Market Overview

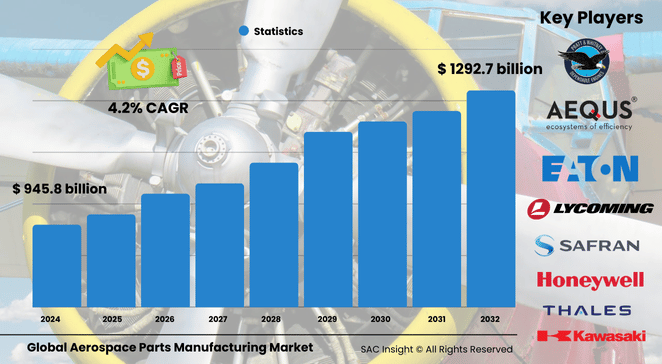

The global aerospace parts manufacturing market size was valued at US$ 945.89 billion in 2024 and is projected to hit roughly US$ 1,292.72 billion by 2032, expanding at a 4.2% CAGR over the 2025-2032 forecast window. First-hand industry insights point to three powerful demand engines: fleet replacement cycles averaging 3.2 percent per year, a sharp rise in passenger and cargo traffic across Asia and the Middle East, and the race for lighter, fuel-efficient aircraft that curb emissions.

SAC Insight's deep market evaluation shows the United States retains a dominant footprint; on a pro-rata basis, the U.S. aerospace parts market is expected to exceed US$ 650 billion by 2032, fueled by a healthy backlog at leading air-framers and steady defense outlays.

Summary of Market Trends & Drivers

• Airlines and leasing firms are fast-tracking orders for next-generation narrow-bodies, lifting demand for advanced engines, avionics, and composite aerostructures.

• Wider adoption of additive manufacturing is shortening lead times, lowering waste, and enabling complex geometries once impossible with conventional machining.

• Lightweight carbon-fiber and high-strength alloys are now standard in cabin interiors, landing-gear systems, and control surfaces, improving payload-range performance and trimming greenhouse-gas footprints.

Key Market Players

The competitive landscape is anchored by a mix of global tier-one suppliers and specialist integrators. Companies such as Safran Group, GE Aviation, Rolls-Royce, Honeywell International, Pratt & Whitney, and Spirit Aerosystems command substantial market share through scale, broad product portfolios, and longstanding OEM ties. A dynamic cohort of mid-sized firms—including Intrex Aerospace, Liebherr International, Diehl Aviation, and Aequs—focuses on precision machining, composite fabrication, and cabin solutions. Their agility in adopting 3D-printing cells, automated lay-up lines, and digital twins enables rapid prototyping and helps secure high-value contracts in both commercial and defense programs.

Key Takeaways

• Market value (2024): US$ 945.89 billion

• Projected value (2032): US$ 1,292.72 billion at a 4.2% CAGR

• Aircraft manufacturing and aerostructures account for just over 50 percent of total revenue

• Commercial aircraft parts represent half of overall demand, yet military upgrades remain a stable secondary engine of market growth

• North America controls roughly 51 percent market share, while Asia Pacific delivers the fastest regional CAGR above 7 percent

• Additive manufacturing, advanced alloys, and smart-sensor avionics top the list of transformative market trends

Market Dynamics

Drivers

• Surging passenger and air-freight volumes, especially on trans-Pacific and intra-Asian routes

• Continuous fleet modernization to improve fuel burn and cut operating costs

• Rising defense budgets that prioritize next-gen aircraft and sustainment contracts

Restraints

• Capital-intensive production lines and high certification hurdles slow new-entrant momentum

• Volatile raw-material prices for titanium and specialty composites press supplier margins

• Talent shortages in aerospace-grade welding, software-defined avionics, and composite lay-up

Opportunities

• Scaling 3D printing of non-critical and eventually structural components opens new revenue pools

• MRO providers in Asia and the Gulf offer joint-venture potential for localized parts production

• Growing interest in hydrogen and hybrid-electric propulsion creates fresh demand for novel systems and support equipment

Challenges

• Supply-chain bottlenecks for forgings, castings, and semiconductors extend lead times

• Heightened ESG scrutiny pushes manufacturers to quantify lifecycle emissions and recyclability

• Geopolitical trade tensions can disrupt cross-border technology transfers and export licenses

Regional Analysis

North America remains the primary manufacturing hub thanks to a mature supplier network, sustained R&D spending, and robust military procurement. Asia Pacific is closing the gap quickly as China, India, and Southeast-Asian nations expand fleets and invest in local MRO capacity. Europe retains strength in advanced materials and propulsion R&D, while the Middle East leverages free-trade zones and strategic logistics corridors to court OEM partnerships.

