Market Overview

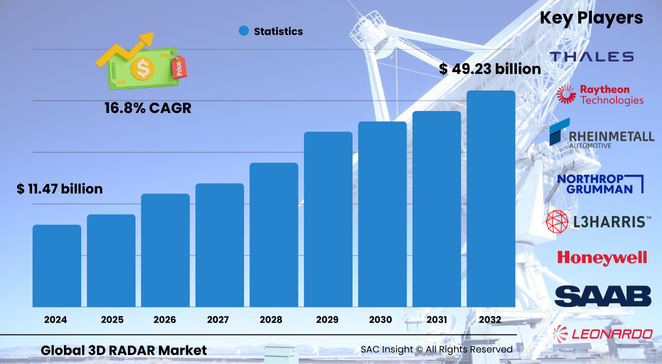

The 3D radar market size is valued at roughly US$ 11.47 billion in 2024 and is projected to accelerate to about US$ 49.23 billion by 2032, expanding at an average 16.83 % CAGR. First-hand industry insights highlight three prime drivers: surging defence modernisation, rising adoption in autonomous mobility, and steady investments in weather and air-traffic surveillance. SAC Insight's deep market evaluation shows the United States 3D radar market alone could advance toward nearly US$ 14 billion by 2032 as federal agencies and private airports upgrade situational-awareness infrastructure.

Summary of Market Trends & Drivers

• Active electronically scanned arrays and software-defined architectures are boosting range, resolution, and multi-target tracking.

• Growing border-security budgets and geopolitical tensions are lifting demand for long-range, high-precision sensors across airborne, ground, and naval fleets.

• Commercial roll-outs in advanced driver-assistance systems (ADAS), smart-city traffic control, and precision weather forecasting add fresh revenue streams, underpinning sustained market growth.

Key Market Players

Global 3D radar market leadership rests with a blend of aerospace primes and specialised sensor suppliers. Firms such as Airbus Defence and Space, BAE Systems, Honeywell, Leonardo, Lockheed Martin, Northrop Grumman, Rockwell Collins, SAAB, and Thales command significant market share through broad product lines, deep R&D budgets, and long-term defence contracts. Their competitive edge centres on phased-array innovation, AI-enabled signal processing, and integrated logistics support.

Rivalry is intensifying as mid-tier companies and start-ups introduce compact, low-power modules for drones, self-driving cars, and coastal monitoring. Strategic alliances, technology licensing, and regional production hubs are helping incumbents protect margins while smaller players capture niche opportunities.

Key Takeaways

• Current global market size (2024): USD$ 11.47 billion

• Projected global market size (2032): USD$ 49.23 billion at a 16.83 % CAGR

• The U.S. market is on course to reach nearly US$ 14 billion by 2032 as NORAD and FAA programmes progress

• Hardware remains the largest revenue contributor, but software and analytics are the fastest-growing offerings

• E/F-band radar leads long-range defence and weather applications, while C/S/X-band solutions dominate multi-role naval and ground systems

• AI-driven sensor fusion and quantum-enhanced detection are the standout technology trends shaping future market analysis

Market Dynamics

Drivers

• Rising defence spending and border-surveillance programmes in North America, Europe, and Asia-Pacific

• Expanding deployment in autonomous vehicles, drones, and smart-infrastructure projects

• Continuous technological advances in gallium-nitride transmitters, digital beamforming, and AI-based target classification

Restraints

• High upfront cost of development, integration, and compliance testing

• Export-control regimes and varying national procurement rules that slow cross-border sales

• Complex power-consumption and signal-interference challenges in dense electromagnetic environments

Opportunities

• Miniaturised radar chips for mass-market automotive and consumer drones

• Space-based 3D radar constellations for global weather and maritime domain awareness

• Energy-efficient designs that align with sustainability targets and lower total cost of ownership

Challenges

• Semiconductor supply-chain bottlenecks and rare-earth material constraints

• Skill shortages in advanced RF engineering and AI-enabled data analytics

• Growing congestion in shared frequency bands requiring smarter spectrum management

Regional Analysis

North America retains the largest market share owing to robust defence modernisation, active commercial aerospace sectors, and early adoption of ADAS in passenger vehicles. Europe follows, driven by air-traffic control upgrades and NATO collaborative radar initiatives, while Asia-Pacific records the fastest percentage growth as China, India, Japan, and South Korea fund wide-area surveillance and coastal-security systems.

• North America – Defence modernisation and large-scale FAA modernisation keep demand high

• Europe – Strong aerospace cluster, joint defence projects, and weather-service upgrades spur sales

• Asia-Pacific – Highest CAGR on the back of military expansion and smart-city initiatives

• Middle East & Africa – Border-security and critical-infrastructure protection sustain steady uptake

• Latin America – Airport-safety and coastal-monitoring projects unlock niche opportunities

Segmentation Analysis

By Offerings

• Hardware – Core revenue engine.

