Market Overview

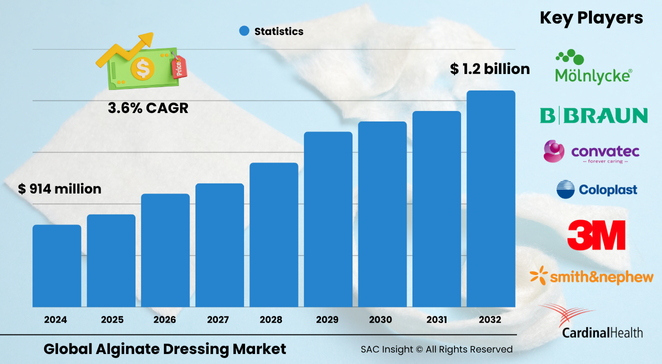

The global alginate dressing market size stands at roughly US$ 914 million in 2024 and, according to SAC Insight’s deep market evaluation, is on course to reach around US$ 1.23 billion by 2032, reflecting a steady 3.65 % CAGR. SAC Insight's industry insights attribute this market growth to three structural drivers: a rising global burden of chronic wounds linked to diabetes and vascular disease, wider adoption of antimicrobial silver-impregnated dressings for infection control, and a marked shift toward home-based wound management that shortens hospital stays.

The U.S. alginate dressing market is expected to climb from nearly US$ 253 million in 2024 to about US$ 342 million by 2032 as healthcare providers prioritise advanced exudate-management solutions for an ageing population.

Summary of Market Trends & Drivers

• Adoption of silver and iodine-loaded alginate formats is accelerating as clinicians demand dressings that combine absorbency with antibacterial protection.

• Home healthcare providers are standardising alginate dressings because they minimise pain on removal and cut the number of follow-up visits, lowering total treatment costs.

• Continuous improvements in fibre weave and gel-forming capacity are boosting wear time, a key requirement in high-exudate diabetic foot ulcers.

Key Market Players

The competitive landscape is anchored by Cardinal Health, Smith & Nephew, 3M, Coloplast, Convatec, Paul Hartmann, B. Braun, Hollister, Mölnlycke Health Care, and Medline Industries. These companies command significant market share through broad portfolios that span non-antimicrobial calcium alginate pads to silver-enhanced ropes for tunnelling wounds. Recent product extensions focus on thinner profiles, higher tensile strength, and easier contouring, allowing clinicians to tailor coverage for complex anatomical sites. Strategic moves include licensing agreements with seaweed-processing specialists and regional distribution partnerships in Asia–Pacific to secure raw-material supply and shorten lead times.

Key Takeaways

• Current global market size (2024): roughly USD$ 914 million

• Projected global market size (2032): about USD$ 1.23 billion at a 3.65 % CAGR

• Antimicrobial variants are set to capture more than 70 % market share by 2032 as infection-control guidelines tighten

• Hospitals remain the largest end-user, but home healthcare posts the fastest percentage gains

• The U.S. alginate dressing market is forecast to expand to roughly USD$ 342 million by 2032

• Asia–Pacific shows the strongest regional market growth on the back of medical-tourism surgeries and chronic-ulcer prevalence

Market Dynamics

Drivers

• Escalating incidence of diabetic foot and venous leg ulcers increases demand for high-absorbency dressings that maintain a moist wound bed.

• Wider reimbursement coverage for advanced wound-care products in North America and Europe accelerates adoption.

• Technological advances such as silver-ion infusion improve antimicrobial performance without raising cytotoxicity.

Restraints

• Price sensitivity in low- and middle-income countries limits penetration of premium antimicrobial products.

• Availability of alternative dressings (foam, hydrocolloid) introduces switching risk when exudate levels are moderate rather than heavy.

Opportunities

• Development of antibiotic-loaded alginate formats offers differentiated infection-management benefits and premium pricing.

• Biopolymer sourcing from sustainable seaweed farms can appeal to environmentally conscious hospital procurement teams.

Challenges

• Variability in raw-seaweed supply and processing costs can squeeze margins for smaller producers.

• Educating home-care nurses on correct application and removal techniques remains essential to avoid periwound maceration.