• North America – Largest market, driven by fleet ageing and defense upgrades

• Europe – Strong in engines, avionics, and composite research; modest overall growth

• Asia Pacific – Fastest-growing region on the back of rising middle-class travel and expanding low-cost carriers

• Middle East & Africa – Niche growth centered on wide-body maintenance hubs and military offsets

• Latin America – Gradual rebound as economic stability returns and carriers renew regional jets

Segmentation Analysis

By Product

• Engines – High-value core of the market

Engines deliver the richest revenue stream due to complex engineering and long-term maintenance contracts.

• Aircraft Manufacturing (Aerostructure) – Dominant share above 50 percent

Fuselages, wings, and door pairings form the structural backbone of every aircraft.

• Cabin Interiors – Lean, modular, passenger-centric

Airlines seek lighter seats, touchless lavatories, and flexible galleys to enhance experience and add ancillary-revenue options, keeping interior retrofits in steady demand.

• Equipment, Systems, & Support – Fastest CAGR through 2032

Landing gear, environmental control, actuation, and braking systems are critical for safety and fuel savings.

• Avionics – Digital backbone of modern flight

Fly-by-wire controls, satcom links, and collision-avoidance systems are moving to open-architecture platforms, allowing rapid software updates and cross-fleet commonality.

• Insulation Components – Niche yet indispensable

Thermal and acoustic insulation safeguards cabin comfort and system reliability, benefiting from eco-friendly foams and fire-resistant fabrics.

By Aircraft Type

• Commercial Aircraft – Core demand engine

With passenger numbers rebounding past pre-pandemic highs, narrow-bodies and wide-bodies alike drive component orders, from wing ribs to seat tracks.

• Business Aircraft – Upside from private travel boom Light and medium jets are gaining traction among corporations and high-net-worth individuals seeking flexible point-to-point travel.

• Military Aircraft – Stable, tech-intensive

Ongoing fighter, tanker, and rotorcraft programs ensure consistent demand for high-spec engines, radar-ready nose cones, and reinforced landing-gear assemblies.

• Other Aircraft – Special-mission and regional turboprops

Surveillance drones, firefighting tankers, and commuters add incremental demand for customized structures and avionics.

Industry Developments & Instances

• August 2022 – Safran Data Systems acquired an Indian telemetry specialist, expanding its footprint in strategic high-growth markets.

• May 2022 – JAMCO forged an agreement with an electric vertical-take-off developer to co-engineer lightweight cabin modules.

• October 2022 – Boeing India and a state-owned metallurgy firm partnered to develop indigenous aerospace-grade alloys for next-gen aircraft.

• January 2023 – U.S. startup secured USD$ 90 million to build fully automated precision-machining factories aimed at closing the supply-demand gap in structural parts.

Facts & Figures

• Around 39,000 new commercial aircraft are expected to enter service over the next two decades, creating a sustained pipeline for parts suppliers.

• Additive manufacturing can cut raw-material waste by up to 60 percent on low-volume components.

• Lightweight composite substitution can deliver a 15-20 percent fuel-burn reduction over an aircraft’s lifecycle.

• The average commercial airframe age globally is 11.5 years, underscoring the coming wave of replacements.

• Advanced avionics packages reduce maintenance-related AOG (aircraft on ground) events by nearly 30 percent, boosting airline adoption rates.

Analyst Review & Recommendations

Near-term market growth will be defined by the speed at which suppliers adopt digital manufacturing and secure stable raw-material pipelines. Firms that integrate data-rich additive processes, partner for regional MRO capacity, and invest in sustainable materials will outpace peers. Strengthening strategic collaborations with air-framers and diversifying into both commercial and defense platforms remain the clearest paths to resilient revenue and long-term market share gains.