Market Overview

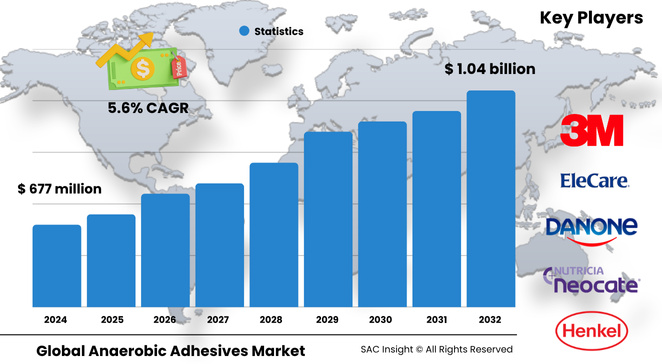

The glonbal anaerobic adhesives market size is valued at roughly US$ 677.0 million in 2024 and is on track to reach about US$ 1.047 billion by 2032, expanding at a steady 5.65% CAGR. SAC Insight's first-hand industry insights highlight rising demand for vibration-proof fastening in automotive powertrains, compact electronics, and high-pressure hydraulic systems as the core growth engine.

SAC Insight's deep market evaluation shows the United States anaerobic adhesives market alone could advance from about US$ 172.9 million in 2024 to around US$ 271.5 million by 2032 as OEMs prioritise leak-free, maintenance-friendly assemblies.

Summary of Market Trends & Drivers

• Automation and lightweighting push manufacturers toward liquid threadlockers that replace mechanical fasteners, trimming weight and assembly time.

• Miniaturised consumer electronics and medical devices need micro-gap retaining compounds that cure cleanly without heat, underpinning market growth.

• Sustainability goals are steering formulators to low-VOC, high-temperature acrylic systems that extend service life and cut rework waste.

Key Market Players

Global market share is concentrated among innovation-led suppliers such as 3M, Henkel, Illinois Tool Works, Permabond, Parson Adhesives, WEICON, Loxeal, Bodo Möller Chemie and Astral Adhesives. These firms anchor the competitive landscape with broad product catalogues spanning high-strength threadlockers, rapid-cure retaining compounds and specialty gasket sealants.

Competitive dynamics centre on faster curing chemistries, green formulations and regional capacity expansion. Strategic moves—ranging from H.B. Fuller’s 2024 acquisition of ND Industries to Parson’s forthcoming India plant—signal an arms race to secure local supply and tailor grades for EV drivetrains, aerospace hydraulics and precision medical assemblies.

Key Takeaways

• Current global market size (2024): about USD$ 677 million

• Projected global market size (2032): USD$ 1.047 billion at a 5.65% CAGR

• US market share: roughly 25.5% in 2024, climbing on electrified-vehicle output

• Threadlockers command the largest product market share thanks to widespread use in automotive and heavy machinery

• Acrylic chemistry accounts for close to half of revenue, prized for rapid cure and chemical resistance

• Asia Pacific leads regional revenue with nearly 36% share, propelled by China and India’s vehicle and electronics production

Market Dynamics

Drivers

• Shift toward predictive maintenance and zero-leak assemblies in automotive, aerospace and wind-turbine gearboxes

• Miniaturisation of electronics demanding precision bonding in confined spaces

• Growth of EV and renewable-energy equipment requiring high-temperature, chemical-resistant sealing

Restraints

• Limited effectiveness on non-metal or inert substrates without primers raises processing complexity

• Price sensitivity in mass-market automotive and consumer goods can slow premium-grade adoption

Opportunities

• Bio-based acrylic formulations meet tightening VOC and sustainability mandates

• 3D-printed metal parts create new demand for gap-filling retaining compounds

Challenges

• Variability in regional certification standards adds testing costs for multinationals

• Supply-chain tightness for specialty monomers can inflate input prices

Regional Analysis

Asia Pacific dominates on the back of vast automotive, electronics and infrastructure output, while North America remains a prime centre for high-spec R&D. Europe follows with strong aerospace and machinery demand, focusing on low-carbon formulations.

• Asia Pacific – Largest market share, fastest CAGR, driven by China and India’s manufacturing surge

• North America – High adoption in EV, oil & gas and medical devices; robust after-market demand

• Europe – Focus on sustainability and aerospace quality standards sustains premium pricing

• Latin America – Moderate growth tied to industrial machinery upgrades

• Middle East & Africa – Niche demand for oilfield equipment sealing and infrastructure projects

Segmentation Analysis

By Product Type

• Threadlockers – Cornerstone segment.

Liquid threadlockers prevent vibration-induced loosening in engines, pumps and gearboxes, accounting for over 30 % of 2024 revenue.