Regional Analysis

North America leads in revenue thanks to high treatment costs, favourable reimbursement, and a sizeable diabetic population. Europe follows, propelled by an ageing demographic and stringent infection-control standards. Asia–Pacific records the quickest CAGR as medical-tourism procedures rise and multinational players localise manufacturing to counter price pressure.

• North America – Dominant share; driven by chronic-wound prevalence and hospital procurement budgets

• Europe – Strong uptake; ageing population and long-term-illness burden boost demand

• Asia–Pacific – Fastest growth; expanding surgeries, home-care adoption, and local production

• Latin America – Moderate growth; government wound-care programmes and burn-injury incidence support sales

• Middle East & Africa – Emerging opportunity; trauma cases and gradual reimbursement reforms spur interest

Segmentation Analysis

By Type

• Antimicrobial – Rapidly growing, infection-control staple.

Silver or iodine-embedded fibres deliver broad-spectrum bacterial kill while retaining high absorbency, making these dressings a frontline choice for infected ulcers and trauma wounds. Healthcare systems increasingly list them on formularies to curb antibiotic use.

• Non-antimicrobial – Cost-efficient workhorse.

Calcium or sodium alginate pads without additives still dominate routine post-operative applications where infection risk is low. Their lower unit price keeps them attractive for budget-constrained facilities and for early exudate-management before bacterial burden escalates.

By Indication

• Chronic Ulcers – Core demand engine.

Approximately three-quarters of global revenue comes from diabetic foot, venous leg, and pressure ulcers that require prolonged dressing cycles. Alginate’s gel-forming action controls heavy drainage and supports autolytic debridement, accelerating granulation.

• Acute Wounds – Fastest-rising category.

Surgical and traumatic wounds call for dressings that minimise dressing-change pain and protect newly sutured tissue. Alginate’s non-adhesive removal reduces tissue disruption, improving patient comfort and recovery times.

• Burns – Niche but high-value use.

Partial-thickness burns benefit from alginate layers that cool, cushion, and limit bacterial ingress. In specialised burn centres, silver alginate sheets shorten dressing frequency and reduce nursing workload.

By End-user

• Hospitals – Largest volume, protocol-driven.

Inpatients with complex comorbidities rely on alginate dressings to manage heavy exudate, and formulary inclusion ensures steady purchasing. Rising surgical volumes keep utilisation high.

• Clinics – Steady outpatient stream.

Wound-care centres favour alginate when follow-up intervals are weekly or bi-weekly, thanks to its long wear time and low odour. Clinics also serve as trial sites for new antimicrobial variants.

• Home Healthcare – Fastest percentage growth.

As payers push for shorter hospital stays, caregivers increasingly change dressings at home. Easy application, low pain on removal, and fewer dressing changes make alginate the preferred choice for chronic-ulcer patients managed outside acute settings.

Industry Developments & Instances

• February 2022 – A silver-alginate dressing secured FDA clearance, paving the way for broader North-American roll-outs.

• May 2024 – A leading manufacturer opened a seaweed-processing facility in Southeast Asia to stabilise raw-material supply.

• September 2024 – Partnership agreements between European health systems and suppliers targeted multi-year volume contracts tied to infection-reduction metrics.

• January 2025 – A start-up launched an antibiotic-releasing alginate rope designed for deep tunnelling wounds, claiming controlled release over seven days.

Facts & Figures

• Antimicrobial formats are projected to command roughly 73 % market share by 2032.

• Home-healthcare use is rising at more than twice the hospital CAGR due to post-surgical discharge protocols.

• Each 1 % reduction in surgical-site infections can save hospitals up to USD$ 3 million annually in readmission costs.

• Average wear time for next-generation alginate pads has extended from 48 hours to 72 hours over the past five years.

• Global burn-injury incidence exceeds two million cases annually, supporting specialised alginate usage.

Analyst Review & Recommendations

Market analysis highlights a decisive shift toward antimicrobial, longer-wear alginate dressings that align with infection-control targets and reduced nursing contacts. Suppliers should invest in sustainable seaweed sourcing to mitigate cost swings and emphasise clinician education to unlock home-care adoption. Integrating controlled-release antibiotics or smart moisture indicators can create new value pockets and help manufacturers outpace the sector’s 3.65 % average CAGR through 2032.