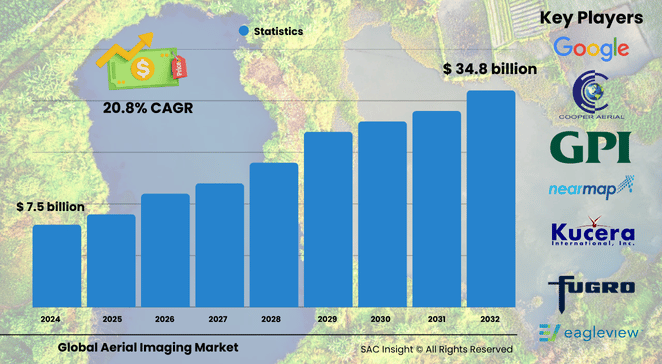

Market Overview

The global aerial imaging market size was valued at approximately US$ 7.53 billion in 2024 and is projected to surge to about US$ 34.80 billion by 2032, expanding at a 20.87% CAGR over the 2025-2032 forecast period. SAC Insight industry insights highlight three interlocking growth engines: the rapid fall in drone acquisition costs, sharper demand for location-based decision support in urban infrastructure, and AI-driven analytics that convert raw pixels into actionable intelligence.

SAC Insight's deep market evaluation also shows budgets rebounding for public-sector mapping initiatives, while precision agriculture and real-estate marketing accelerate commercial uptake. The U.S. aerial imaging market alone is expected to reach close to US$ 17.12 billion by 2032, underscoring North America’s continued appetite for high-resolution spatial data.

Summary of Market Trends & Drivers

• AI-enabled object recognition, cloud delivery, and on-demand “imagery-as-a-service” subscriptions are reshaping customer expectations for speed and insight.

• Regulators in major economies are drafting BVLOS (beyond visual line of sight) guidelines, opening the door for scalable drone corridors and continuous geospatial monitoring.

• High-resolution multispectral sensors are migrating from defense to civilian projects, giving agronomists and energy operators a new level of crop-health and asset-condition granularity.

Key Market Players

Global leaders such as Google, Fugro, Nearmap, EagleView Technologies, and Cooper Aerial Surveys channel significant R&D into ultra-high-resolution cameras, AI post-processing, and automated flight planning. Their competitive edge lies in pairing proprietary image libraries with analytics platforms that deliver ready-to-use data layers for planners, insurers, and agribusinesses.

Key Takeaways

• 2024 market value: USD$ 7.53 billion.

• 2032 projection: USD$ 34.80 billion, reflecting sustained market growth at a 20.87% CAGR.

• North America and Asia-Pacific collectively command over 72% of global market share, with Asia-Pacific edging ahead in drone adoption.

• UAVs captured approximately 48.3% of platform revenue in 2024 thanks to low operating costs and ease of access to remote areas.

• Geospatial mapping remains the largest application slice, while surveillance & monitoring posts the fastest growth on the back of AI-enabled threat detection.

• Oblique imagery is the quickest-expanding camera orientation, driven by immersive media and real-estate visualization needs.

Market Dynamics

Drivers

• Escalating infrastructure projects require up-to-date terrain and construction progress data.

• Precision farming and environmental compliance push demand for multispectral and thermal imagery.

• Government disaster-response programs increasingly rely on rapid aerial assessments to prioritize relief.

Restraints

• Fragmented air-traffic regulations for drones limit seamless cross-border operations.

• Data-privacy concerns and security rules complicate large-scale imaging of urban centers.

Opportunities

• Smart-city initiatives create recurring revenue for continuous aerial monitoring and 3D city models.

• Integration of machine learning with imagery unlocks predictive maintenance services for utilities and transport networks.

Challenges

• Shortage of skilled UAS pilots and data scientists can slow project delivery.

• High-precision sensors remain expensive, constraining adoption among small service providers.

Regional Analysis

North America continues to set the pace, buoyed by healthy defense allocations and a mature commercial drone ecosystem, while Asia-Pacific’s 35.9% share in 2024 reflects surging infrastructure and agriculture deployments across China and India. Europe follows with sustained investment in cross-border rail and renewable-energy corridors.

• North America – strong regulatory support for BVLOS testing and robust enterprise spending.

• Europe – steady adoption in renewable-energy inspections and heritage preservation programs.

• Asia-Pacific – fastest overall expansion, fueled by smart-city budgets and domestic drone manufacturing.

• Latin America – growing need for plantation monitoring and mineral-exploration surveys.

• Middle East & Africa – highest forecast CAGR, driven by mega-projects and coastline resilience mapping.