High-gain antennas, solid-state transmitters, and ruggedised processors deliver precise imaging and long mission life, making hardware indispensable across defence and commercial sectors.

Hardware dominates spend because end-users prioritise reliability and high performance, yet ongoing innovation is shrinking size, weight, and power, supporting adoption in UAVs and self-driving cars.

• Software – Fastest-growing slice.

Adaptive beam-shaping, threat-classification algorithms, and real-time data visualisation enable smarter, more autonomous operations.

Software licences and cloud-based analytics unlock recurring revenue and allow legacy systems to gain next-generation capability without costly hardware swaps.

• Services – Integration and lifecycle support.

Consulting, installation, calibration, and predictive maintenance ensure peak uptime in mission-critical settings.

Service providers benefit from long-term contracts tied to performance-based logistics, boosting margins and customer loyalty.

By Frequency Band

• C/S/X-Band – Balanced range and atmosphere penetration.

Favoured for naval vessels and medium-range air-defence where multi-mission flexibility is essential.

Its adaptability and mature component ecosystem keep C/S/X-band the workhorse across diverse operating conditions.

• L-Band – Long-range reconnaissance.

Well-suited for over-the-horizon surveillance and air-traffic control thanks to strong propagation through weather.

Utilities and air-navigation service providers prefer L-band for persistent coverage and reduced clutter.

• E/F-Band – High-resolution seekers.

Critical for ballistic-missile defence, severe-weather monitoring, and space-situational awareness.

Demand is accelerating as nations invest in early-warning networks capable of tracking low-observable threats.

• Other Bands – Niche scientific and experimental uses.

HF and VHF applications serve ionospheric research and special-purpose military missions.

Though smaller in value, these segments drive breakthroughs that often migrate into mainstream defence programmes.

By Platform

• Airborne – Highest mobility.

Fighter jets, AEW&C aircraft, and large UAVs rely on lightweight AESA arrays for 360-degree coverage.

Airborne radar growth is propelled by the global shift toward multi-domain operations requiring rapid situational insight.

• Ground – Broadest installed base.

From fixed coastal stations to mobile counter-UAS trucks, ground systems provide layered defence and civilian safety.

Logistics ease and relative affordability make ground platforms the go-to choice for emerging-market homeland-security upgrades.

• Naval – Blue-water and littoral dominance.

Frigates, destroyers, and unmanned surface vessels deploy 3D radar for surface, air, and ballistic-missile warning.

Fleet renewal programmes and rising anti-ship missile threats are fuelling strong naval demand.

By Industry

• Defence & Aerospace – Cornerstone customer.

Modern force-protection doctrines depend on rapid, high-accuracy tracking, keeping defence budgets the leading revenue source.

• Automotive & Public Infrastructure – Emerging high-volume segment.

ADAS, traffic management, and smart-intersection projects integrate compact 3D sensors to enhance safety and throughput.

• Energy & Utilities – Grid and pipeline oversight.

Radar-based intrusion detection and severe-weather prediction safeguard critical assets, reducing downtime and repair costs.

• Government & Others – Meteorology, research, and disaster response.

National weather services and scientific agencies turn to dual-polarisation 3D radar for precise storm modelling and early warnings.

Industry Developments & Instances

• April 2025 – A leading aerospace contractor unveiled a gallium-nitride transmit-receive module that doubles detection range while halving power draw.

• January 2025 – Joint venture between a European prime and an Asian electronics firm launched a compact automotive 4D/3D radar chipset targeting Level-4 autonomy.

• October 2024 – Major airport group commissioned a cloud-based 3D radar network for drone incursions across five hubs.

• July 2024 – Naval fleet upgrade contract awarded for multi-beam E/F-band arrays, including AI-powered threat-classification software.

• February 2024 – Meteorological agency deployed the world’s first space-based 3D weather radar demonstrator in low-Earth orbit.

Facts & Figures

• Hardware accounts for about 65 % of current market revenue.

• Over 480 new 3D radar installations were ordered worldwide in 2024, a 22 % year-on-year increase.

• AI-enhanced tracking can cut false-alarm rates by up to 40 % in cluttered urban environments.

• Miniaturisation has reduced average airborne array weight by nearly 30 % since 2020.

• E/F-band systems capture roughly 45 % of long-range defence sales and are growing at more than 18 % annually.

Analyst Review & Recommendations

The global 3D radar market analysis indicates a decisive shift from monolithic, platform-specific sensors to modular, software-upgradable solutions. Providers that pair high-efficiency gallium-nitride hardware with AI-driven analytics and flexible service contracts will capture outsized market share. To stay ahead, invest in open architectures that ease integration, cultivate local manufacturing partnerships to mitigate supply-chain risk, and prioritise low-power designs that align with emerging sustainability mandates.