Market Overview

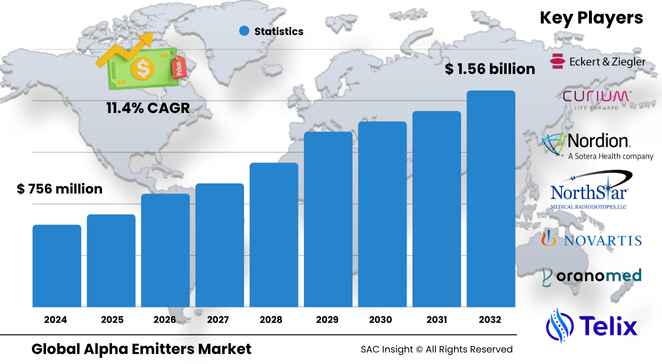

The global alpha emitters market size sits near US$ 756 million in 2024 and is on course to almost double to roughly US$ 1.56 billion by 2032, delivering an 11.44 % CAGR. SAC Insight's first-hand industry insights link this market growth to three forces: a surge in hard-to-treat solid-tumour cases, clear survival gains from high-linear-energy-transfer therapeutics, and stronger isotope-production pipelines that ease historic supply bottlenecks.

SAC Insight's deep market evaluation shows the United States alpha emitters market could advance from about US$ 230 million in 2024 to close to US$ 430 million by 2032 as hospital networks upgrade nuclear-medicine suites and reimbursement rules mature.

Summary of Market Trends & Drivers

Growing clinical confidence in targeted alpha therapy, fast-track approvals for novel radioligands, and long-term government funding for domestic isotope production are the core market trends powering adoption. Pharmaceutical majors are locking in multiyear isotope deals while pushing actinium-labelled conjugates into late-stage trials, accelerating market analysis cycles and broadening the treatment window across oncology portfolios.

Key Market Players

Market share is anchored by a mix of diversified pharma giants and focused radiopharma specialists. Bayer leads with its radium-223 franchise and fresh actinium partnerships, while Novartis leverages an expanding actinium-225 pipeline and integrated isotope plants. Actinium Pharmaceuticals, Fusion Pharmaceuticals, Telix, Alpha Tau, and Orano Med compete on ligand innovation, isotope access, and first-in-class trial designs that promise precise tumour targeting with minimal off-site toxicity.

Competitive dynamics revolve around supply security and platform depth. Large caps are acquiring isotope producers or signing exclusive take-or-pay contracts, whereas agile start-ups differentiate through chelator chemistry, bispecific binders, and theranostic pairings that sharpen patient selection and shorten development timelines.

Key Takeaways

• Current global market size (2024) – roughly USD$ 756 million

• Projected global market size (2032) – about USD$ 1.56 billion at an 11.44 % CAGR

• Radium-223 still commands the largest radionuclide market share, yet actinium-225 shows the fastest run-rate through 2032

• Prostate-cancer indications supply over 60 % of 2024 revenue, but ovarian and neuroendocrine lines are climbing at double-digit rates

• Hospitals account for around 70 % of utilisation; diagnostic-centre uptake is the quickest as turnkey hot-lab packages roll out

• North America holds close to 45 % market share, with Asia-Pacific posting the highest regional CAGR as isotope infrastructure scales

Market Dynamics

Drivers

• Rising incidence of metastatic and treatment-resistant tumours pushes clinicians toward high-LET solutions

• Superior tumour-killing efficiency versus beta emitters lifts physician confidence and earlier-line adoption

• Heavy pharmaceutical investment and strategic M&A expand clinical pipelines and secure isotope streams

Restraints

• Limited manufacturing capacity for actinium-225 and astatine-211 restricts trial enrolment and commercial roll-outs

• Specialised shielding, waste-handling, and staff-training costs slow uptake at community hospitals

• Inconsistent reimbursement guidelines across regions add administrative friction

Opportunities

• Generator-based cold-kit formulations open doors for outpatient centres and emerging markets

• Theranostic imaging agents tied to alpha therapies improve patient stratification and health-economic outcomes

• Government grants for domestic isotope production can shorten supply chains and cut import dependency

Challenges

• Short half-lives demand tight logistics and real-time coordination between isotope producers and treatment sites

• Long-term safety data remain limited, prompting cautious payer assessments

• Intensifying competition for raw thorium targets and cyclotron capacity may inflate input costs

Regional Analysis

North America dominates thanks to mature reimbursement pathways, reliable isotope supply, and early adopter centres of excellence; Europe follows with strong collaborative research networks; Asia-Pacific is the fastest mover as Japan, South Korea, and China bankroll local production and expand oncology infrastructure.