Segmentation Analysis

By Platform

• UAV – 48.3% revenue share, cost-efficient data capture

UAVs dominate because they cover small-to-medium areas quickly, slip into tight airspace, and carry advanced sensors without the overhead of manned aircraft.

• Fixed-wing Aircraft – high-coverage efficiency

Fixed-wing platforms excel at wide-area surveys, pipeline monitoring, and corridor mapping where long endurance and altitude stability matter.

• Helicopter – agile, vertical lift capability

Rotary craft fill the gap for high-altitude, precision-hover tasks such as utility-line audits and search-and-rescue imagery.

• Others – balloons, airships, and vehicle-mounted masts

Niche solutions provide persistent surveillance or ultra-low-altitude imaging where drones are restricted.

By Camera Orientation

• Vertical – baseline for orthophotos and cadastral mapping

Straight-down images generate accurate, distortion-free maps essential for GIS and land-registry updates.

• Oblique – fastest-growing orientation for immersive visuals

Low- and high-oblique angles supply realistic façade views that enrich real-estate marketing, 3D city modeling, and situational awareness.

• Low Oblique – detailed ground perspective

Low oblique shots help appraisers verify building attributes and aid emergency responders in navigating street-level obstacles.

• High Oblique – broader context including horizon line

High oblique imagery gives planners and media producers a sweeping landscape view useful for tourism promos and large-scale terrain analysis.

By Application

• Geospatial Mapping – core demand engine

Governments and engineers rely on centimeter-level orthomosaics for land-use planning, corridor routing, and utility asset management.

• Surveillance & Monitoring – real-time situational insight

Border patrols, wildlife agencies, and facility-security teams deploy aerial streams to detect incursions and environmental threats on the fly.

• Disaster Management – rapid damage assessment

Post-event flights supply before-and-after visuals that guide rescue logistics and insurance claims.

• Energy & Resource Management – asset lifecycle optimization

Oil, gas, and renewable operators use thermal and lidar overlays to spot leaks, corrosion, and vegetation encroachment.

• Urban Planning – smart-city infrastructure modeling

3D meshes and change-detection analytics support zoning decisions and traffic-flow simulations.

• Others – media production, archaeology, insurance underwriting

By End Use

• Government – largest revenue block

Agencies leverage aerial imaging for defense reconnaissance, infrastructure audits, and environmental stewardship.

• Military & Defense – persistent ISR (intelligence, surveillance, reconnaissance)

High-resolution, day-night imagery strengthens situational dominance and mission planning.

• Energy – pipeline, wind-turbine, and solar-farm inspections

Timely aerial checks reduce downtime and lower maintenance costs.

• Agriculture & Forestry – precision input management

Multispectral maps guide variable-rate fertilization and early pest intervention.

• Civil Engineering – progress verification and volumetric analysis

Contractors track earth-moving and structural milestones to keep projects on schedule.

• Media & Entertainment – cinematic aerial content

Professionals capture sweeping vistas and immersive VR experiences.

• Commercial & Others – insurance, mining, real estate

Industry Developments & Instances

• September 2024 – Google enhanced its historical imagery feature, adding 80 years of aerial pictures to support longitudinal urban-change studies.

• February 2024 – Fugro began mapping Italy’s coastal habitats for a national restoration program using combined aerial and remote-sensing payloads.

• June 2022 – Fugro secured a five-year lidar and imagery contract with Energinet to survey Denmark’s transmission grid.

• November 2021 – Nearmap expanded its post-catastrophe imagery program across North America, offering insurers rapid damage visualization following extreme weather.

• September 2021 – A leading U.S. geospatial firm obtained an eight-figure federal contract to supply high-resolution orthoimagery for nationwide land-use monitoring.

Facts & Figures

• Average global CAGR 2025-2032: 20.87%.

• UAVs generated nearly half of platform revenue in 2024.

• Asia-Pacific captured roughly 35.9% market share in 2024.

• Oblique imagery demand is rising at more than twice the rate of vertical imagery.

• AI-enhanced analytics can cut data-to-decision time by up to 60%.

• Real-estate listings with aerial photos see click-through rates jump by 35% on average.

Analyst Review & Recommendations

Aerial imaging is transitioning from episodic data capture to always-on spatial intelligence. Players that bundle high-frequency UAV sorties with AI-powered analytics and cloud APIs will set the pace. Strategic priority should center on easing regulatory friction, investing in pilot-training pipelines, and forging alliances with GIS and smart-city platforms. Companies that deliver turnkey insights—rather than raw pixels—stand to claim outsized value as location-centric decisions become integral to infrastructure, agriculture, and security workflows.