• Thread Sealants – Fastest-growing slice.

Pipe fitters and HVAC contractors favour anaerobic sealants for leak-free joints in water, gas and hydraulic lines, propelling a 6 %-plus CAGR.

• Retaining Compounds – Load-bearing specialists.

These high-viscosity grades secure bearings, bushings and splines, delivering 100 % surface contact to boost torque transmission.

• Gasket Sealants – Flexible micro-gaskets.

Form-in-place gaskets replace cut sheets on housings and flanges, cutting inventory and simplifying maintenance.

• Structural Adhesives & Others – Niche high-strength bonds.

Hybrid anaerobic systems bond metals to composites in e-mobility battery trays and aerospace brackets.

By Adhesive Chemistry

• Acrylic – Roughly 49 % market share.

Acrylic formulations cure rapidly, resist oil and withstand 200 °C, making them the workhorse choice in high-volume assembly.

Acrylic grades shorten line takt time and minimise clamp fixtures, appealing to lean-manufacturing plants.

• Silicone – Temperature-proof alternative.

Silicone-based anaerobics tolerate thermal cycling in aerospace bleed-air ducts and solar trackers.

They remain elastic, maintaining seals where movement or thermal shock is expected.

• Butyl – Flexible sealing option.

Butyl variants offer superior moisture barrier performance for outdoor electrical enclosures.

Their pliability suits applications exposed to constant vibration and weathering.

• Others – Methacrylate and specialty hybrids.

These custom blends serve nuclear valves, medical implants and other critical niches needing extreme chemical resistance.

By Substrate

• Metal – Dominant at about 47% market share.

Anaerobic cure relies on metal ions, giving steel, aluminium and brass exceptional bond strength.

Typical uses include crankshaft bearings, turbine bolts and industrial valves.

• Plastics – 43% share and rising.

Surface-activated variants enable secure bonds on PVC, ABS and polycarbonate housings.

Electronics assemblers leverage them for lightweight casings without threaded inserts.

• Rubber – Emerging micro-segment.

Modified primers allow bonding to nitrile and EPDM seals in HVAC and automotive cooling lines.

• Others – Ceramics, glass and composites.

Specialty grades serve sensor housings and high-voltage insulators where metal contact is limited.

By End Use

• Manufacturing – Largest end-user at 37% share.

Assembly lines value one-step liquid gaskets and threadlockers to cut torque audits and warranty claims.

Global re-shoring of machinery production supports steady demand.

• Automotive – High-volume growth driver.

Electric-drive units, battery packs and ADAS modules face intense vibration and thermal cycling, boosting anaerobic consumption.

• Electronics – Fastest CAGR above 6%.

Miniature retaining compounds secure ferrite cores, connectors and sensors without flux residues.

• Aerospace – Precision, safety-critical niche.

High-temperature sealants protect hydraulic lines and satellite structures where mechanical fasteners add excess weight.

• Construction – Plumbing and HVAC staple.

Pipe sealants and gasket makers ensure code-compliant, leak-free installations in high-rise developments.

• Others – Energy, marine and medical sectors.

Wind-turbine nacelles, ship engines and syringe assemblies complete the demand landscape.

Industry Developments & Instances

• May 2024 – H.B. Fuller acquired ND Industries, enlarging its portfolio of anaerobic fastener coatings and sealants.

• May 2023 – Permabond launched fire-retardant TA4230, a UL94-V0-rated toughened acrylic adhesive.

• April 2022 – Parson Adhesives broke ground on a Vadodara plant, set to expand Indian output by 200 %.

• 2024 – Leading OEMs specified low-VOC acrylic threadlockers for next-generation EV drivetrains, signalling a pivot toward greener chemistries.

Facts & Figures

• Threadlockers generated roughly US$ 263 million in 2024 revenue.

• Acrylic chemistry covers nearly half of global market share.

• Asia Pacific captured close to 36% of 2024 revenue, led by China’s manufacturing base.

• Typical anaerobic cure achieves handling strength in under 15 minutes, boosting assembly throughput by up to 40%.

• Replacing mechanical lock-washers with liquid threadlockers can reduce component weight by 10% in automotive assemblies.

Analyst Review & Recommendations

Market analysis underscores a decisive shift toward greener, faster-curing acrylic systems and application-specific grades that bond mixed substrates. Suppliers that invest in regional production, primer-free plastic bonding technology and UL-rated fire-safe formulas will outpace average market growth. OEMs should standardise on liquid locking solutions early in the design stage to streamline assembly and cut total cost of ownership while meeting tightening sustainability mandates.