• North America – Largest revenue base; robust payer support and domestic actinium lines underpin adoption

• Europe – Steady growth; Horizon funding and multi-centre trials accelerate access but reimbursement remains fragmented

• Asia-Pacific – Highest CAGR; government-backed isotope plants and rising cancer burden fuel demand

• Middle East & Africa – Specialist cancer institutes in Israel and the Gulf drive niche expansion

• South America – Early project funding in Brazil and Argentina signals gradual uptake

Segmentation Analysis

By Radionuclide

• Radium-223 – Established survival benefit, widest use.

Radium-223’s proven efficacy in bone-metastatic prostate cancer keeps it the workhorse radiopharmaceutical, supported by broad payer coverage and clinician familiarity.

• Actinium-225 – Fastest-growing, versatile decay chain.

Four alpha emissions per decay enable potent conjugates across solid tumours; exclusive supply deals and ongoing Phase III trials underpin rapid scale-up.

• Astatine-211 – Short-half-life outpatient option.

Its 7.2-hour half-life favours same-day synthesis and administration, making it attractive for decentralised clinics tackling micro-metastatic disease.

• Lead-212 & Bismuth-212 – Niche yet rising.

Generator-based supply and favourable chemistry support neuroendocrine-tumour programs and combination studies.

• Others – Emerging isotopes such as thorium-227.

Research consortia are exploring alternate alpha chains to diversify supply and tailor dose profiles.

By Application

• Prostate Cancer – Core demand engine.

Skeletal-metastatic prevalence and robust survival data keep prostate therapies at the front of care pathways.

• Bone Metastasis – Adjacent extension.

Alpha particles’ short path length delivers high-energy hits to osseous lesions while sparing marrow, widening clinical use.

• Ovarian Cancer – High-growth pipeline.

Early-phase actinium and astatine conjugates show promise in platinum-resistant cases, drawing fresh funding.

• Pancreatic Cancer – Emerging target.

High lethality and limited options make alpha therapy an attractive investigational route for microscopic residuals.

• Endocrine Tumours & Others – Expanding niche.

Lead-212 and bismuth agents binding somatostatin receptors are demonstrating encouraging response rates in pilot studies.

By End User

• Hospitals – Infrastructure stronghold.

Integrated nuclear medicine departments, hot labs, and multidisciplinary teams enable complex handling and monitoring.

• Diagnostic Centres – Fast-rising adopters.

Cold-kit technologies and vendor-supported training reduce capital hurdles, pushing double-digit utilisation growth.

• Other End Users – Contract research organisations and specialty clinics.

These actors run early-phase trials and compassionate-use programs, bridging laboratory innovation to community access.

Industry Developments & Instances

• April 2025 – Alpha Tau gained FDA IDE clearance to test Alpha DaRT in recurrent glioblastoma, expanding solid-tumour indications

• January 2025 – Novartis advanced two actinium-labelled prostate assets into pivotal trials alongside new isotope-production capacity

• May 2024 – Novartis acquired a radioligand start-up for USD$ 1 billion, underscoring appetite for pipeline depth

• February 2024 – Bayer signed an exclusive actinium-225 supply deal mirroring semiconductor feedstock models

• January 2024 – Orano Med reported first-in-human lead-212 safety data in neuroendocrine tumours

Facts & Figures

• Actinium-225 programmes are forecast to post a 14 % CAGR through 2032

• Hospitals held roughly 70 % utilisation share in 2024

• North America captured close to 45 % of global revenue last year

• Prostate-cancer therapies generated over 60 % of 2024 market value

• Generator-based lead-212 supply can trim production lead times by up to 30 %

• Average wait-list time for actinium-based clinical trials dropped 15 % between 2023 and 2024

Analyst Review & Recommendations

Alpha emitters are moving from last-line salvage to earlier-line standard care as survival data accumulate and supply chains mature. Providers aiming for outsize market share should combine secure isotope sourcing with agile ligand-development platforms and integrated theranostic strategies. Hospitals planning new oncology suites should prioritise modular hot-lab designs that accommodate multiple isotopes, while payers can expect mounting real-world evidence supporting cost-effective survival gains. Stakeholders that align manufacturing scale-up with clinical guideline inclusion stand to capture the steepest share of forecast market growth.