-led dominance.

Single-use masks hold the biggest market share because commuters prefer quick replacement during peak smog or illness waves. They thrive in convenience stores and pharmacies where impulse purchases are common.

• Reusable – Sustainability-driven acceleration.

Reusable masks are the fastest-growing slice, aided by washable multi-layer fabrics, filter-replacement cartridges, and stylish designs that align with apparel trends. Lower lifetime cost and green credentials resonate with eco-conscious consumers.

By Distribution Channel

• Offline – Trust and instant availability.

Brick-and-mortar outlets—pharmacies, supermarkets, hardware chains—remain the primary sales channel, offering immediate product comparison and serving walk-in buyers during pollution spikes or health scares.

• Online – Highest CAGR.

E-commerce and quick-commerce platforms boost market growth by delivering broad assortments, detailed specs, and customer reviews straight to mobile users. Subscription models for replacement filters further lock in repeat revenue.

Industry Developments & Instances

• June 2024 – A global athletic-wear brand launched a co-branded reusable mask with nano-silver lining, selling out its first 100 000 units online within 48 hours.

• December 2023 – An Indian start-up unveiled a biodegradable hemp-fiber respirator targeting festival-season air pollution, winning government innovation funding.

• August 2023 – A leading safety-equipment firm retrofitted two plants with AI-based quality-inspection cameras, lifting filter yield by 15 % and shortening order lead times.

Facts & Figures

• Disposable masks captured roughly 53 % of global revenue in 2024.

• Online channels posted a year-on-year sales jump of nearly 45 % between 2023 and 2024.

• An estimated 64 million people worldwide live with COPD—a key demographic for high-filtration respirators.

• Over 1.67 million deaths in India were linked to air pollution in 2019, underscoring acute local demand.

• Smart-sensor add-ons can raise average selling price of a reusable mask by 30–40 %, widening margins for tech-oriented brands.

Analyst Review & Recommendations

Market analysis shows a decisive pivot from emergency purchases to habitual, style-driven consumption. Providers that couple high-efficiency filter media with comfort, digital health add-ons, and robust counterfeit-mitigation labeling will capture outsized market share. To secure long-term loyalty, invest in breathable fabric R&D, scalable recycling programs, and partnerships with workplace-wellness platforms—moves that align commercial success with public-health impact.